Fundamentals Report #147

This week's top news item is the Chinese mining situation. We take a look there and how to view it. Also top stories from major Bitcoin sectors.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (podcast) Present and Future of the Euro, ECB Annual Report Breakdown - E232

- (podcast) Reverse Repo, Fed, and Bitcoin - FED 54

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $32,679 (-$3768, -10.3%) |

| Market cap | $616 billion |

| Satoshis/$1 USD | 3,060 |

| 1 finney (1/10,000 btc) | $3.26 |

| Median fee confirmed (finneys) | $3.21 (0.98) |

| Market cycle timing | Beginning second half of bull market |

| Weekly trend | Trying to bottom |

| Media sentiment | Negative |

| Network traffic | Low |

| Mining | Dramatic shift |

Market Commentary

Despite what mainstream blue-pilled people will say, the situation going on in Bitcoin mining is not a bad thing.

MSM: "The CCP is cracking down on bitcoin mining!"

Bitcoiner: "So what? They're shooting themselves in the foot."

MSM: "The hash rate is crashing, making bitcoin less secure."

Bitcoiner: "No. That capital is in the process of moving to where it is treated better, where it can be used more securely. That equipment is not being used to attack bitcoin. Bitcoin's 'security' is probably higher exactly because the remaining hash rate is very profitable making honest behavior even more well paid."

What is happening to mining?

The biggest news of the week for Bitcoin is definitely the CCP crackdown on bitcoin mining. First off, bitcoin has had an on-again/off-again relationship with China for years, I think the first bans were in 2014 or 2015. So this time, when rumors started flying in May 2021 of an impending crackdown, most bitcoiners brushed it off, because 'who would be so dumb as to ban bitcoin in their country?' The CCP, that's who.

Regulations and bans have been coming out hot and heavy in China since then. It started on May 18th with the perennial crackdown on trading and bitcoin services from banks. Then on May 21st, CCP officials announced a crackdown on bitcoin mining as well. This was something new and miners got spooked. Immediately Chinese miners began sending their mining equipment overseas.

The enforcement started in Inner Mongolia with an excuse about green energy usage, then Xinjaing, and now Sichuan has begun shutting people down. That brings us to today.

Let the FUD roll

Via Reuters

China's sweeping ban on cryptocurrency mining has paralysed an industry that accounts for over half of global bitcoin production, as miners dump machines in despair or seek refuge in places such as Texas or Kazakhstan.

Note the kind of language. "Paralyzed an industry", "despair or seek refuge"? How do we know the MSM is total garbage sensationalism? Because several weeks ago, top level miners already met and shared intel/data on other regions globally to move their mining operations, and hash rate already is in a massive exodus from China as of mid-May.

Many miners leaving the network does not paralyze the system. All that happens is blocks (confirmations) come a bit slower - 20% slower than the prescribed 10 mins at the moment - until the difficulty is adjusted every 2016 blocks (5 days away). This will reset the difficulty and time of the blocks back to a 10 min average. Lowering the difficulty also increases the profitability of the remaining miners.

China didn't command "over half of global bitcoin production" either. As we pointed out in back in April on our member-only letter, when a power outage cut off a majority of Chinese hash rate, the estimate for hash rate in China was a maximum of 40% of the network.

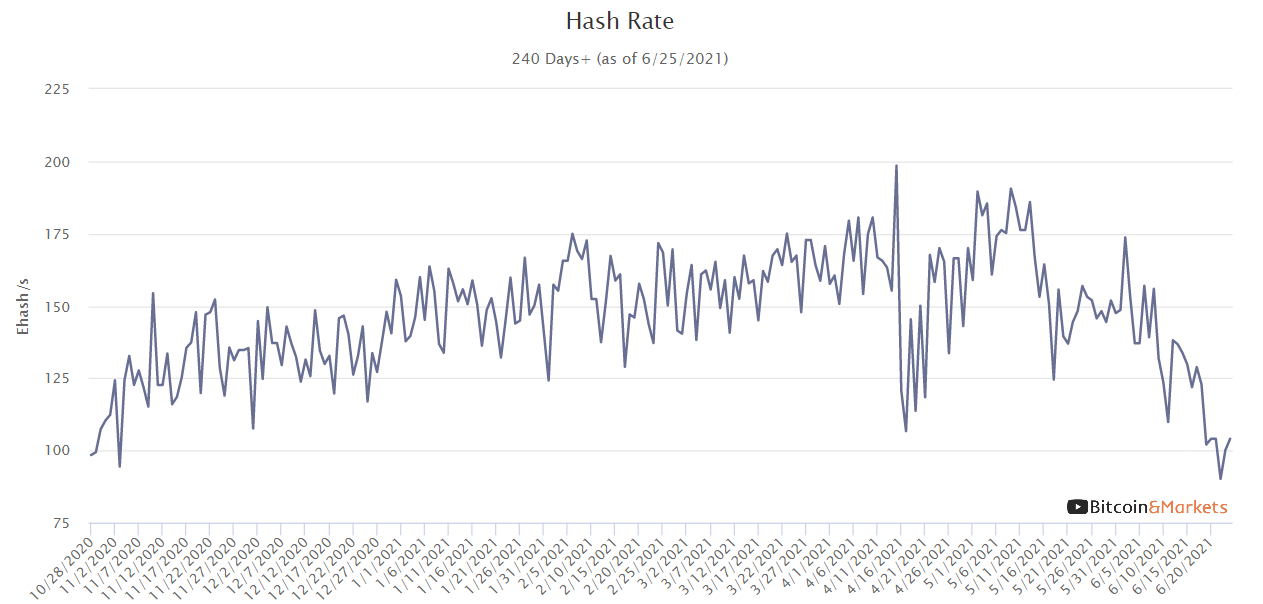

Then why has the hash rate dropped by almost 50%? Don't forget, we are in the middle of chip shortage as well. It is very possible that 1) miners are leaving China, 2) remaining miners are having trouble sourcing new equipment as old equipment dies, and 3) the price is suppressed making some hash rate simply uneconomical at these prices. All-in-all, a 50% reduction in hash rate is not the end of the world. It's only a minor speed bump, the industry is not paralyzed.

Bottom line, this is not a death blow to bitcoin. In fact, many are rightfully pointing out that this move will geographically distribute mining even more than it was, which builds robustness into the system by diversifying regulatory risk. It also squashes all future attempts at the China China China FUD around bitcoin. We've heard for years that bitcoin is a CCP plot to destabilize the West. How's that one working out?

SHARE our content with friends and family!

Quick Price Analysis

Weekly BMI | 1 : Slightly bullish

Become a paid member to access our much more in depth technical analysis and member newsletter.

What an uninspiring time for the chart. Many people new to bitcoin might be surprised that bitcoin is boring most of the time, puntuated by a couple months of incredibly fast paced gains. Right now the price is laying the ground work for the next push higher.

Price did breakdown to new lows for this pullback, breaking the $30k mark for a short time. The chart looks quite bearish, with price comforably below the 50 EMA, sluggish volume, droopy indicators and oscillators. Just when everything aligns in one direction, that is about the time a reversal happens.

Overall, price is strong at these levels. This time last year, on June 25, 2020 we closed at $9239. $32k isn't bad. This is an excellent time to stack a few sats. Do be aware, today is the close of the CME June contract, the quarter, and the first half of the year. This regular convergence could be volatile and mark the significant shift in price action.

Mining

The slowdown in hashrate does not seem to have affected the mempool (the pool of transactions waiting to be confirmed). During periods like now, when blocks are 20% slower than average, transactions tend to back up more than what we are seeing now. Currently, only 25MBs or roughly 20 blocks are waiting to be confirmed. (Related info in the Development section below)

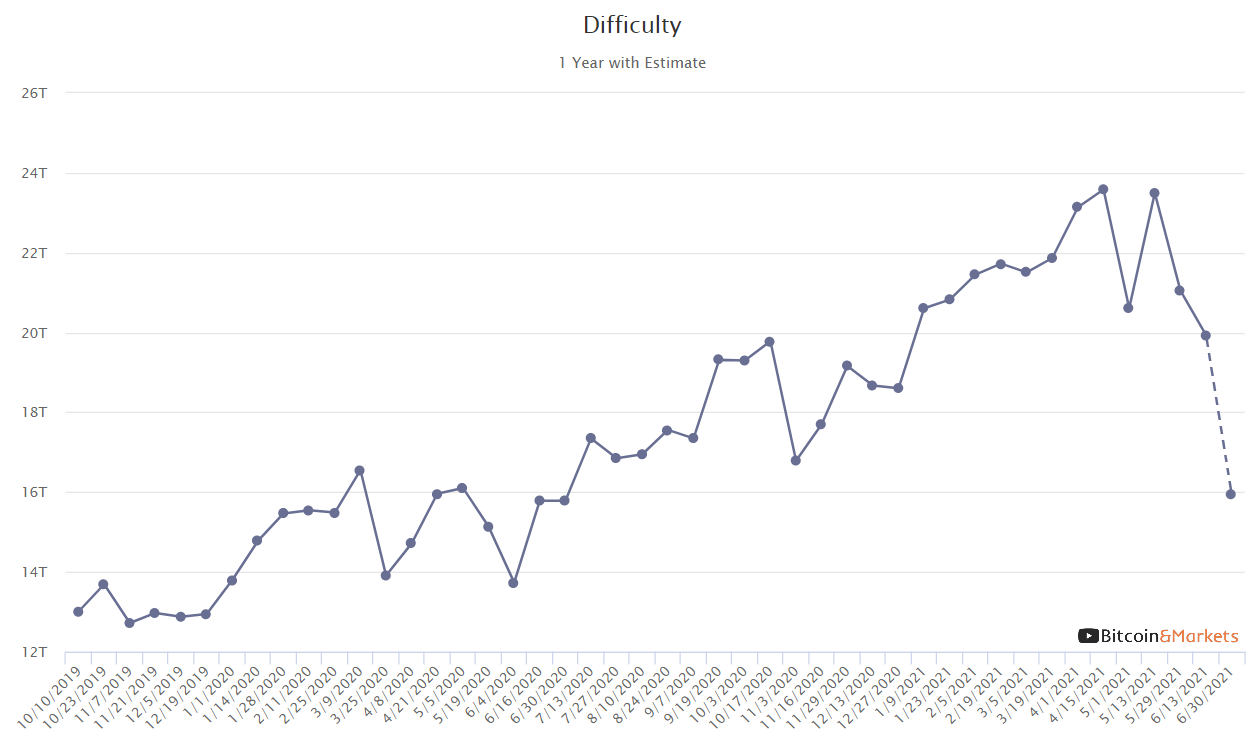

The difficulty is estimated to drop over 20% this period in 5-6 days. This drop will put difficulty back to where it was in June of 2020. We expect this to quickly recover at least 50% of this drop in the next few months, but for total recovery of the mining industry to take 6-12 months to return to normal.

Development

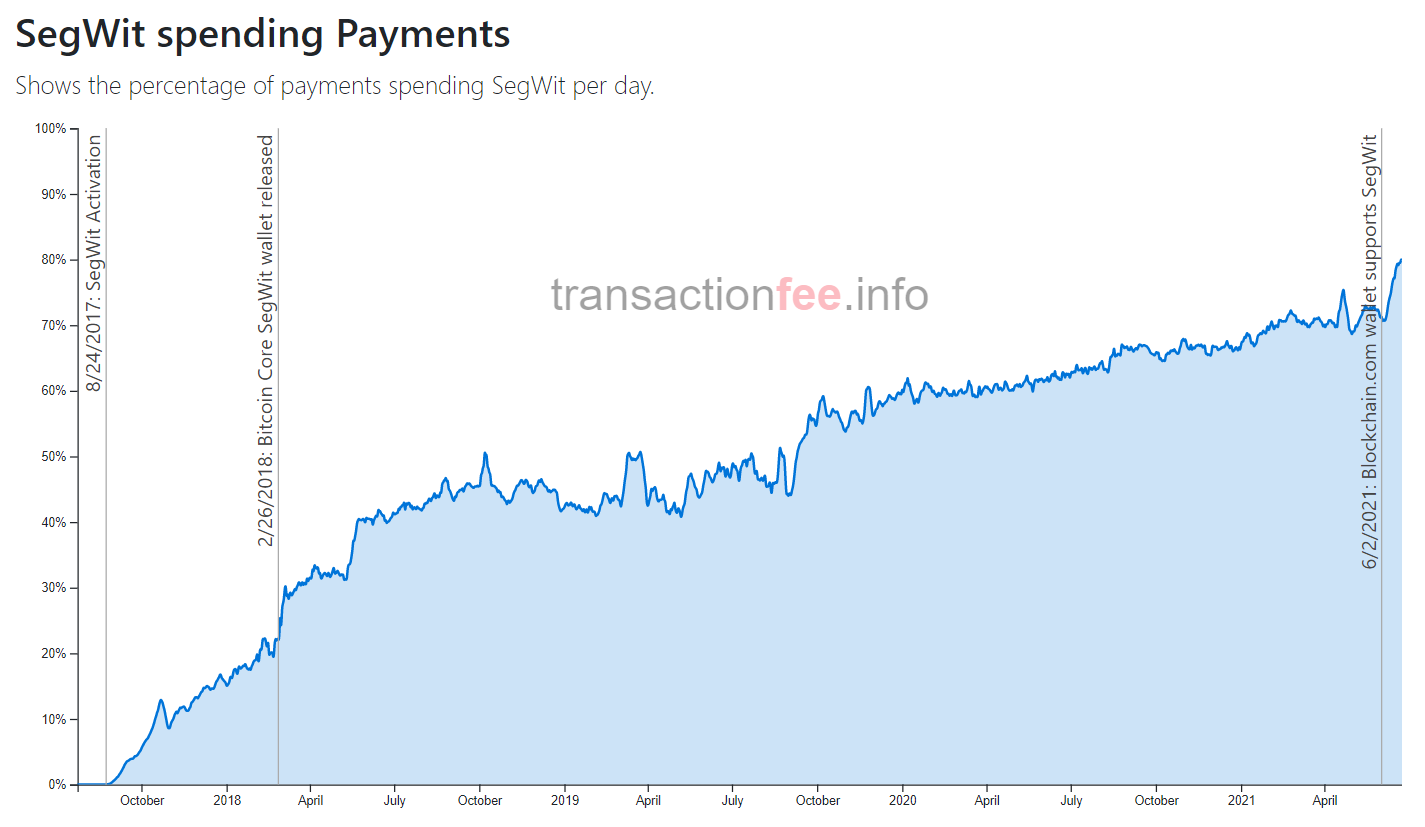

Segwit transactions are more efficient with their block space usage. They have many benefits and most services used them almost immediately back in 2017. A long time holdout, for purely political reasons, was blockchain.info (now blockchain.com).

Since they upgraded to support Sewit, close to 80% of transactions now use it, after only 3.5 years! Wallets need to use SegWit in order to access the Lightning Network or to use new transactions enabled by the Taproot upgrade being implemented in November. This is a great sign that usage of bitcoin's unique features is in demand and growing!

CBDC / Stablecoins / Altcoins

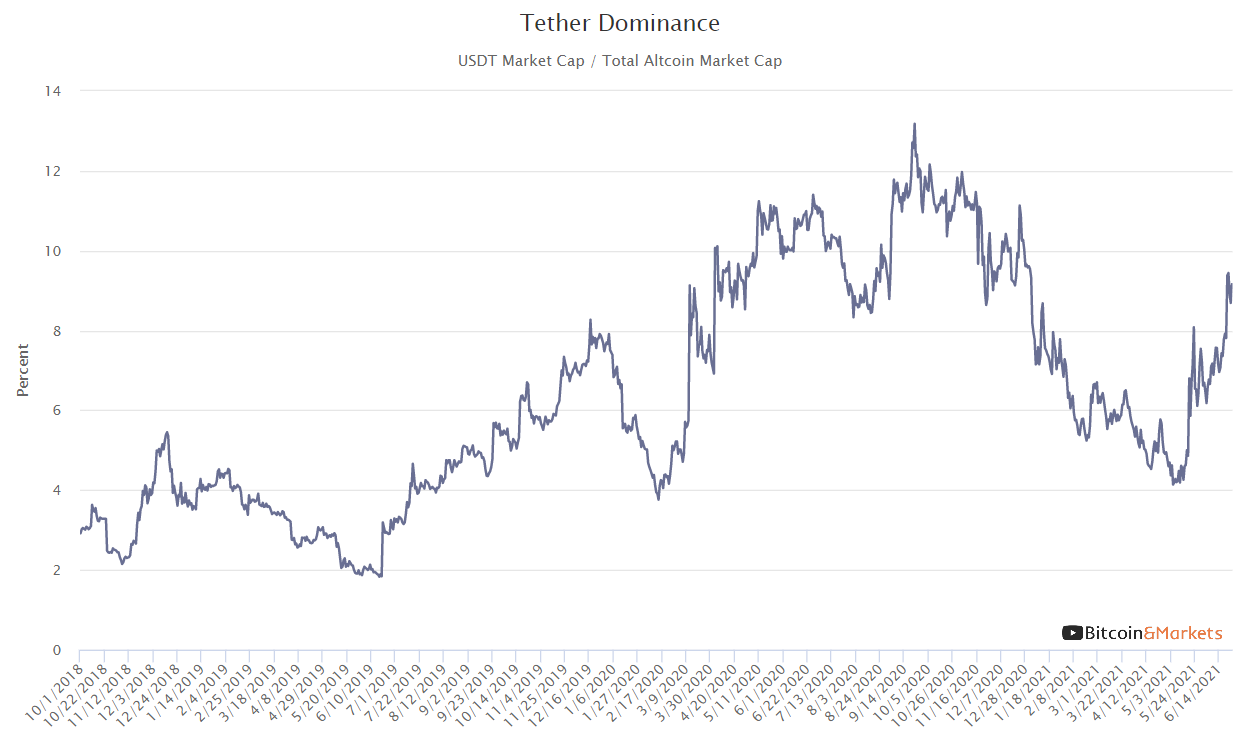

It has been a while since we've updated the Tether Dominance chart. During the altcoin bubble we just lived through, you can see on the chart that Tether's share of the total altcoin market shrank dramatically, back to a prior low mark.

We use this as a proxy for liquidity in the altcoin market. When Tether loses market share, altcoins as a sector become relatively less liquid and prone to volatility. In some cases that's volatility up, in others it's volatility down. As the altcoins crash, Tether's share of the market naturally increases, leading to more liquidity but not necessarily more demand and price recovery, just less volatility.

Miscellaneous

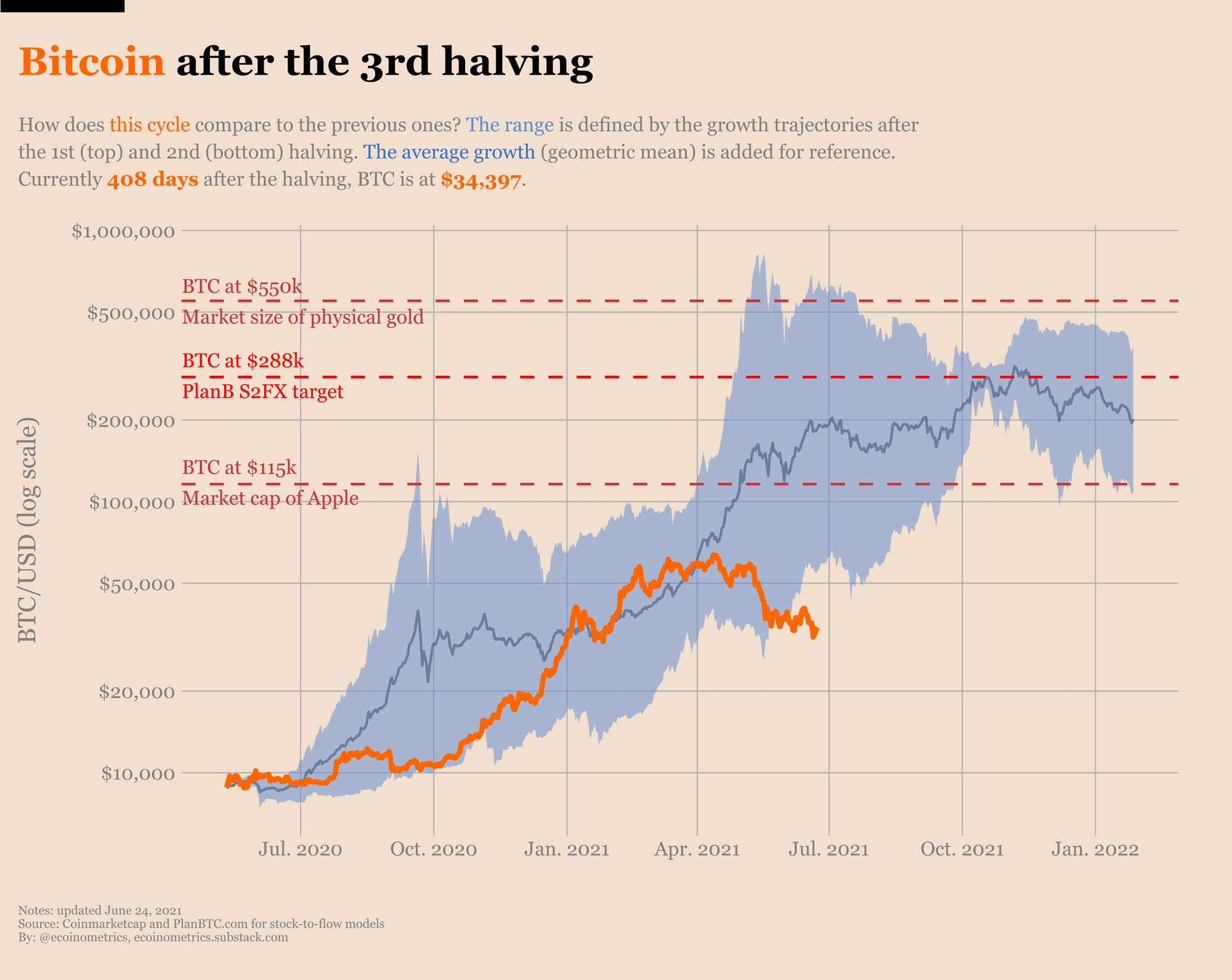

Cool chart from ecoinometrics, one of Ansel's favorite charting accounts on twitter. This an update to this chart which we have commented on before. It shows the overlap and average growth from the previous halving cycles, and comparing it to price action from the current halving cycle.

As you can see the orange line is dropping below the 2017 bull market pace. According to this chart, a resumption in the bull market should be expected anytime in the next month or two.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

June 25, 2021 | Issue #147 | Block 688,808 | Disclaimer

Meme by @BTCshopMiami