Bitcoin Fundamentals Report #154

This week we dive into Ethereum's pattern of lies and shifting sands of marketing terms, bitcoin price, mining, Defi hacks, and google trends!

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (Podcast) Taper Talk, Repos, China, and Bitcoin Advocacy - FED60

- (Member) Bitcoin Pulse #116 - Deep dive into bitcoin charts

- (Blog) Macro Chart Rundown - 12 Aug 2021

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $46,326 (+$3,701, +8.9%) |

| Market cap | $872 billion |

| Satoshis/$1 USD | 2,158 |

| 1 finney (1/10,000 btc) | $4.63 |

| Median fee confirmed (finneys) | $0.45 (0.097) |

| Market cycle timing | Beginning second half of bull market |

| Weekly trend | Bullish consolidation |

| Media sentiment | Negative |

| Network traffic | Low |

| Mining | Quick recovery |

Market Commentary

After last week's massive news cycle with the Infrastructure Bill, this week is slightly more tame. Some of the biggest stories of the week point out the stark difference between bitcoin and the altcoin sector, and why it is not a good idea to have shared advocacy in Washington for these two very different groups.

In the Fed Watch podcast released Wednesday, Ansel covers his thoughts succinctly (37:35 min mark).

I did not like to see people jumping behind certain people lobbying for bitcoin, not even bitcoin, "Crypto". I didn't like to see people supporting them. Supporting these questionable players out there in the bitcoin space. Also, you saw the most outspoken people out there were big altcoiners like Novogratz, Jesse Powell from Kraken, and Brian Armstrong from Coinbase. They came out and were very vocal against this. Even Elon Musk with his Dogecoin proclivities.

I didn't like that this became a kumbaya moment, because I think Gensler, he's coming for altcoins. He's coming for centralized scams. And if Bitcoiners are going to put ourselves in the same bucket as these scams, I don't think we should do that. Bitcoin is decentralized, it is the only real project out there, and if we put ourselves in the line, in the basket with all other cryptos, we're going to have a much harder time of it. What ever we want to accomplish in this country, the United States, is going to be made much harder.

Ethereum narratives

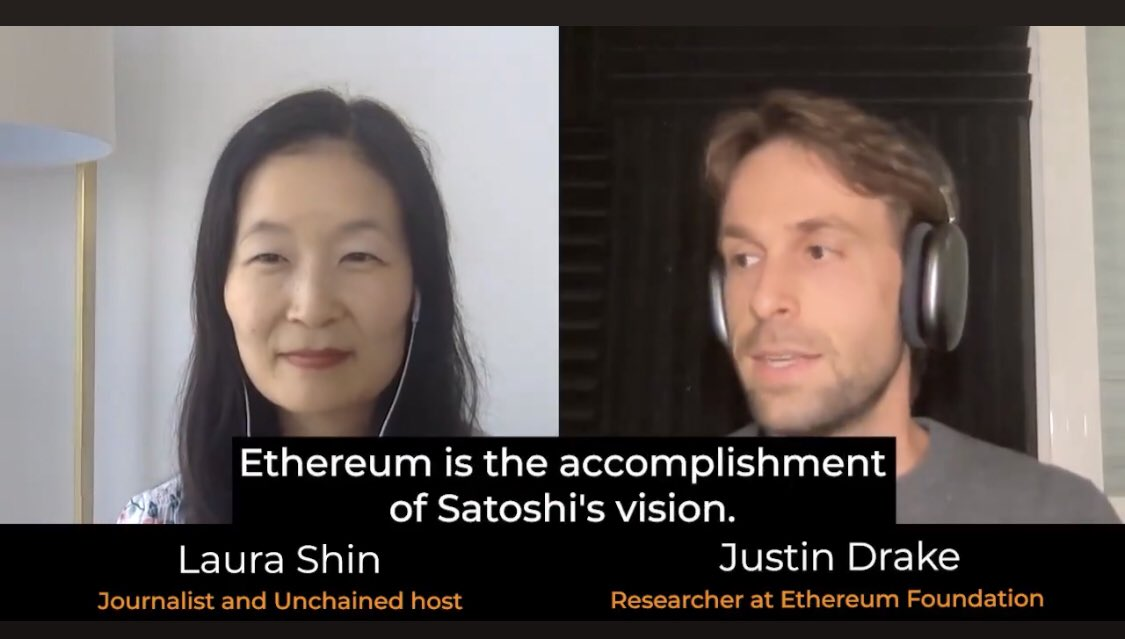

The fact that the White House and Treasury implied acceptance of Proof-of-work (bitcoin's concensus mechanism) and a crackdown on Proof-of-stake (used in Ethereum 2.0) was not lost on Ethereum folks. They're scared and immediately started marketing new narratives.

The first thing they did was lie about Ethereum being the fulfillment of Satoshi's Vision. An absolutely asinine claim. But guess who is very enamored with Satoshi? Gensler, the Chair of the SEC.

Ethereum is not bitcoin.

— Pomp 🌪 (@APompliano) August 12, 2021

Ethereum promoters also continued the faulty climate argument.

Sea level rise of 5 m by 2150 under a very high emissions scenario (thus far, the norm) cannot be ruled out.

— Chris Burniske (@cburniske) August 9, 2021

By the time #bitcoin stops inflating, Miami may be underwater. https://t.co/hKIcpGotSY

And go after Jack and Twitter with delusional threats about a hostile takeover.

Also FYI Jack only owns 24% of Twitter and activist investors have tried to remove him before as too much of his time is focused on his other business…

— Adam Cochran (@adamscochran) August 12, 2021

Wen TwitterHostileTakeoverDAO?

Grubles summed it up nicely.

So it’s been less than a week since the whole infrastructure bill thing and Ethereum people have:

— grublés (@notgrubles) August 13, 2021

* Lied about Ethereum being Bitcoin

* Continued to spread FUD about BTC mining

* Called for a hostile takeover of Twitter

Beginning to think they aren’t really on our side…

We were here when Ethereum launched. Back then people literally claimed Ethereum was going to be used as the software for the flight controls on rockets. Not a joke. Today, they can barely handle rock images and trading cards, transaction fees are over $100, and every single project built on top is centralized and leaks like a sieve due to hacks.

These are the people funding Coin Center and Congressmen lobbying for friendly language. Coin Center is providing top cover for altcoin scammers. What makes Ethereum somewhat censorship resistant? Lobbying and corruption, not the protocol design. Ethereum is nothing like Bitcoin.

SHARE our content with friends and family!

Quick Price Analysis

Weekly BMI | 1 : Slightly bullish

The bitcoin price is rallying today after a quick consolidation down to the $43k's. At the time of writing, it has just barely missed the swing highs at around $46,787.

This level on the chart has several converging sources of resistance. We are not surprised price has paused here. Bitcoin is going to go much higher soon, but headwinds right now could push price lower in the short term. A slightly longer, slightly deeper consolidation down to $42k and lasting through the weekend is very possible. Our line is $48,000, if price can get above that level, risk of a further consolidation drops dramatically. Until then caution on longs is recommended.

On the member exclusive Bitcoin Pulse this week, we went through 10 different charts, examining many different indicators. If you'd like to get those updates, become a paid member today! It's only $5/mo.

Become a paid member to access our much more in depth technical analysis and member newsletter.

Mining

| Previous difficulty adjustment | 7.3% |

| Next estimated adjustment | Up in 14 days |

| Mempool | 0 MB |

| Fees | 1 sat/byte |

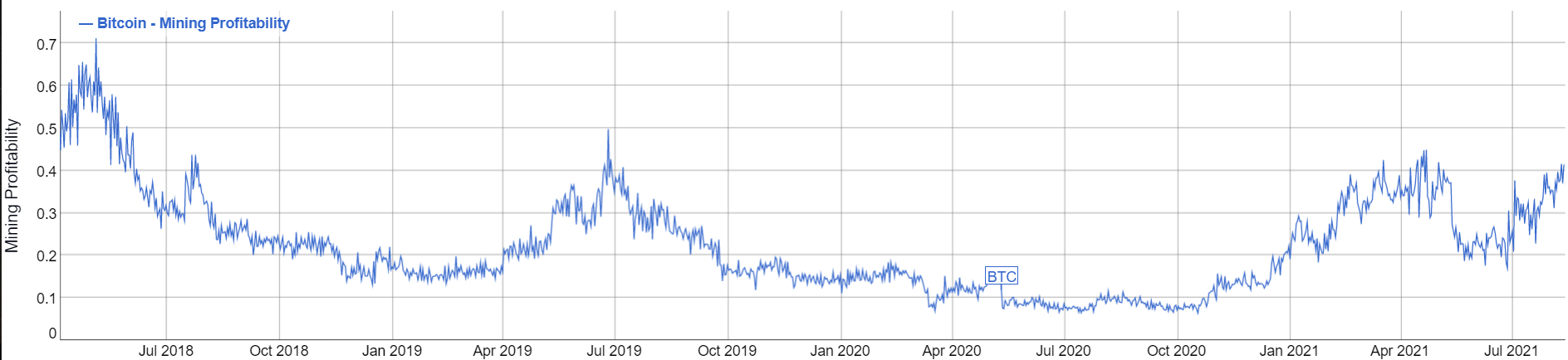

Hashrate continues to return after the China mining ban. This morning difficulty adjusted upward by a whopping 7%!

Taking a look at mining profitability on the chart below, we can see this era is the most profitable time to mine since the summer of 2018. We measure profitability by THash/sec ("tera-hashes"). The halving in May of 2020, dropped profitability from $0.14/day per THash/s to $0.07.

Today it sits around $0.40, meaning miners earn $0.40 per day for every THash of mining power they have. Total miner revenue for the entire network is $42.9 million per day.

Mempool

Transactions continue to get confirmed relatively fast, keeping the mempool basically empty. Some transactions, however, can take a couple hours at most to be confirmed at the lowest possible fee.

Now is still a great time to do UTXO management if needed. By that we mean mixing coins to remove history, managing wallet balances, or combining smaller fractions of coins into larger more economical outputs. When fees eventually rise again, these housekeeping transactions become much more expensive.

CBDC / Stablecoin / Altcoin

Here is a small sample of the shifting narratives of altcoins:

- The Next Bitcoin

- More scalable than Bitcoin

- World Computer

- Code is Law

- Initial coin offerings (ICOs)

- Smart contract platform

- Programmable money

- Money legos

- Decentralized Finance (defi)

- Non-fungible tokens (NFTs)

- Ultra-sound money

And this is a short list. Note, none of these things develop into long-lasting value propositions. They are marketing terms. Each iteration in marketing is sufficiently complicated to confuse most people for a year or two. A few famous VCs or "innovators" promote these scams as 'interesting' or the 'future', and tokens pump. After huge problems with these narratives pop up, they dump on bagholders and move onto the next marketing scheme.

This happened to ICOs as it became obvious they offered very little actual code other than an user interface to take people's initial investment. The SEC also began going after the worst offenders as illegal securities, sending scammers scurrying, exposing ICO claims of decentralization as a big lie.

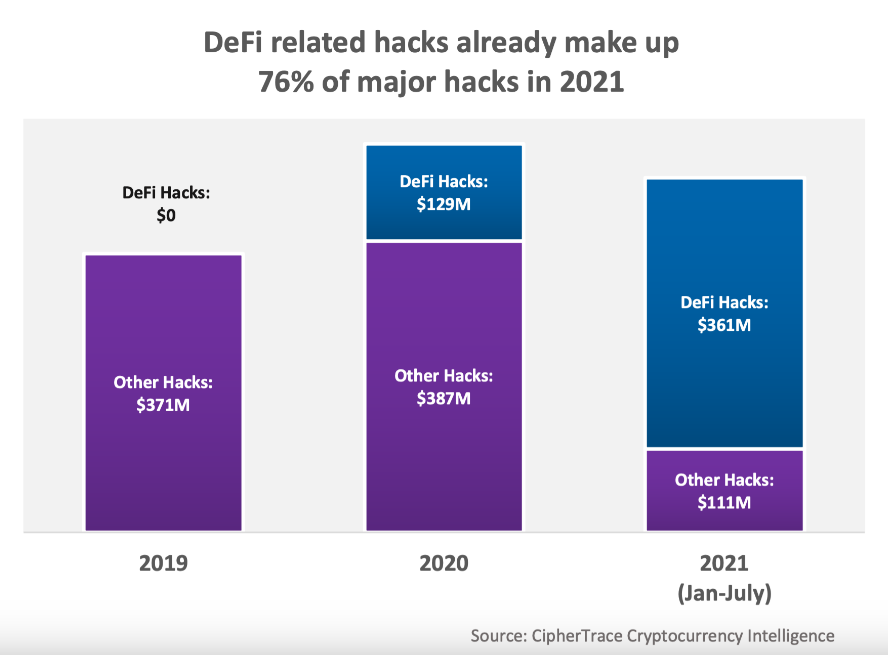

It is currently happening to Defi. Promoters have spent years claiming Defi was building an uncensorable financial system, only to be shown time and time again that the minute something goes wrong, like a hack, all of Defi is centralized. The latest version of this story is the Poly Network hack.

Poly Network Hack

Poly Network is an "interoperability protocol", meaning they provide an interface with multiple other networks like Ethereum and Binance Chain. This week, they were hacked for $600 million worth of tokens! Altcoiners lost their minds. The network was immediately frozen, other integrated projects (also supposed to be decentralized) froze their operations, even Tether froze tokens (but Tether is different because it is proudly centralized).

The lie that is Defi was exposed again. Promoters claim defi projects are decentralized, that no one is in control, yet it is trivial to freeze operations. They might not be able to steal the money directly, but they can leverage their control over the system and relationships with other platforms to freeze accounts and claw back the funds.

Just yesterday, a separate hack netted attackers another $7 million from DAO Maker affecting 5,251 accounts. A recent paper from firm CipherTrace reports 76% of funds lost in hacks in the space in 2021 have come from Defi. If we add the Poly Network hack to the totals, we get more than $1 billion in hacks alone in 2021, with Defi making up 90%. And that doesn't include fraud in the space, which they counted separately. Fraud has totaled $237 million in 2021, almost 50% ($113 million) coming from Defi.

Bottom line, Defi's narrative of being an innovative, uncensorable financial system is falling apart. It will take time for the marketing to pivot and for all the value locked in Defi contracts to dissipate, but it's going to happen.

Miscellaneous

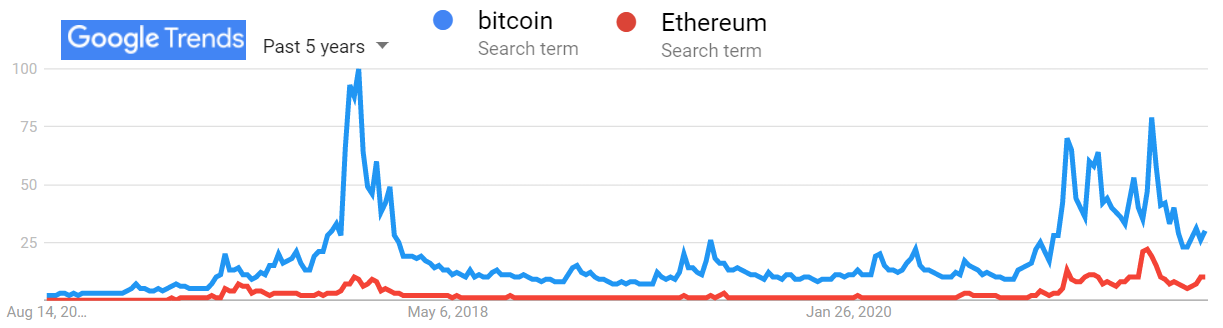

Google Trends for Bitcoin and Ethereum

We thought the Google searches for "bitcoin" might decline over time as bitcoin entered the collective consciousness and people no longer needed to search for it. However, in the first half of this 4-year cycle, searches for bitcoin have nearly reached the previous peak in 2017. Very interesting to note as well is the high volume has been sustained for months now.

Ethereum smashed through its previous peak and is also maintaining a relatively high search volume. Based on the many signs this year, it is obvious bitcoin and "crypto" went mainstream. We also included the top 10 cities with the most search volume.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

August 13, 2021 | Issue #154 | Block 695,587 | Disclaimer

Meme by @jack