Fundamentals Report #144

Conference special with initial impressions, price analysis, Taproot update, ECB CBDC comments, Eth2.0 delay (again), and google search volumes.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (podcast) Q&A on Deflation: Part 1 - E230

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $37,178 (+$182, +0.5%) |

| Market cap | $696 billion |

| Satoshis/$1 USD | 2,690 |

| 1 finney (1/10,000 btc) | $3.71 |

| Median fee confirmed (finneys) | $2.96 (0.80) |

| Market cycle timing | Mid-cycle adjustment |

| Weekly trend | Strong consolidation |

| Media sentiment | Neutral |

| Network traffic | Low |

| Mining | Stable |

Market Commentary

This week is going to be a short Report because we are both down in Miami for the Bitcoin 2021 Conference being put on by Bitcoin Magazine. Hopefully, we'll get to meet several of our supporters and readers!

While there, we are going to be making observations about the state of the community, the presence of euphoria or not, the popularity of different subjects, and just observe the general health of the industry. We will report back to you, our readers, next week on our conclusions.

Initial impressions from today: This conference is a major milestone in the life of bitcoin. If you were at this conference or into bitcoin prior to this conference, you were "early". From here on out, bitcoin is mainstream. If you get into bitcoin after this weekend, you will be considered part of the majority in bitcoin's S-curve of adoption.

OPSEC

Getting together with like-minded people is a good thing. However, operation security should be a big consideration during events like these. If you were a maniac with intentions to hurt bitcoin in the medium term, this collection of influential and hodlers of coins would be a good target.

So, if you are a reader of the letter and are down in Miami, be careful. Keep your head about you, watch for anything out of the ordinary, and trust your gut.

Other Market Observations

A quick commentary on the bitcoin market as a whole this week, is that it is slow. Since the Great Sell-Off on May 19th, it has been sideways and calm. Some banks are making announcements about bitcoin, CBDCs, defi, and regulation, which we will cover below. Also, covered below is the biggest news of the week for bitcoin, taproot signaling. Overall, very little newsworthy developments in the space, so we see headlines about Dogecoin being added to Coinbase (a complete joke coin getting added to what is supposed to be the premier bitcoin company) and minor altcoin X adding silly feature Y.

Expect lots of announcements of new projects and involvement in bitcoin during the conference. A good example is Square's announcement this morning that they will be building a hardware wallet in the spirit of open source. All these announcements will be very bullish, leading us into the second half of the bull market.

Buckle up, though. This is the quiet before the storm. We expect some real fireworks the rest of the year.

SHARE our content with friends and family!

Quick Price Analysis

Weekly BMI | 2 : Bullish

Become a paid member to access our much more in depth technical analysis and member newsletter.

Ansel will be writing a new Pulse issue first thing next week to debrief the price action over this weekend.

Our brief comments for this letter are as follows. There will be lots of announcements as mentioned above, but there will also be a lot of whales at the conference who won't be trading. Once everyone gets home and back to their computers we expect the price to react very positively.

Development

Taproot Signaling

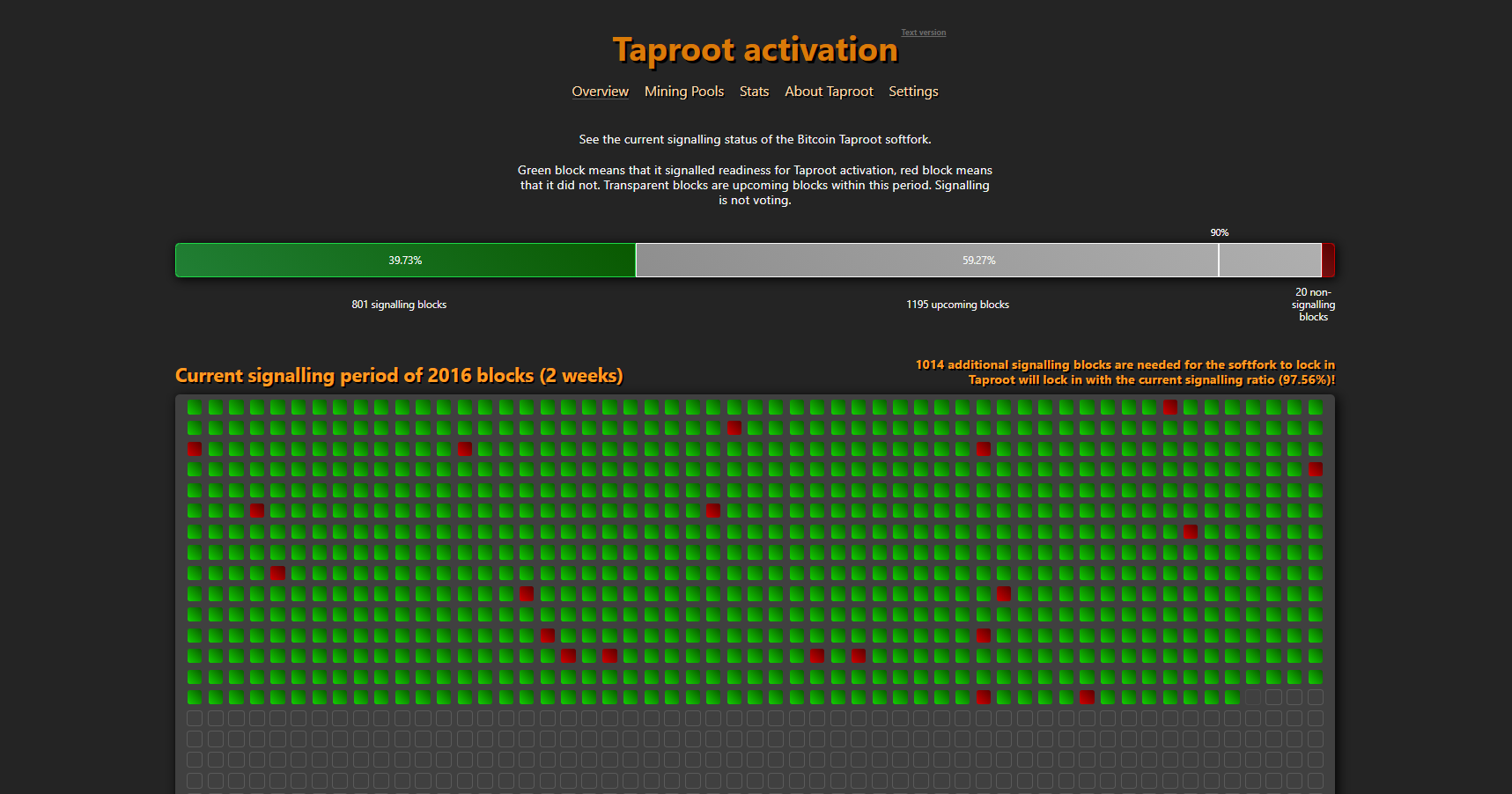

The biggest development for bitcoin this week that will fly under the radar due to the conference is Taproot signaling. It will be quietly locked-in this difficulty period. We are cautiously optimistic about the 6 month window between being locked-in and activation. It was "too easy", there is plenty of time for drama before November when it becomes live in the code.

For the beginner reader, Taproot is a major upgrade to bitcoin that doesn't break old nodes in a process called a soft fork. Node running old code can continue to function as usual, while nodes running the new software will have new features available to them via Taproot. The new features revolve around the cryptography of signatures allowing more complexity in transactions, at the same time as making all transactions look the same for privacy. Great write up for more on Taproot by Bitcoin Magazine here.

The timing of this lock-in period is fortuitous, being the same time as the biggest bitcoin conference in history and the sea-change from early bitcoin to being mainstream.

Mining

The mempool cleared this week for the first time this year, and this bull market cycle. It is now back up to nearly 30 blocks worth of unconfirmed transactions waiting to be included in the block chain.

Hash rate is stable and recovering slightly from its recent declines. The effects of the recent China mining drama that we wrote about last issue have yet to find a new home it appears.

Fees are very low right now. To be included in the next few blocks will cost <$5 and if you can wait for 24 hours fees can be as low as $0.25. We don't expect this to last long. In the next couple of weeks, fees should return to >$10, so if you'd like to rebalance your wallets or mix your coins, this would be a great week to do so.

CBDC / Stablecoins / Altcoins

ECB published their annual report this week which included a section on CBDCs research. We briefly summarize some of their comments below.

They discuss the things that effect the success of a currency. No mention of legal tender laws.

The global appeal of a currency depends on fundamental economic forces, which digitalisation is unlikely to alter. Such determinants include, for instance, the size of the issuing economy in terms of global trade and finance, the soundness of economic policies, financial market depth and liquidity, and inertia in international currency use.

They are starting to discover network effects for money.

These specific features may combine to amplify positive feedback loops in the use of a CBDC as a means of payment and as a store of value. Recent research suggests that a currency’s role as an invoicing or payment unit acts as a complement to its role as a store of value, resulting in positive feedback loops.

This section exposes their biggest worry in our opinion, namely that the Euro will lose market share to a digital dollar if they don't intervene and force the issue with an ECB led CBDC.

The availability of a CBDC could facilitate currency substitution in third countries with instable currencies and weak fundamentals. It might facilitate digital “dollarisation” in such countries, leading to the full or partial replacement of their currencies with the CBDC for local payments, as a savings vehicle and, ultimately, as the unit of account. This would strengthen the global status of the currency in which the CBDC is denominated but would also reduce monetary policy autonomy in the economies concerned.

Finally, attention should be paid to the risks to stability that might arise if a central bank does not offer a digital currency. One concern could be a situation in which domestic and cross-border payments are dominated by non-domestic providers, including foreign tech giants potentially offering artificial currencies in the future. Not only could this threaten the stability of the financial system, but individuals and merchants alike would be vulnerable to a small number of dominant providers with strong market power, and the ability of central banks to fulfil their monetary policy mandate and role as lender of last resort would be affected. Issuing a CBDC would help to maintain the autonomy of domestic payment systems and the international use of a currency in a digital world.

The report goes more in depth on certain aspects of CBDCs, like bearer-CBDC versus account-based CBDC which are important to understand. It is too long to include on this letter, but Ansel will be writing a detailed blog post over at BTCM Research on it in the next week. Stay tuned and subscribe to that feed over there.

Ethereum

Real quick note on Ethereum 2.0. Surprise surprise, it has been delayed again. In comments this week, Vitalik has said it will be at least the end of 2022 for Phase 1. That is just the first phase of 7. At this pace, a realistic schedule for ethereum 2.0 completion is 2030 or later, if at all.

#Ethereum's central planners don't want to rush the 7 phase process for making snake oil. https://t.co/VpXXNnEBo0

— Ansel Lindner (@AnselLindner) June 2, 2021

Miscellaneous

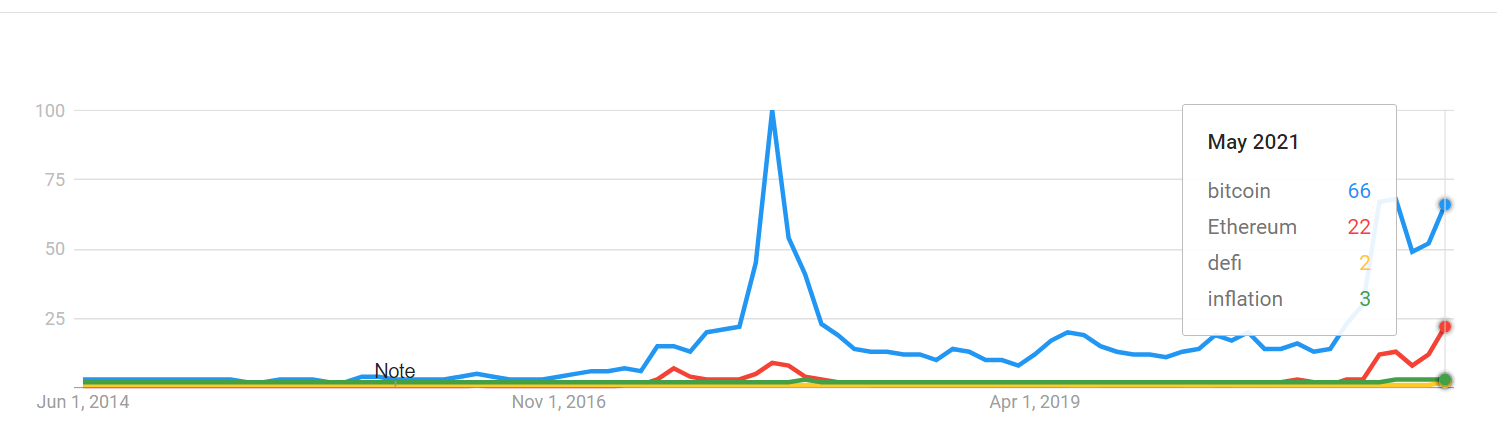

Google search volume for the term bitcoin is approaching its 2017 highs once again. This is a good narrow metric to measure newcomer interest in bitcoin. In the chart, we also included Ethereum, defi and inflation. It tells an interesting story.

Ethereum searches are well above previous highs, perhaps signaling that its bubble is closer to over than bitcoin's. The defi volume is pitiful for what is supposed to be the premier use case for altcoins, and also supposed to appeal to newcomers to the finance around the world. Pretty telling that defi is very overblown. Lastly, we are told inflation is terrible and a huge concern, yet search volume is extremely low. Not very many people are concerned about it, maybe because it is overblown as well

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

June 4, 2021 | Issue #144 | Block 686,266 | Disclaimer