Fundamentals Report #121

December 24, 2020 | Issue #121 | Block 662,820

December 24, 2020 | Issue #121 | Block 662,820 | Disclaimer

Written by Ansel Lindner and Jeff Si

Bitcoin in Brief

| Weekly price | $23,476 (+$749, +3.30%) |

| Satoshis/$1 USD | 4,260 |

| 1 finney (1/10,000 btc) | $2.35 |

| Stock to Flow (new supply to existing) 463/d | 1.047 |

| Mayer Multiple (ratio to 200 d MA) | 1.85 |

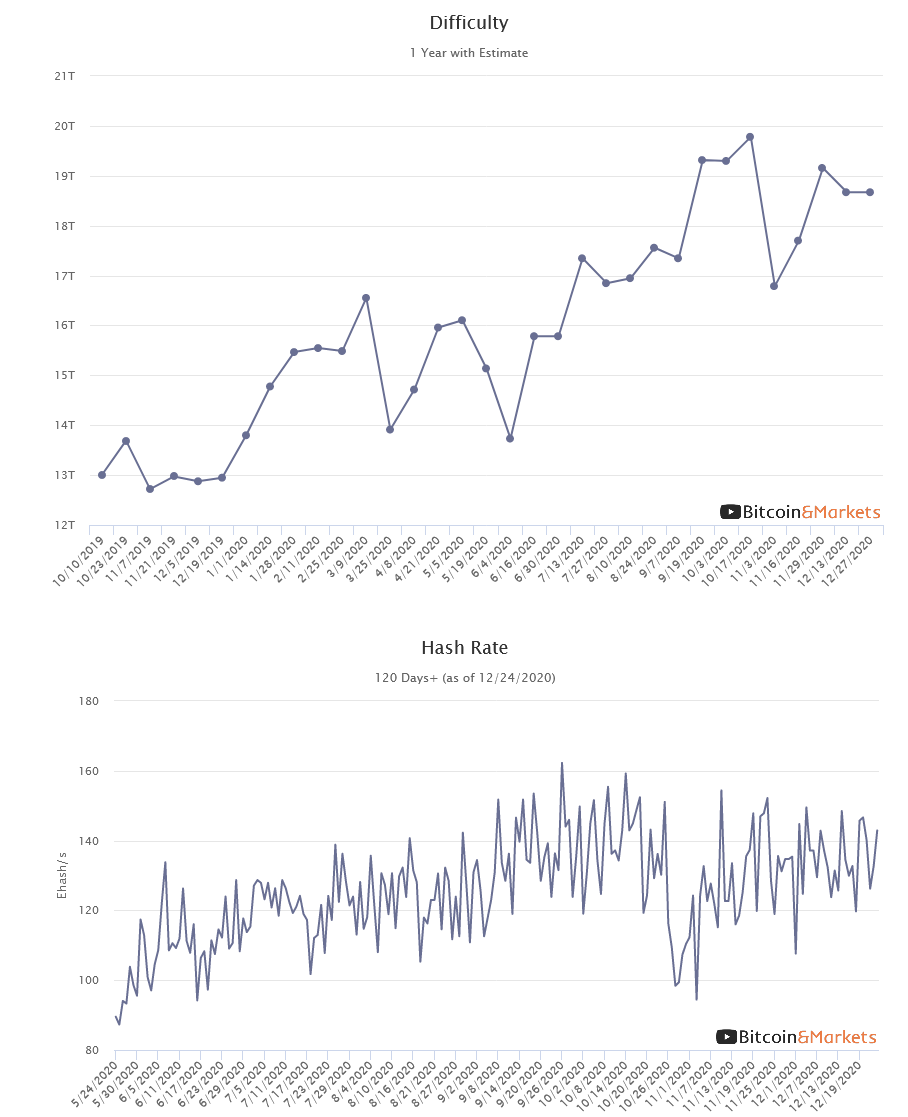

| Est. Difficulty Adjustment | -0.33% in 3 days |

| Previous Adjustment | -2.54% |

This week's Bitcoin & Markets content

- (Member) Raging Bulls and Understanding Gaps - Bitcoin Pulse #94

- Slow holiday week. Big plans for coming podcast episodes!

Go to our Info Page to join our community, find where to listen, and follow us.

The Bitcoin Dictionary is LIVE on Amazon!

Market Commentary

Picture a dark alley full of lifelong unapologetic criminals that will mug you in a heartbeat if you make your way passed them. Now, imagine a person at the entrance screaming, "You will get mugged if you go down this alley!" Yet, some people still go down the alley and obviously become a victim.

This is the situation we find ourselves in about Ripple. They are logically an unregistered security and a scam. We've been yelling from the rooftops for years it's a scam. Well, we were right to warn people, the SEC is now charging Ripple with being an unregistered security. We are not happy the State is using force against people, but you can only warn people so much.

This is a big deal and the panic is spreading through bitcoin exchanges.

Will Coinbase and others who promoted and sold ripple to retail investors be fined or charged as well? Will ripple be delisted everywhere? We hope not, but we don't expect this to be the last of such moves by the US or other government goons.

Be advised! Altcoins are vulnerable to State action in ways bitcoin is not. Bet future value accordingly.

Quick Price Analysis

Weekly BMI | 1 : Slightly bullish

Price is hanging in mid-air at moment. There are several possible negative affects on price, as well as long term positive affects.

On the negative side, we have year end selling coming in the form of hedge fund rebalancing and for tax reasons. Also, the Chinese new year has traditionally been a downward pressure on bitcoin's price as people sell their coins to buy presents. Finally, the last week of the year is typically very light volume and the macro situation is uncertain.

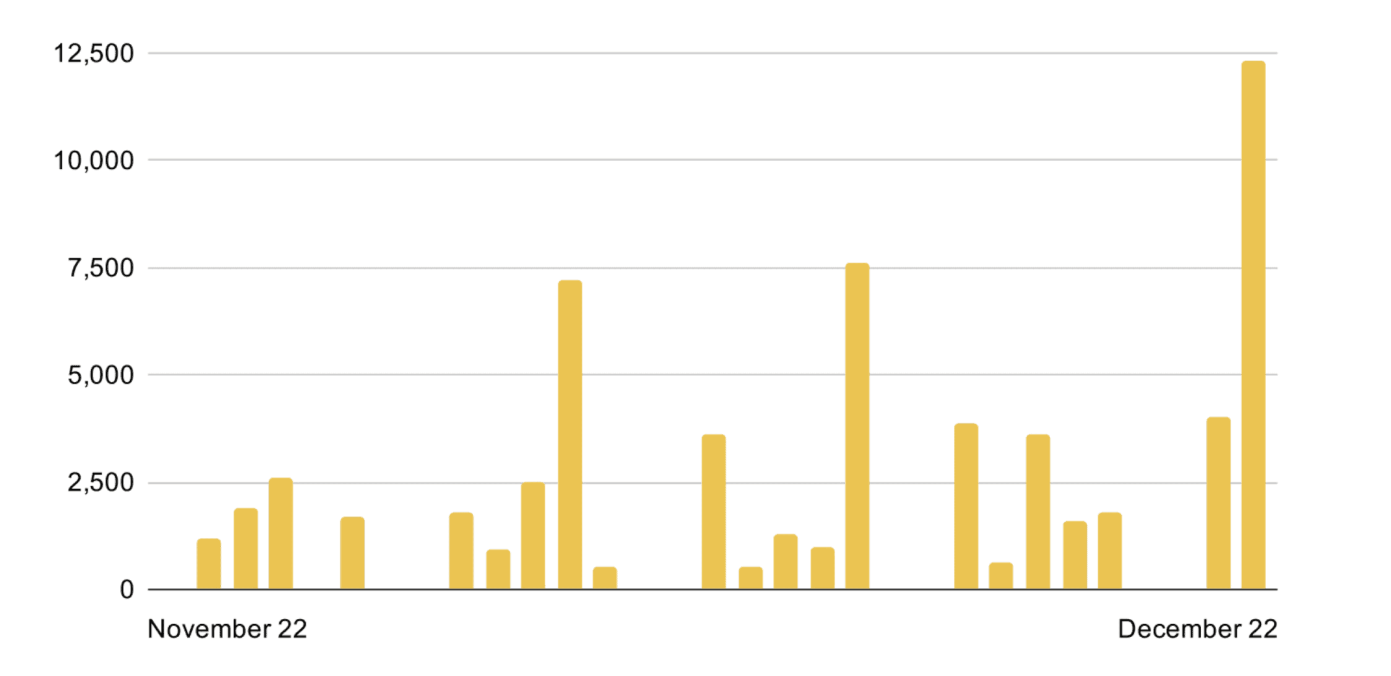

On the positive side, we have a massive amount of volume from institutions flooding into bitcoin. Demand from Grayscale (ticker GBTC) is setting records. On Dec 22nd alone the acquired 12,000 btc or 13 days worth of mining rewards. While buys might slow this week, they are coming, we know more institutions are coming, and many of us will try to front run them.

Become a paid member to access our full technical analysis and member newsletter.

Mining

The mempool cleared transactions down to 18 MB, most of which were 1 sat/byte (the cheapest possible fee other than free) since our report last week. The mempool currently has 66 MB of transactions, but 80% of those have fees of 6 sats/byte or lower, so, transactions are still inexpensive. We also expect the mempool to clear over the weekend due to holiday activities around the world.

Blocks are being found a little slower the last few days and difficulty is now tracking to be about even for the next adjustment in 3 days.

Stablecoins / CBDC / Altcoins

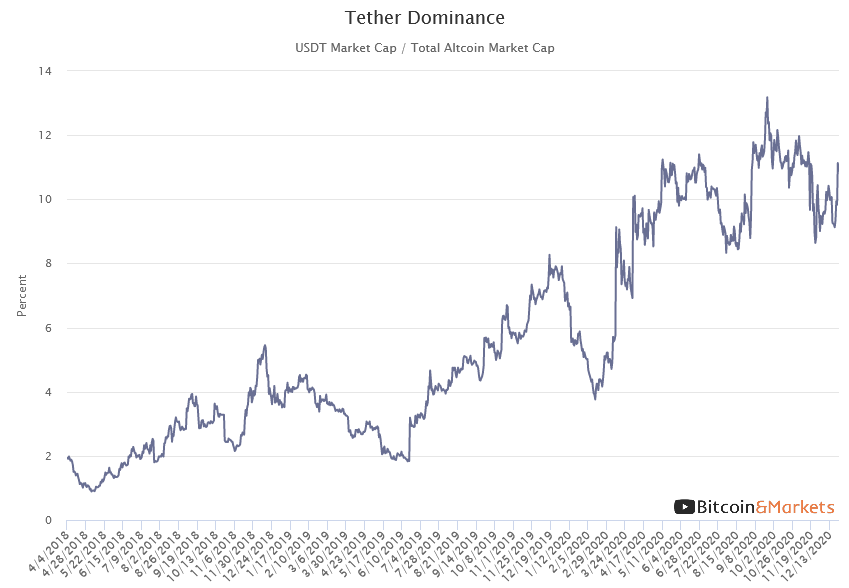

Tether Dominance: 10.89% (+1.7%)

Presented with little comment other than to say Tether's market cap increased this week by $600 million while other altcoins bled out. Remember, the competition in the space is bitcoin versus the dollar. Don't get side tracked by altcoins.

Miscellaneous

Coinmetrics published their Year in Review numbers a week early this year and it's no surprise they look strong.

There are several interesting numbers to note:

Active Addresses and Transaction Count: this increase shows bitcoin's one network transactions remain in high demand and effort is continuing to efficiently use the limited throughput.

Supply Held by Exchanges, Held by Miners, and Held by Mining Pools: in general, bitcoin held by exchanges dropped, which is good as a percentage of supply, but when you consider the dollar value on exchanges, it still increased dramatically. That's the best of both worlds.

Supply held by different types of miners was relatively muted, but at least logically supporting the decentralization narrative. Large miners lost some share and pools (where small individual miners participate) gained. This is a good sign for decentralization of mining, and we expect that to be even more pronounced next year.

Addresses (accounts) with bitcoins: This increased across the board except for the 100 btc category. This makes sense if you think that the 0.01 to 1 btc category will be individuals, and the 1,000 btc category will be institutions or large entities. More individuals are holding their own keys and taking control of their financial destiny as well as more large institutions coming in. (small note: most smaller investors hold their coins on exchanges, so this can make the growth look smaller than it is)

That's it for this week. Have a very merry Christmas. See you next week!

Demystify Bitcoin Jargon with the Bitcoin Dictionary

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.