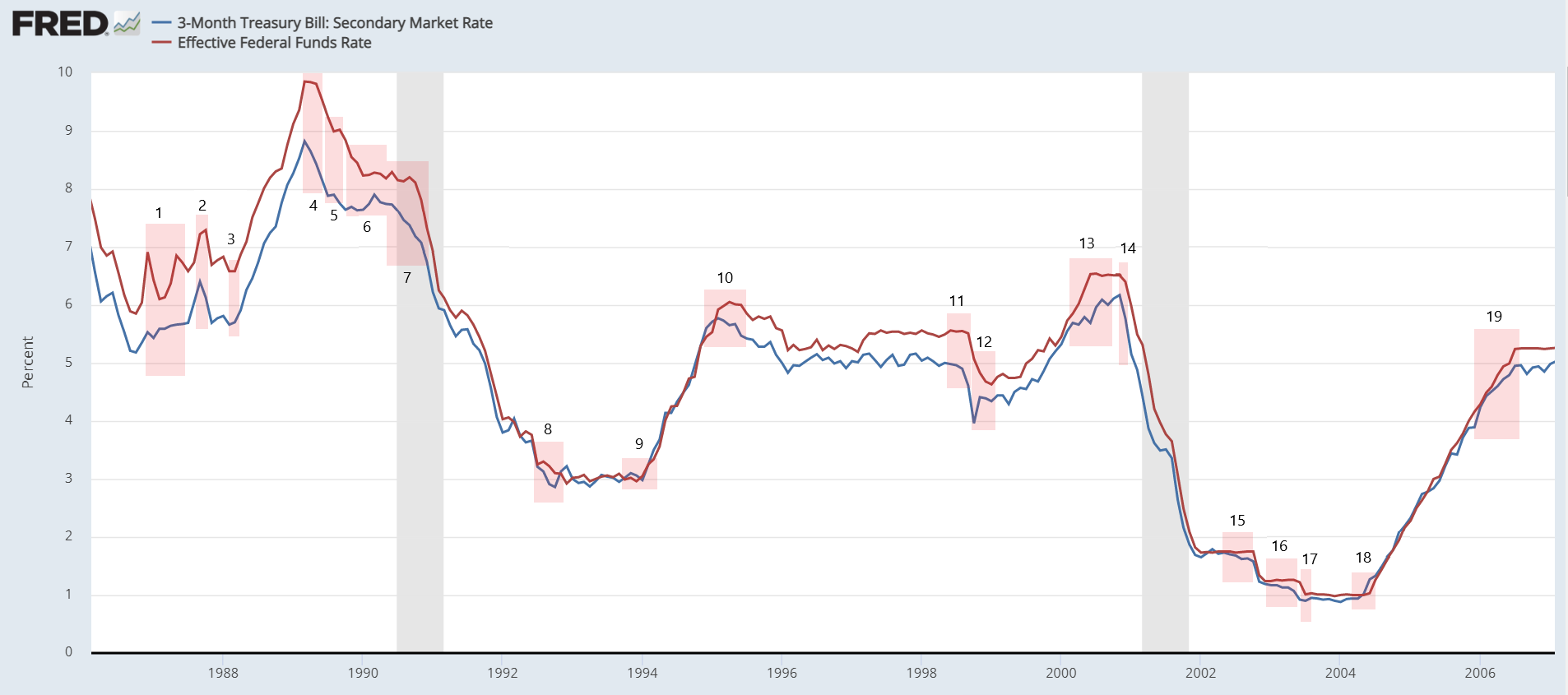

Greenspan Era: Fed Funds vs 3-month T-bill

A detailed analysis of the Greenspan era at the Fed and whether or not he set interest rates or interest rates guided Fed policy.

This post is a supplement to an upcoming article on Bitcoin Magazine. It further illustrates a point I make there.

The Bitcoin & Markets macro thesis includes the idea that central banks do not set interest rates. The Fed follows the market and jawbones to sway confidence and the market narrative. It goes by many names, Expectation Management, Expectation Policy or Forward Guidance.

We are told that Greenspan was the Maestro. The market waited on his every word. He conducted the economy like conductor does a symphony. BS.

Below is a chart of the Greenspan era at the Fed (1987-2006) showing the Effective Fed Funds Rate (red line) and the 3-month T-bill (blue line). If the Fed is in charge of rates, we should see the Fed Funds leading the market rates. But we see just the opposite.

I've highlighted 19 places where the market led the Fed, (and there's even more, as I write this I see at least one I missed). Among these are very important times at the tops and bottoms of trends/cycles.

- Fed Funds dips, market doesn't buy it, continues higher

- Market reverses a little, Fed Funds continues higher, then reacts late

- Market ticks higher, Fed Funds flat, then they surge higher

- Market peaks and starts lower, Fed Funds flat then reacts

- Market flat for a month, Fed Funds flat the next month, trying to mirror

- Market rate stops falling, Fed Funds continues down, then flattens out

- Market rate starts to dive, Fed Funds flat and then months later follows

- Market rate goes lower and sets the floor, Fed Funds follows slowly

- Market rate ticks higher over Fed Funds, then Fed Funds follows

- Market peaks first and starts down, Fed Funds peaks months later and follows

- Fed Funds lags again

- Market reverses as Fed Funds is still coming down

- Market rate is resistant and opens up spread to Fed Funds

- Market rates dive, Fed Funds remain flat to slightly down before following

- Market knows it's not done falling, Fed Funds waits to follow

- Market knows it's not done falling, Fed Funds waits to follow

- Fed Funds is behind and goes down, as the market rate has bottomed and ticks up

- Market rate leads

- Fed Funds continues to rise, market rate says no we're done

What this tells us is that the Fed is not in control of rates. Greenspan had great insight on the market and where rates were heading is all. He followed while talking as though he was the Maestro.