Fundamentals Report #125

Examining the FUD of the week, price, bitcoin mining metrics, analysis of stablecoin market caps, and more!

January 22, 2021 | Issue #125 | Block 667,211 | Disclaimer

Written by Ansel Lindner and Jeff See

Bitcoin in Brief

| Weekly price | $33,260 (-$2774, -7.70%) |

| Satoshis/$1 USD | 3,007 |

| 1 finney (1/10,000 btc) | $3.33 |

| Stock to Flow (new supply to existing) 463/d | 1.17 |

| Mayer Multiple (ratio to 200 d MA) | 2.08 |

| Est. Difficulty Adjustment | +1.88% in 1 day |

| Previous Adjustment | +10.80% |

This week's Bitcoin & Markets content

- (Member) No Pain, No Gain - Bitcoin Pulse #98

- (Podcast) Another Government Letdown - FED 37

- (Blog) High transaction fees on bitcoin

- (Blog) Dark Age Interest Rates (5th through 11th Centuries)

Go to our Info Page to join our discord community, find where to listen, and follow us. Become a member for exclusive content.

The Bitcoin Dictionary is LIVE on Amazon!

Market Commentary

To a beginner the FUD (Fear Uncertainty and Doubt) of the last week may be concerning, especially since it was correlated with the large price dip. But rest assured, none of these stories have much if any merit, and they certainly didn't cause the sell off. Below we comment on the 3 biggest fake news items.

Double-Spend

First, the double-spend that supposedly took place a couple days ago. A double-spend is when the same coins are successfully sent to two or more recipients. With cash this isn't a problem, because you can't hand the same dollar bill to two people simultaneously. Double spending is strictly a digital money problem, and if possible on bitcoin would make it instantly worthless.

The recent news about a double-spend on bitcoin was an "attempted" double-spend. Bitcoin is specifically designed to make a successful double-spend impossible, but it can't, and has never promised, to stop attempts to double-spend.

Two transactions which send the same coins is possible only until the first confirmation (approximately every 10 mins). That is when the network decides which transaction is valid and which is not. You cannot have two confirmed transactions sending the same coins. That is how it works. People can attempt to double-spend, but they will only be successful fooling a recipient if they don't wait a short time for the confirmation in the next block.

Not all bitcoin transactions have this lag time. Transactions through the Lightning Network are immediately checked, and are cryptographically valid or not. These aren't transactions that go through the main network, so they don't have to wait for a confirmation.

Tether

Tether, a USD stablecoin created to bypass banking hurdles of moving USD around the world, has always been the focus of a small group of aggressive detractors. The countless baseless allegations levied against Tether have never significantly affected Tether or bitcoin, but the body of allegations is now big enough to garner the attention of regulators, even though they are false and defamatory.

After years of scrutiny, there is only one convenient incident that regulators have found to go after Tether legally. Specifically, a third party theft of $850 million in Tether funds and the subsequent way in which Tether plugged the hole (very easily and fairly btw). We say this is a convenient incident, because it is possible Tether's powerful competition had something to do with it.

The NYAG swiftly began an investigation after the incident, and January 15th was an important deadline in the investigation where Tether was to provide specific documents to the court. The detractors focused on this date, claiming Tether's evil ways would finally be exposed. Well, nothing much happened and the deadline was pushed back 30 days. Like Q, believers in the evilness of Tether were left frustrated once again.

Bottom line for this FUD is nothing about the investigation that would negatively affect bitcoin anyway. If Tether had problems, billions of dollars in Tether would flee, mostly into bitcoin.

Government crackdown

Christine Lagarde critical comments about bitcoin are a couple weeks old now, where she called for global regulation against "cryptocurrencies" because they are used for heinous money laundering. LOL. This week, Janet Yellen, the new Treasury Secretary in the US, made very similar comments, saying:

"Cryptocurrencies are a particular concern, I think many are used—at least in a transactions sense—mainly for illicit financing."

However, Yellen's written comments yesterday struck a polar opposite tone:

"Bitcoin and other digital and cryptocurrencies are providing financial transactions around the globe. Like many technological developments, this offers potential benefits for the U.S. and our allies... I think it important we consider the benefits of cryptocurrencies and other digital assets, and the potential they have to improve the efficiency of the financial system."

Notably, the US stance is much more reserved than that of Europe, likely due to the more dire circumstances in which the Euro finds itself. Overall, this rhetoric is nothing new and they are no closer to banning bitcoin. If anything comes from regulation it will be the average Joe being more comfortable buying some.

Quick Price Analysis

Weekly BMI | 0 : Neutral

This week's issue of the Bitcoin Pulse covered the charts in detail. All technical analysis must be matched with insightful fundamental analysis, and that's where we shine. Don't miss that one, sign up at the link below.

What a week for price. It dropped to new lows as we predicted, breaking the bullish market structure for the time being. In the near term, we expect a sizeable bounce to a level where hope returns, followed by another drop to new fresh lows.

This is a sizable correction, after an intense rally. February is shaping up to be a less volatile accumulation phase, followed by March and April as the next leg up in this market to new highs.

Become a paid member to access our full technical analysis and exclusive member newsletter each week!

Mining

Bitcoin mining has been surprisingly consistent and resistant to spikes and dips in price. New blocks continue to be produced roughly every 10 minutes as designed, but the number of transactions waiting confirmation remains high.

Word on the street is new mining hardware is hard to come by and many are still waiting for back orders. It is hard to know where or what the delays in the supply chain are, and if they are abnormal. Hash rate (computing power) tends to lag price movement and since the price rallied so quickly, some of the delay might simply be normal lag.

We expect hash rate to come online and follow the surge in bitcoin price in the next couple of months. In the mean time, the difficulty is still expected to adjust up very moderately at 1.9% tomorrow.

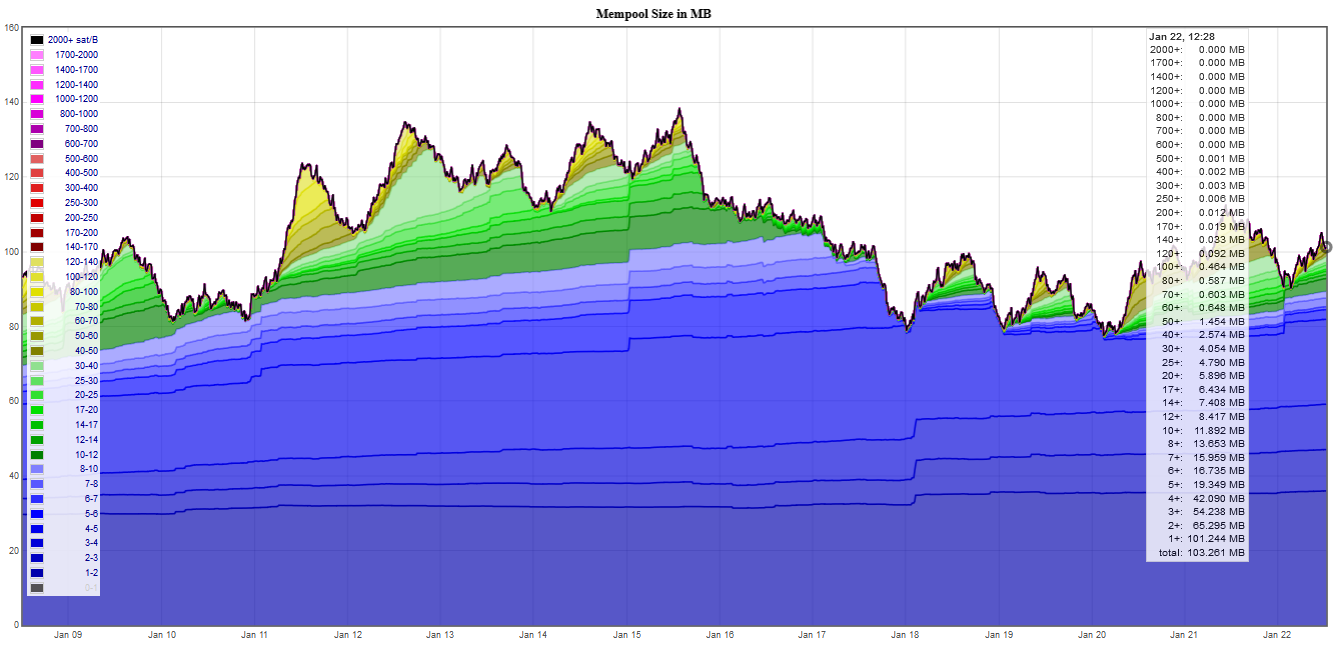

The mempool hasn't grown since last week, currently at about 100 MB of transactions waiting to be processed. The low point this week as 80 MB, clearing transactions down to 5 sats/byte in fee. The rule of thumb is the transactions with the higher fees get processed first, so, a transaction with less than 5 sats/byte in fees would have been lucky to be confirmed. At the time of writing, to get in the next block you will need to pay a fee of about 100 sats/byte (~$7).

Stablecoins / CBDC / Altcoins

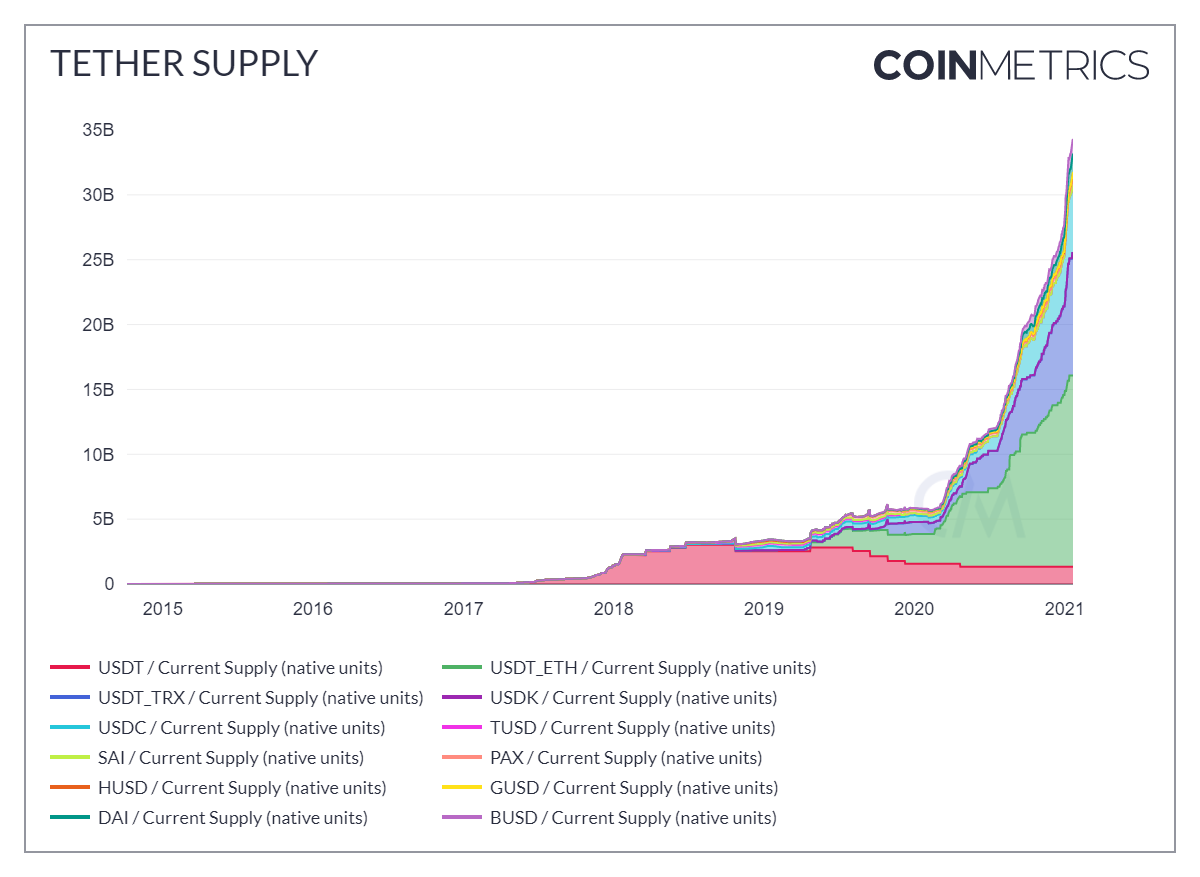

We haven't posted much in this section of the report for a while, because there hasn't been much news regarding this segment of the market. However, this week we wanted to show the incredible growth of the combined stablecoin market cap.

As you can see it grew from approximately $5 bn in Jan 2020 to more than $35 bn today. This also doesn't count many of the defi stablecoins out there. Does this look like market participants are worried about regulation?

Lastly, two addition things to note, 1) despite the (organized) campaign against Tether, it remains $25 out of $35 bn, or over 70% of all stablecoins; 2) these stablecoins are usually counted as part of the total altcoin market cap and against bitcoin in the dominance measure.

Miscellaneous

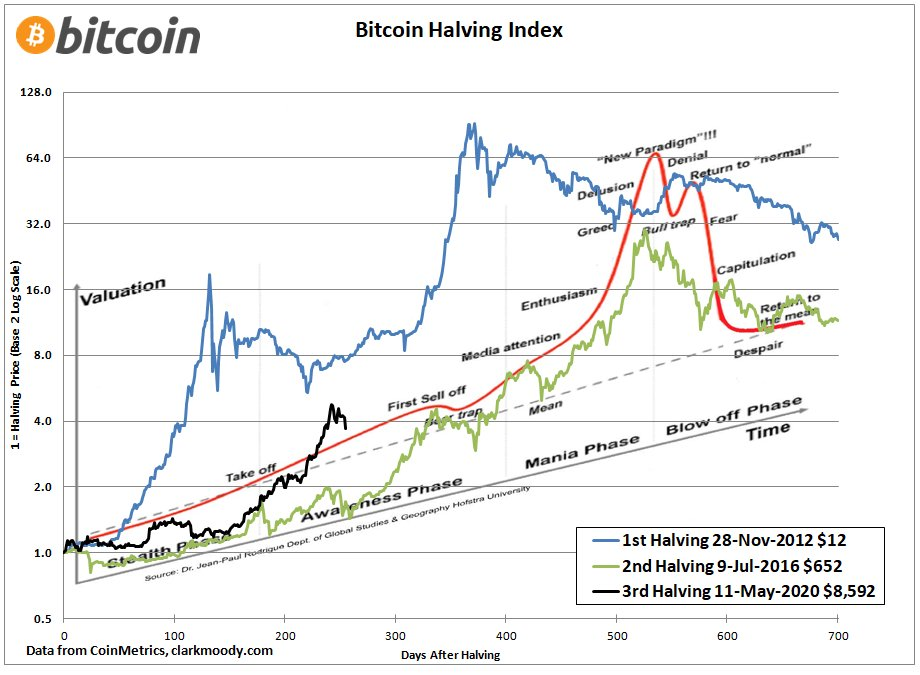

Our friend ChartsBTC on twitter asks if this is the first sell off? His image cleverly overlays the bitcoin halving cycle with the psychology of a bull market cycle.

Demystify Bitcoin Jargon with the Bitcoin Dictionary

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.