Bitcoin Fundamentals Report #155

We summarize important news from all sectors of bitcoin, like mining, price, and altcoins. This week's commentary is on Afghanistan with a bitcoin twist.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

It was a light week for content from Bitcoin & Markets. We did record a podcast episode for Fed Watch but it will not be released until next Tuesday. It is a panel discussion with Greg Foss and Aaron Segal about centralization vs decentralization, China and the US. Don't miss it!

The next article for Bitcoin Magazine about the burden of world reserve currency on the US is close to being done.

Lastly, another Macro Chart Update and member exclusive Bitcoin Pulse will be coming out hopefully in the next few days!

- (Latest Podcast) Taper Talk, Repos, China, and Bitcoin Advocacy - FED60

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $48,785 (+$2,459, +5.3%) |

| Market cap | $914 billion |

| Satoshis/$1 USD | 2,049 |

| 1 finney (1/10,000 btc) | $4.85 |

| Median fee confirmed (finneys) | $0.39 (0.08) |

| Market cycle timing | Second half of bull market |

| Weekly trend | Bullish breakout |

| Media sentiment | Positive |

| Network traffic | Low |

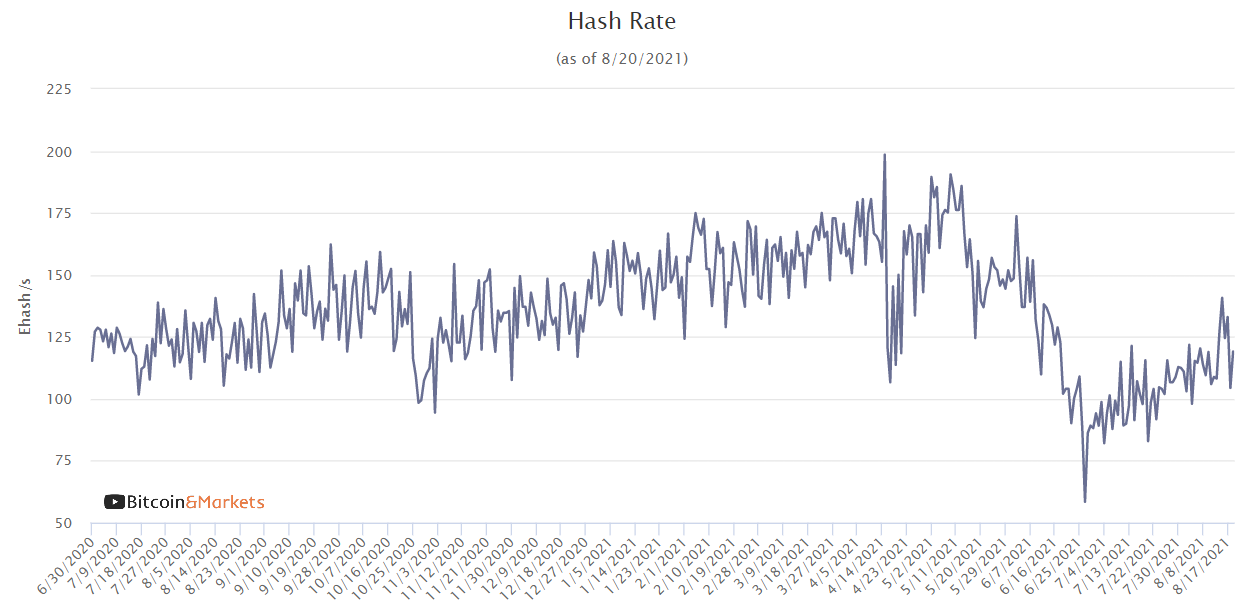

| Mining | Recovering quickly |

Market Commentary

It was a slow news week in bitcoin, probably because of the debacle in Afghanistan. As always, we keep you up-to-date on the most important news this week for the bitcoin industry. Our Commentary this week about Afghanistan and our contrarian takeaways, and hopefully we can bring a little positivity to the situation.

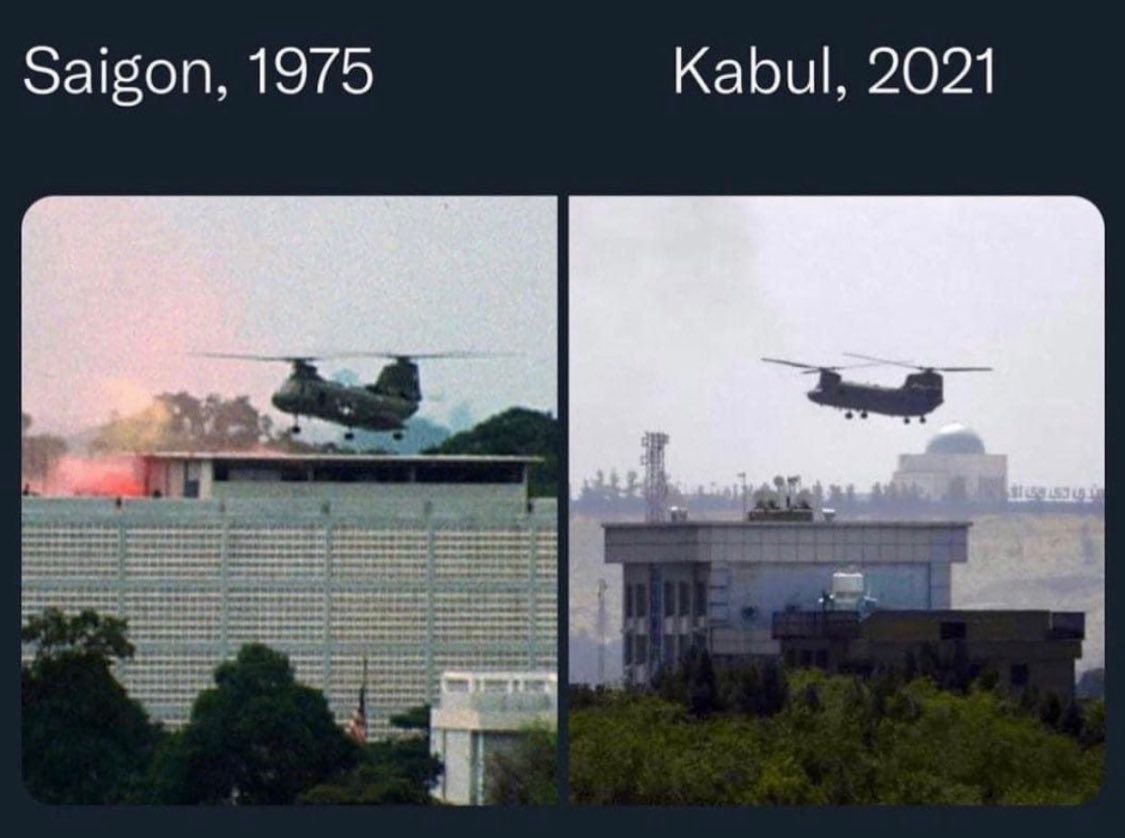

As you know, the US finally withdrew from Afghanistan. It was not so much a withdraw as an unorganized retreat. After 20 years of occupation, they were totally surprised by the Taliban's lightning fast advance through the country and surrounding of the capital of Kabul, weeks prior to an agreed upon date for withdraw. Thousands of military members, contractors, local government officials, interpreters, etc., rushed to the Kabul airport and tried to get on the few flights leaving. 10-20,000 more Americans are stranded elsewhere in the country. It is a disaster.

Most in the bitcoin industry claim this is a sign of the end days for the US, collapse is imminent, and the dollar is so obviously going away. While we are bitcoin maximalists and believe bitcoin will eventually be the dominant currency and financial system, it'll take years or a decade and the current geopolitical situation isn't one of US collapse, but of US withdraw and the rest of the world collapsing.

Many believe this anti-US narrative so ardently, they refuse to look at any contrary facts, like 1) the dollar breaking higher not lower, 2) commodity prices coming down, or 3) the amount of tax dollars this will save. It is disappointing that the nearly unanimous bitcoin position is refusing to address actual market behavior.

Yes bitcoin is going higher, but so is the dollar. As predicted here btw.

Ansel's initial reactions were as follows, notice the small numbers of likes from a primarily bitcoin audience:

The US withdrawal from Afghanistan is very long overdue, but it is purely geopolitical. China borders 14 countries. Now they will feel compelled to deal with Afghanistan.

— Ansel Lindner (@AnselLindner) August 14, 2021

Things are happening fast. Financial movement will pick up pace and spread. The big event could be another financial crisis somewhere and wartime rhetoric all over. This time, without the US as policeman. The international institutions will be impotent.

— Ansel Lindner (@AnselLindner) August 16, 2021

An example of the overreaction in the bitcoin industry is a piece from a content producer we highly respect, and a good human being, but one who is wholly into the US-collapse narrative, Marty Bent.

The Empire has fallen. It probably fell years ago, maybe even a decade or two ago, but most don't understand this yet. These type of things are only recognized in retrospect by the public at large.

As it stands today, the US Government has no moral high ground from which to attempt to police the rest of the world. How could they dare to attempt to lecture others?

The US is not collapsing. It might feel like that because we are in a Fourth Turning, the media tries to trigger us, all at the start of a monetary reset. However, the things that make the US a formidable economic power and the center of learning, culture and opportunity, e.g. vast natural resources, waterways, farmland, cheap domestic security, productive labor, accumulated capital, are completely unaffected by this week's events. Indeed, they are bolstered as entangling alliances and expensive deployments end.

The often forgotten fact is that US "Empire" is a relatively new thing. The period since WWII is not the norm. And guess what, it was not as beneficial for the US as people claim. The US provided global trade a security guarantee for the first time in history and a rules-based international framework. Basically, a global subsidy.

The US is an isolationist nation at heart. It's natural tendencies are not toward nation-building or occupation, despite the last 30 years. The US doesn't need to be involved in the rest of the world to be the dominant economy. Yes, they joined (and won) the world wars of last century, but the burden placed on the US to carry the world and win the Cold War against the Soviets was not natural. And it's over.

People wrongly think our history does not have relevance anymore. Please read the Wikipedia page for US non-interventionism. It's very quick and eye-opening. As you do, think of recent events. The American people have wanted to come home for decades, and are better off, not worse off, when they do.

The Pew Research Center reported that their newest poll, "American's Place in the World 2013," had revealed that 52 percent of respondents in the national poll said that the United States "should mind its own business internationally and let other countries get along the best they can on their own." This was the most people to answer that question this way in the history of the question, one which pollsters began asking in 1964. Only about a third of respondents felt this way a decade ago.

A July 2014 poll of "battleground voters" across the United States found "77 percent in favor of full withdrawal from Afghanistan by the end of 2016; only 15 percent and 17 percent interested in more involvement in Syria and Ukraine, respectively; and 67 percent agreeing with the statement that, 'U.S. military actions should be limited to direct threats to our national security.'"

It doesn't matter that the withdraw was an embarrassing debacle. The US is not in any danger of being invaded. There is no alternative currency other than bitcoin to turn to. Bitcoin is growing but it's still early. The US will return home and leave the rest of the world to rediscover how expensive domestic security and security of trade lanes actually are.

Lastly, as this pertains to bitcoin, we'll also say this. The US is amendable to sound money. It was on a gold standard until 1971, it still owns the most gold of any country. The fact that the global economy is stuck in a slow motion deflationary collapse is starting to dawn on people. Central bankers know the system is broken and needs to be replaced eventually. Bitcoin offers a modern 'return to gold', one with wide open technological opportunities while ditching the baggage of the Eurodollar.

The US has the opportunity to be the first-mover here. As they return to their roots of non-interventionism, we also think they'll turn to bitcoin.

SHARE our content with friends and family!

Quick Price Analysis

Weekly BMI | 2 : Bullish

Last week's analysis worked out very well. We called for a slightly deeper and slightly longer pull back than the week prior, before more upside.

We have now broken through $48k on our way to $51,000. Weekends typically are slow because professional traders are still used to their legacy trading hours. We expect the weekend to be slow, but perhaps see a significant breakout Sunday evening when futures reopen.

Bottom line, we are going up from here. It's just a matter of where and when will be the pull backs and consolidations. If we have a replay from last year for the second half of this bull market cycle, we could see $100k within 6 weeks.

Become a paid member to access our much more in depth technical analysis and member newsletter.

Mining and Development

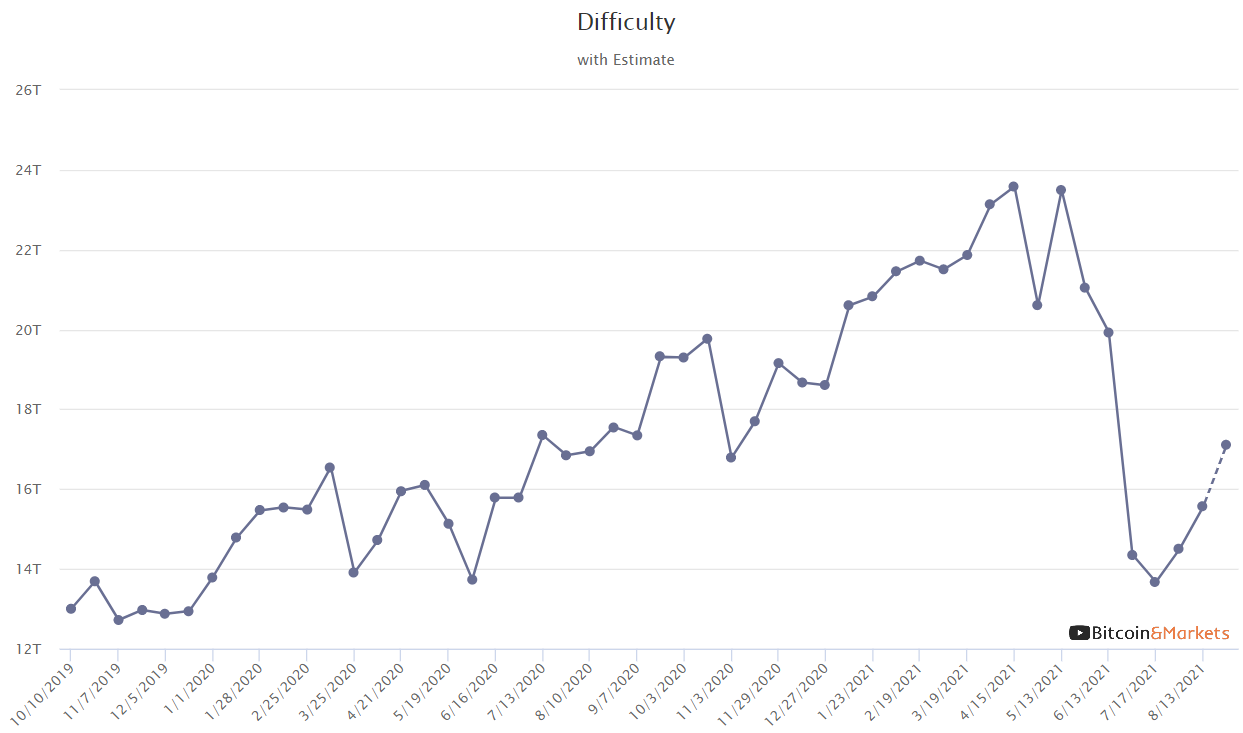

| Previous difficulty adjustment | 7.3% |

| Next estimated adjustment | +11% in ~5 days |

| Mempool | 4 MB |

| Fees | 1 sat/byte |

Hash rate (computer power) continues to climb we've been predicting, and the difficulty is trending toward a positive 11%+ adjustment in five days. The mempool remains calm with only a couple blocks of unconfirmed transactions, meaning periodically you'll have to wait 20-30 minutes for a confirmation.

Transactions will become even more efficient once Taproot is implemented in a couple months which is important as adoption grows. It is still a mystery why there was over 10 times the amount of transactions in the first half of the year.

CBDC / Stablecoin / Altcoin

FED mentions Virtual Currency and Stablecoins in minutes for first time

This is a LATE BREAKING story, dropping just hours prior to sending out the report.

“Some participants cited various potential risks to financial stability including the risks associated with expanded use of (virtual currencies) or the risks associated with collateral liquidity at central counterparties during episodes of market stress. In connection with the former set of risks, a few of these participants highlighted the fragility and the general lack of transparency associated with stablecoins, the importance of monitoring them closely, and the need to develop an appropriate regulatory framework to address any risks to financial stability associated with such products.”

We've been covering stablecoins here for years and the Fed is acting to a T as we predicted. We said other Central Banks would pursue Central Bank Digital Currencies (CBDCs) because they are facing immediate market share competition from US dollar based stablecoins like Tether.

The difference here is that stablecoins are private companies that hold dollar assets and issue USD digital tokens. It is very similar to the way banks accept deposits and then you can use a debit card. CBDCs, on the other hand, are issued directly from the Central Bank. That might seem less risky, except when you consider the risk of wacky new monetary policy, the added surveillance, and the increased ability to freeze accounts.

The Fed is in a unique position to let the stablecoins evolve in the market, regulating around the edges, and that is exactly the road they continue to walk down.

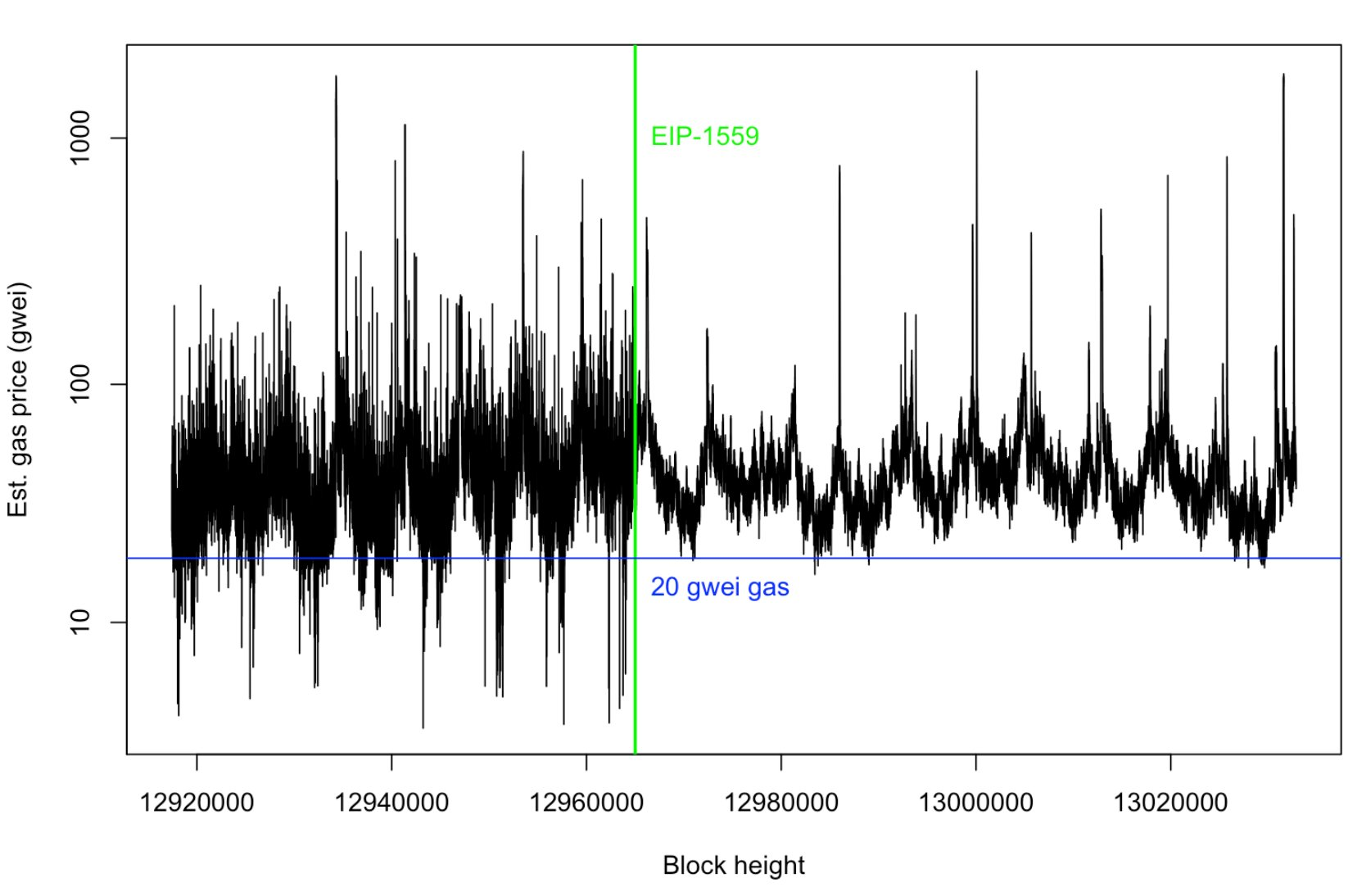

Ethereum fees and competition

Ethereum recently had a hard fork upgrade. It's primary concern was around a change to the way fees are handled. In the past, Ethereum fees were a copy of bitcoin in this way, the fees would go to the miners, but this new changes force burning a large portion of the fees. Burning means it makes then disappear and be unspendable.

The rationale was this would decrease the supply of ethereum over time and outdo Bitcoin's at its own game of a perfectly fixed money supply. It was a huge mistake. The below chart shows fees since the change, they are more stable, but much higher on average.

High fees are bad for a network that is promising to be everything to everybody. At nearly $100 per transaction, any transaction under roughly $500 in value becomes uneconomical. All those small projects wanting to do $1-$100 transactions are priced out.

There are ill-effects to the deflationary aspect of this change as well. Ethereum has clones, competitors that will suck volume and value away from Ethereum. By necessity they compete on their ability to fund marketing through inflation. So we end up with this, "Every single smart contract platform has outperformed ETH this year."

Miscellaneous

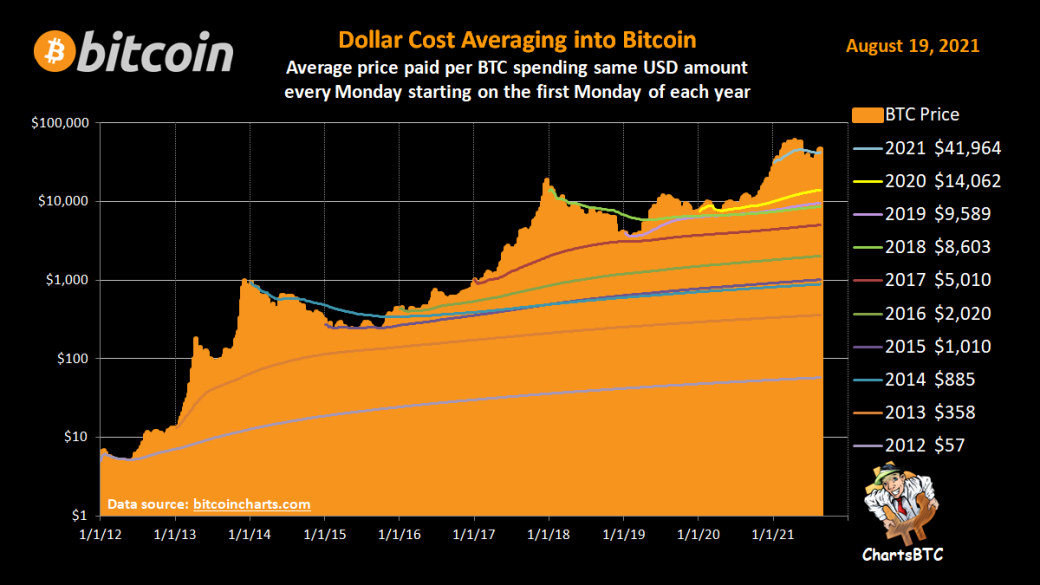

Here is a fabulous chart from ChartsBTC showing how effective Dollar Cost Averaging (DCA) is for accumulating bitcoin. If you had started investing in bitcoin this year by DCA'ing every Monday, with the current price you'd be up ~14%.

Obviously, if we measured it a few weeks ago, you would have been underwater for a short period of time, however, this is a marathon, not a sprint. This chart disproves the common excuse for not buying bitcoin now, because you are "too late". We are still early in global adoption phase of bitcoin.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

August 20, 2021 | Issue #155 | Block 696,731 | Disclaimer

Meme credit: widely shared on twitter