Bitcoin Fundamentals Report #149

On this week's Report we give commentary on the GBTC unlock, a couple SEC developments, price analysis, mining hash rate, CBDCs, and the dollar bounce.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (podcast) Present and Future of the Euro, ECB Annual Report Breakdown - E232

- Keep an eye out this week for Geopolitics and Economics of El Salvador ft Bitcoin on Bitcoin Magazine.

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $33,544 (+$489, +1.5%) |

| Market cap | $627.7 billion |

| Satoshis/$1 USD | 2,981 |

| 1 finney (1/10,000 btc) | $3.35 |

| Median fee confirmed (finneys) | $1.48 (0.44) |

| Market cycle timing | Beginning second half of bull market |

| Weekly trend | Tightening range |

| Media sentiment | Neutral |

| Network traffic | Low |

| Mining | Trying to stabilize |

Market Commentary

The anticipation is building in bitcoin as the price drifts sideways. Let's take advantage of this prolonged mid-cycle adjustment to take a look at a couple important events coming up in the next few weeks.

GBTC

Let's cover the much talked about GBTC unlocking event on 18 July. For those unfamiliar, the Grayscale Bitcoin Trust (GBTC) is a trust which holds bitcoin and sells shares that represent ownership of the underlying bitcoin. When accredited investors buy new shares from Grayscale directly it is at spot (NAV), Grayscale goes out in the market and buys bitcoin to back those new shares. There is also a secondary market at a market price. After a 6 month holding period, shares become unlocked and can be sold on this secondary market.

For the history of GBTC that market price was always a premium, ranging from 10-30% above spot. So, accredited investors could buy new GBTC shares at spot and sell them at a premium, but only after the 6-month lock-up period. That created an arbitrage trade of buying new GBTC at spot, shorting GBTC on the secondary market and waiting 6 months to harvest the spread.

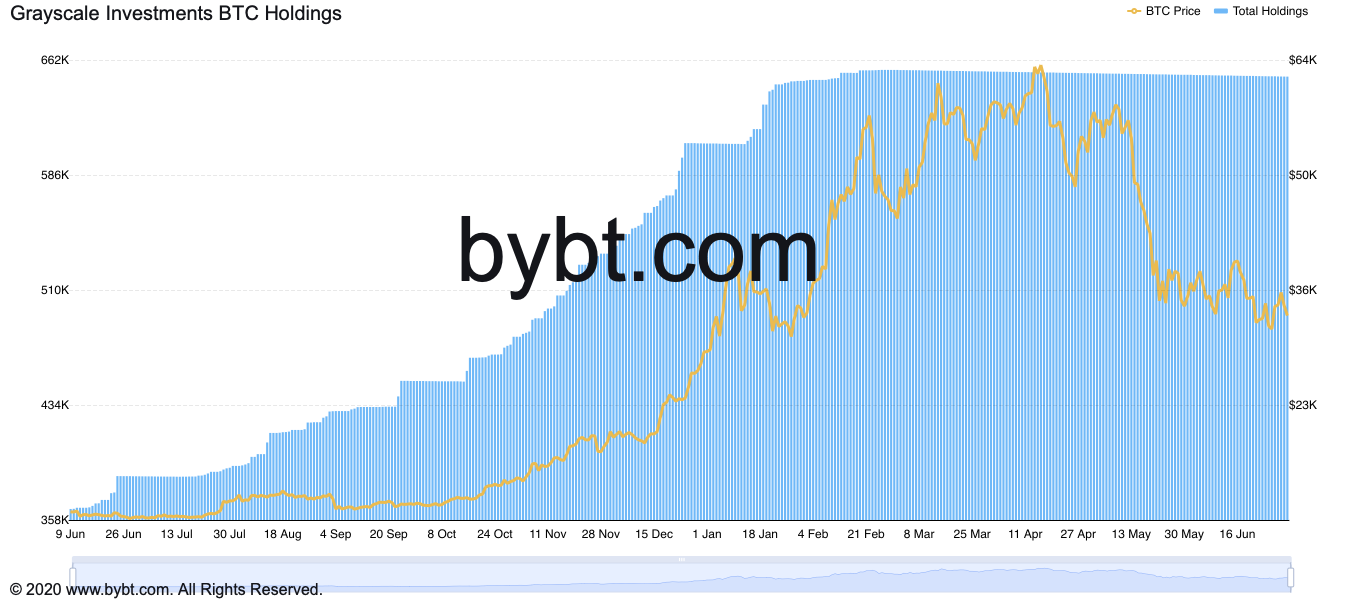

However, recently, the spread has gone negative into a discount, meaning the price of GBTC on the secondary market is below the new GBTC created at NAV. We can see this also in the balance of bitcoin held by the trust. When the spread goes negative, people stop buying new shares, and the holdings go flat.

As lock-up periods end, the shares created 6 months ago become eligible to trade on the secondary market. These unlocking events appear to correlate with downward price movements, so people have been predicting that the big unlocking on July 18th, might have a negative impact on price.

There are three important aspects of this particular unlocking in our estimation. First, it is the last major unlocking, so the supply of secondary market shares is about to dry up. Second, it is the first ever unlocking at a loss. When those shares were created in mid-January, the price was between $38-$42,000. That might affect the parties' willingness to sell the GBTC immediately at unlocking. Third, it is a misunderstanding that selling GBTC is selling bitcoin. No spot bitcoin are sold when GBTC is unlocked.

The main claim for how this will affect price is through the arbitrage trade. Big money can buy secondary market shares of GBTC after the unlock at a discount (no effect on spot price) and go short spot bitcoin (this half of the trade has an effect on price). This trade, again, effectively harvest the spread. We are skeptical of the total effect of this will have on price, but it is possible we see a little dip.

SEC

Two news items in regards to the SEC this week. First, Elizabeth Warren, chair of Senate Banking Committee's Subcommittee on Economic Policy sent an open letter to SEC chair Gary Gensler this week. The letter asked for clarification on several issues around bitcoin exchanges. The deadline given for the answers is July 28, which should shed some light on the thinking of the SEC under the new leadership of Gensler (a bitcoin fan).

Questions we are interested to hear the answer to are:

Describe the extent of the SEC’s existing authority to regulate existing cryptocurrency exchanges. To what extent does that authority differ from the agency’s authority over traditional securities exchanges?

Do you agree with Commissioner Berkovitz’s assessment of DeFi platforms? (that they are illegal under the Commodity Exchange Act)

The second bit of news from the SEC is yet another delay of a bitcoin ETF, this time SkyBridge Capital's application. This comes a week or so after the VanEck ETF delay.

We are not surprised by this new delay in the least. The SEC has been aligned against allowing bitcoin to get a toehold in people's portfolios. Once that happens it will be MUCH harder to introduce bans or draconian regulation. So, by delaying the ETFs they think they are keeping the window open for regulation.

A bitcoin ETF will be gigantic news but isn't a make-or-break thing for bitcoin. Eventually, there will be an ETF as bitcoin continues to eat the world, and the longer the SEC delays the less people will respect them as an impartial regulator. Anyway, these delays are until August this year, at which time they have to approve or deny. We shall see.

SHARE our content with friends and family!

Quick Price Analysis

Weekly BMI | 2 : Bullish

Become a paid member to access our much more in depth technical analysis and member newsletter.

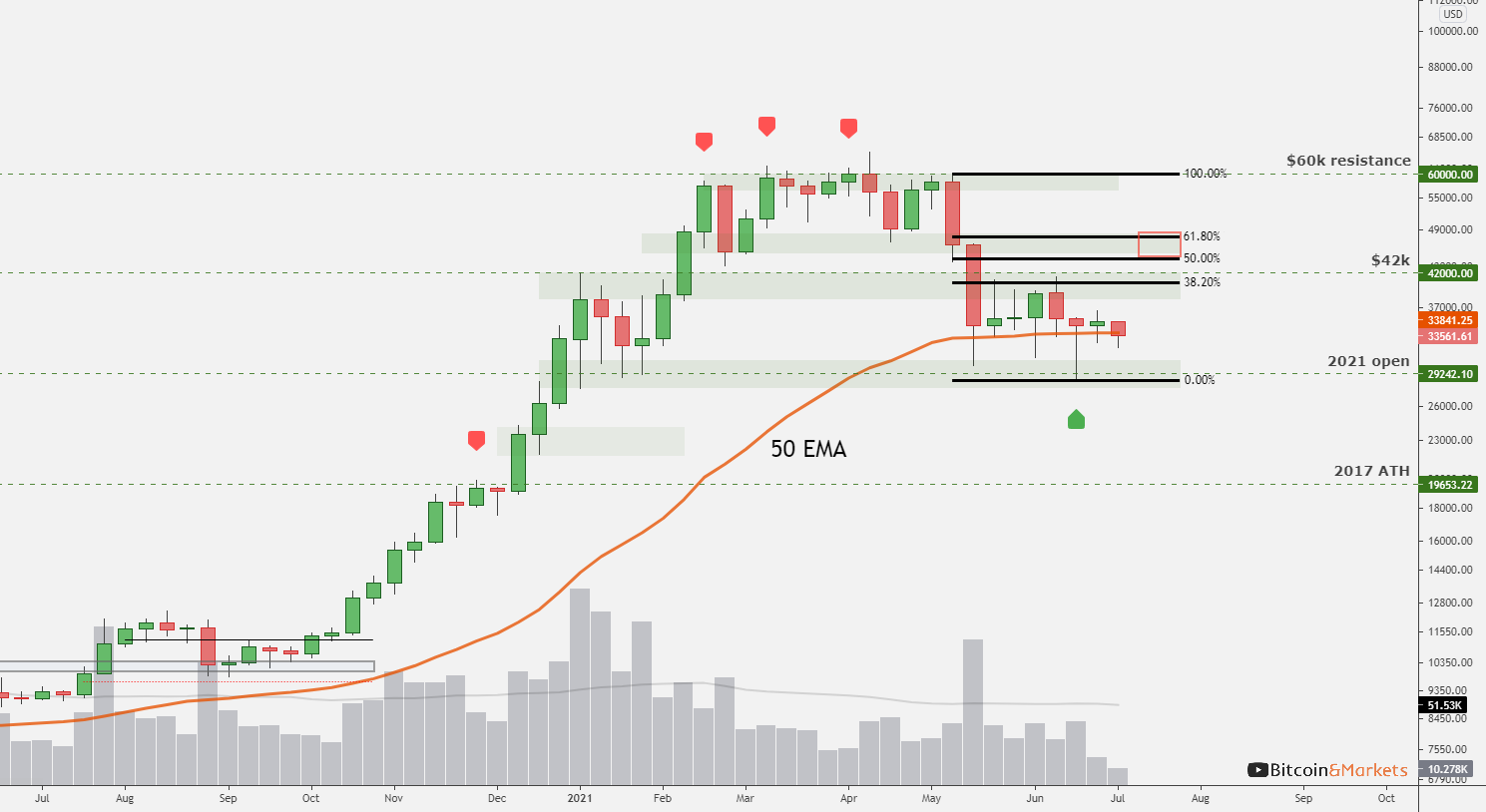

Price is in a tightening range as volatility is the lowest since April.

Daily

There is a mixed bag on the TA. On the bearish side we have overall relation of price to the 50 EMA and price structure, looking like a bear flag, and volume is horrible. On the bullish side we have significant buy support at $30k and bullish divergences on our oscillators.

Weekly

On the weekly chart, price is having an epic battle with the 50 EMA. If this level is not held, it could be a bad sign for price. Also of major note, we saw the first bullish divergence on the weekly chart since December 2014, right at the bottom of that bear market.

Overall, we remain bullish. The bull market is not over. Our forecast is for price to test the 50 EMA soon and after a breakout, higher levels into our target zone.

Mining

Bitcoin's difficulty had a massive downward adjustment of -27.95% last Saturday and hashrate continues to trend down making the next adjustment estimated at -9% in 9 days. Despite slower block times, the mempool remains in good shape with just a few blocks of unconfirmed transactions. Users have been able to pay a fee of 1 to 3 sats/byte ($0.20) and have their transaction confirmed within an hour or two.

We haven't heard any new information this week regarding the Chinese miner's efforts on relocating their hardware. There is lots of speculation about the length of time required for the hardware to find a new home. Some people think it could take only a month or two before we see hashrate increase, while others think it could take up to a year to relocate as the infrastructure will likely need to be built in other locations.

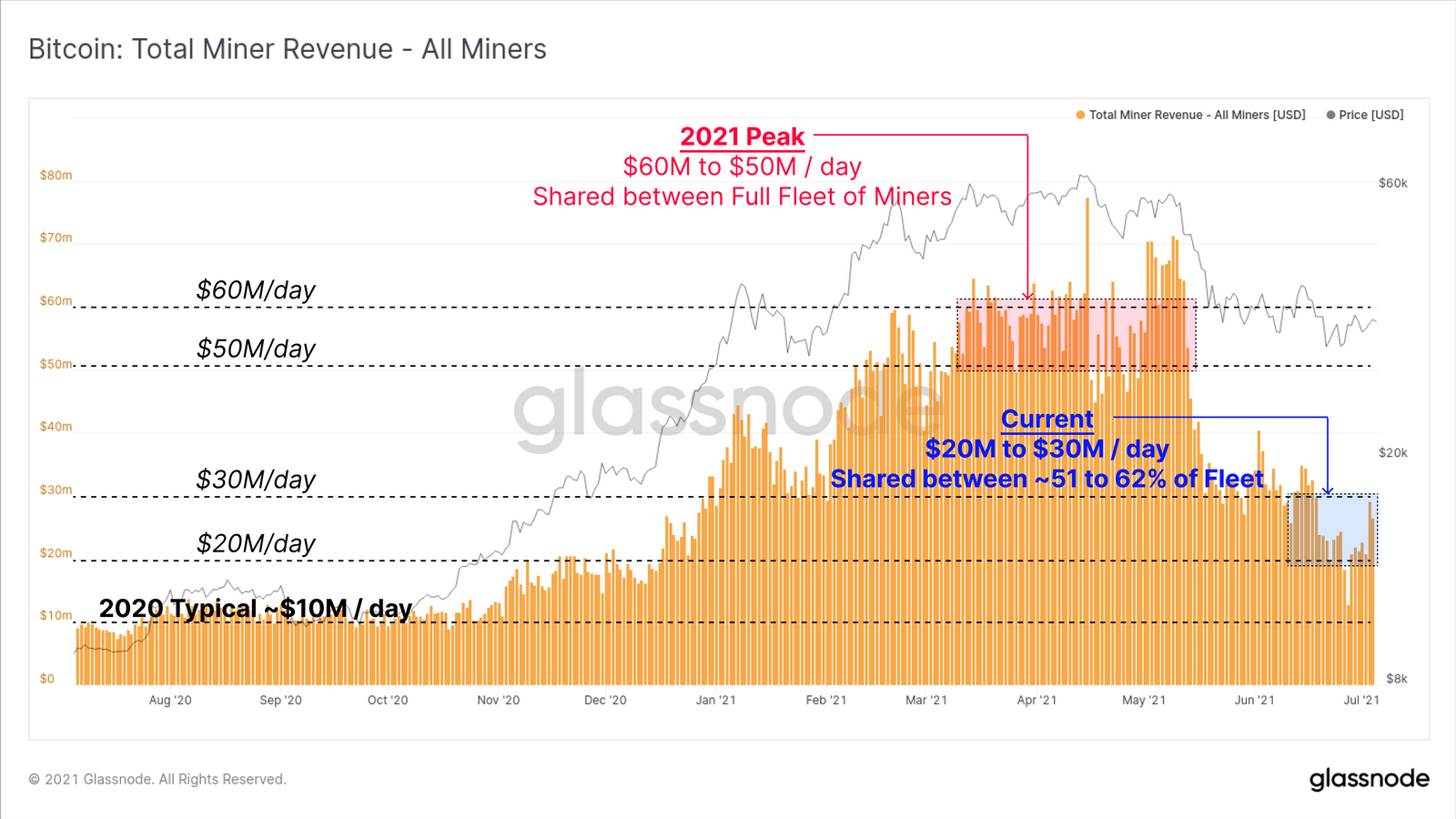

Below is a chart from glassnode showing the total mining revenue going back a year. With the hashrate dropping, the remaining miners become more profitable as they get a bigger piece of the revenue pie.

CBDC / Stablecoins / Altcoins

Several countries continue to pursue their ill-fated CBDC efforts. We written about this and done podcasts on why CBDCs are a not what these central banks think and could cause some massive negative consequences. The driving force continues to be the fear of losing market share to bitcoin and a digital dollar in the form of Tether or other similar private digital dollars.

Just this week we saw France do a test with Singapore, New Zealand announced consultations on a CBDC, and Jamaica will start a pilot program in August.

Miscellaneous

Quick update on the dollar. Ansel will be writing a more detailed Macro Update soon, but for those who only read the Fundamentals Report, we thought it might be a good thing to update the dollar here.

The inflation/reflation narrative is starting to come apart. The dollar has apparently bottomed and is turning around. At this time, price is running into pattern resistance of a diagonal trend line, as well as the 50 EMA on the weekly.

The important level remains 92.5, if we get a weekly close above there it could rally quite quickly. This is commonly assumed to be negative for bitcoin, however, bitcoin and the dollar should rise together. A stronger dollar means weaker other currencies. If emerging markets are having problems, if the Euro is weakening, people from those countries are much more likely to buy bitcoin than an American with reserve currency dollar.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

July 9, 2021 | Issue #149 | Block 690,308 | Disclaimer

Meme by @abrkn