Fundamentals Report #116

November 20, 2020 | Issue #116 | Block 657,868 - This bull market is progressing very quickly. Everyone is bullish. It feels frothy. ...

November 20, 2020 | Issue #116 | Block 657,868 | Disclaimer

The Bitcoin Dictionary is LIVE on Amazon!

Bitcoin in Brief

Weekly price: $18648 (+$2333, +14.3%)

Mayer Multiple: 1.63

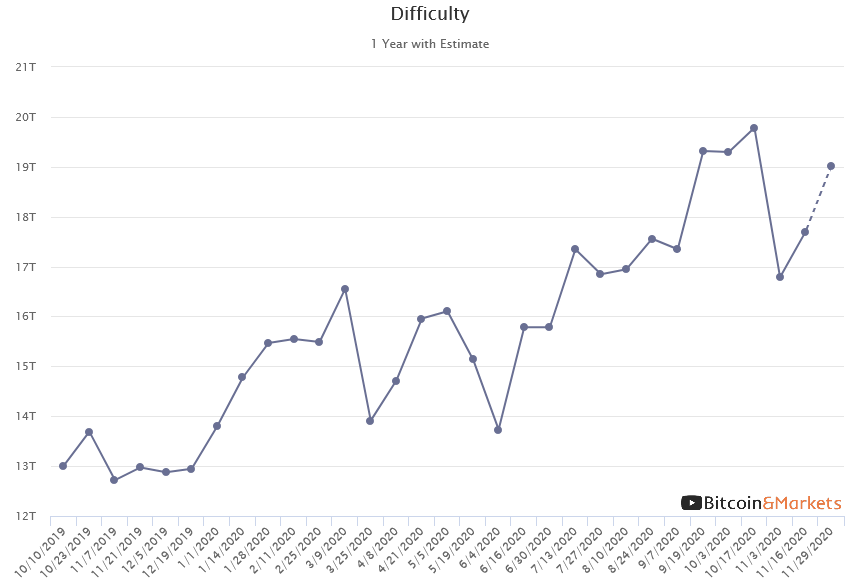

Est. Difficulty Adjustment: +7% in 8d

Prev Adj: +4.82%

Sats/$1 USD: 5362

1 finney: $1.86

This week's Bitcoin & Markets content

- Bitcoin Headlines that Matter - 11/19/2020

- Is the Bitcoin Price Going Directly to the Moon? - Bitcoin Pulse #90

- Michael Saylor Interview on Hedgeye Reaction - E221

Market Commentary

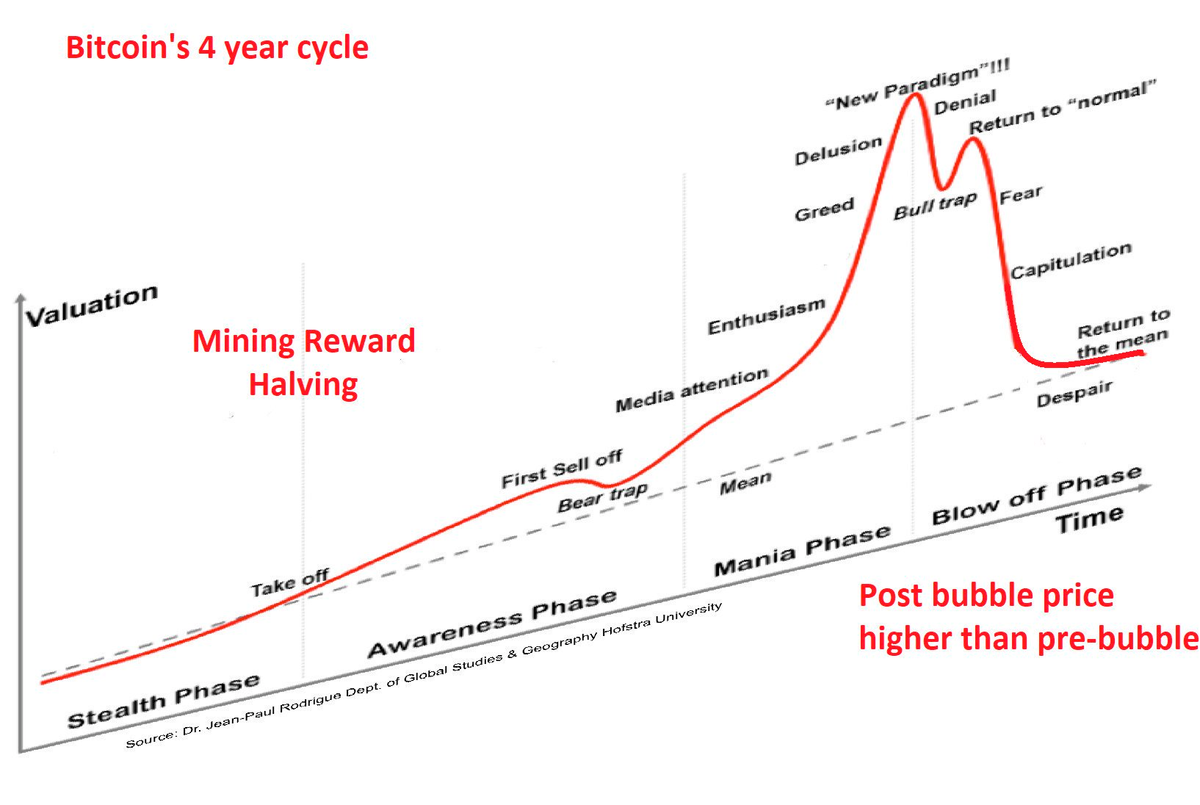

This bull market is progressing very quickly. Not just the price, but the narrative and psychology of the market, too. Everyone is bullish. It feels frothy. Even those who recently bad mouthed bitcoin, like billionaire Ray Dalio, are now open to the idea. Very few negative headlines can be found anywhere. People might be getting too confident.

Bitcoin has a loooong way to go, both in this bull market and in its evolution. It's currently at an All-time-high market cap of $335 billion, which can be thought of as the size of the bitcoin economy, and might be useful to compare that to the GDP of a country. This would put bitcoin's "GDP" around that of Ireland, Hong Kong, or South Africa. You can imagine the time it would take the world to adapt to one of these countries growing at the rate of bitcoin. It wouldn't happen overnight. It's not going to happen overnight for bitcoin either.

By the end of this particular bull market cycle, we can rationally expect the size of bitcoin to grow by 10x. That would put bitcoin's "GDP" at roughly $3.5 trillion, or on par with the 3rd and 4th largest economies in the world, Japan and Germany. To sustain that kind of economic activity, bitcoin will need a massive infrastructure build. Adoption is easy, it's the building of infrastructure and financial products on bitcoin that will take time. Lightning is great, it's becoming more and more ready for the mainstream every day, but it's not ready yet.

This is the way for bitcoin. We'll get there, but don't expect a single rally to do it. Be prepared for significant drawdowns in price.

Quick Price Analysis

Weekly BMI | -1 : Slightly bearish

We expected late October and early November to see sizable gains, but this rally has surpassed any of our expectations. December has marked the top of the last two bull markets with a blow off top (2013 and 2017), and in 2018 it marked the bottom. So, December is pretty important for bitcoin.

Extreme caution is warranted. Many indicators are maxed out and either need a significant drawdown or several months of sideways action to reset for the next move higher. It's possible price continues to push upward, but that simply sows the seeds for a larger drop in the future. Bitcoin will test support. This time is not different.

Become a paid member to access our full technical analysis and member newsletter.

Mining

As expected, the mempool cleared last weekend and has been clearing every day throughout this week. Fees have dropped back into normal range.

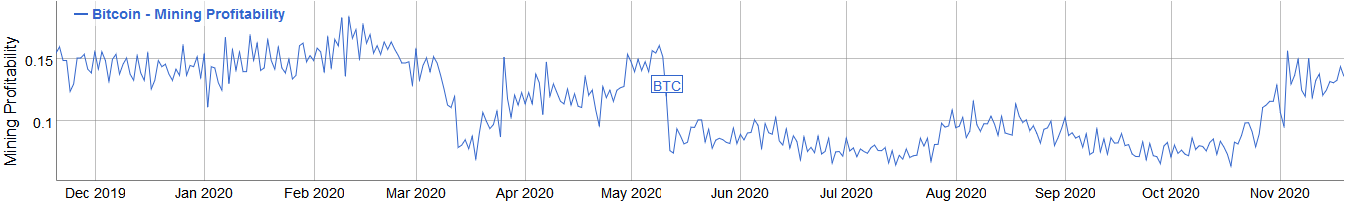

Difficulty adjusted up 4.82% on Monday and the hashrate continues to come back online causing the next adjustment to be estimated as +7%. Over time, mining profitability has gone down making it difficult for some operators to successful manage their operations. In the second mining chart below, we show profitability is nearing where it was pre-halving due to the price increase. This is good news for miners, helping those who may have mismanaged resources during the last cycle, or allowing successful miners to expand.

Stablecoins / CBDC / Altcoins

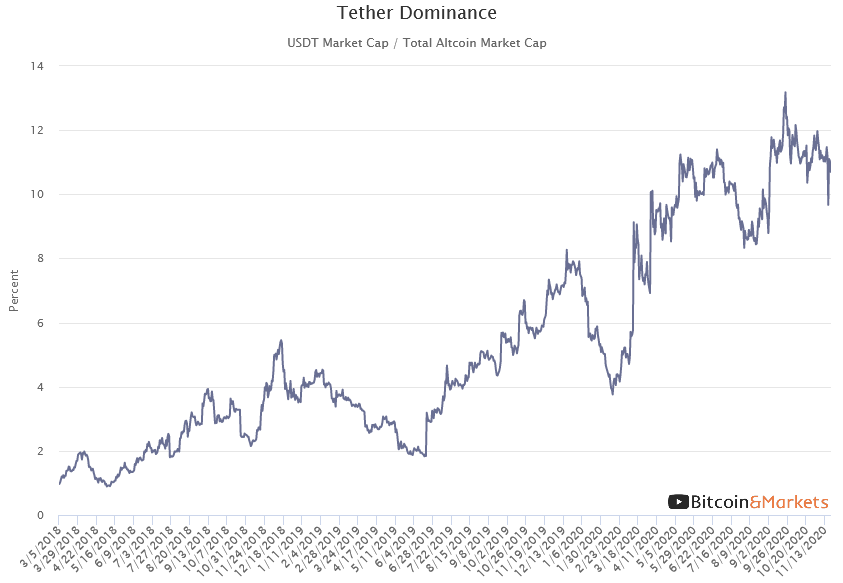

Tether Dominance: 10.7% (-0.3%)

Important note: as tether dominance goes down altcoins should become relatively less liquid, meaning volatility is ahead (probably to the downside).

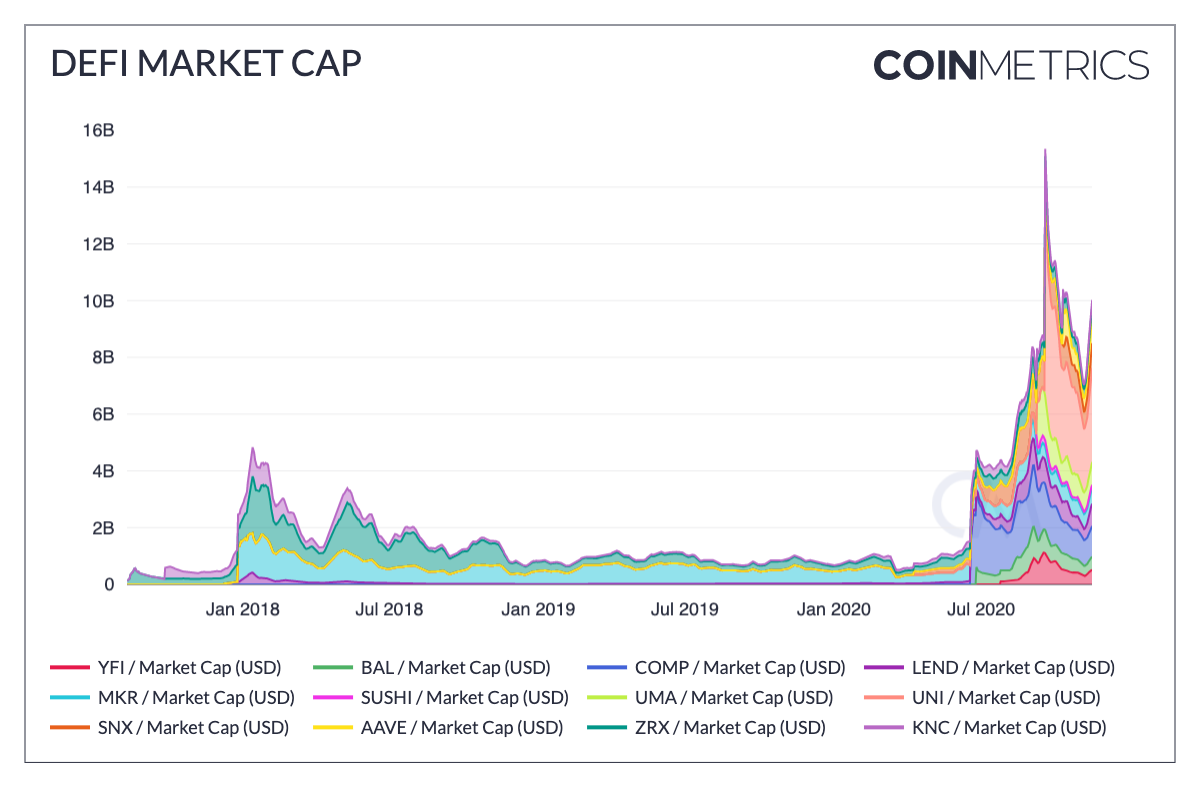

Check out the difference between Tether's natural growth and adoption, and Defi's below. There has been a frenzy of launches since July of this year. Several tokens were launched per week, each pumping then dumping. It is not as if a magic secret for creating effective Defi protocols appeared in July of this year. No, ponzis were launched, cloned, launched, cloned, etc.

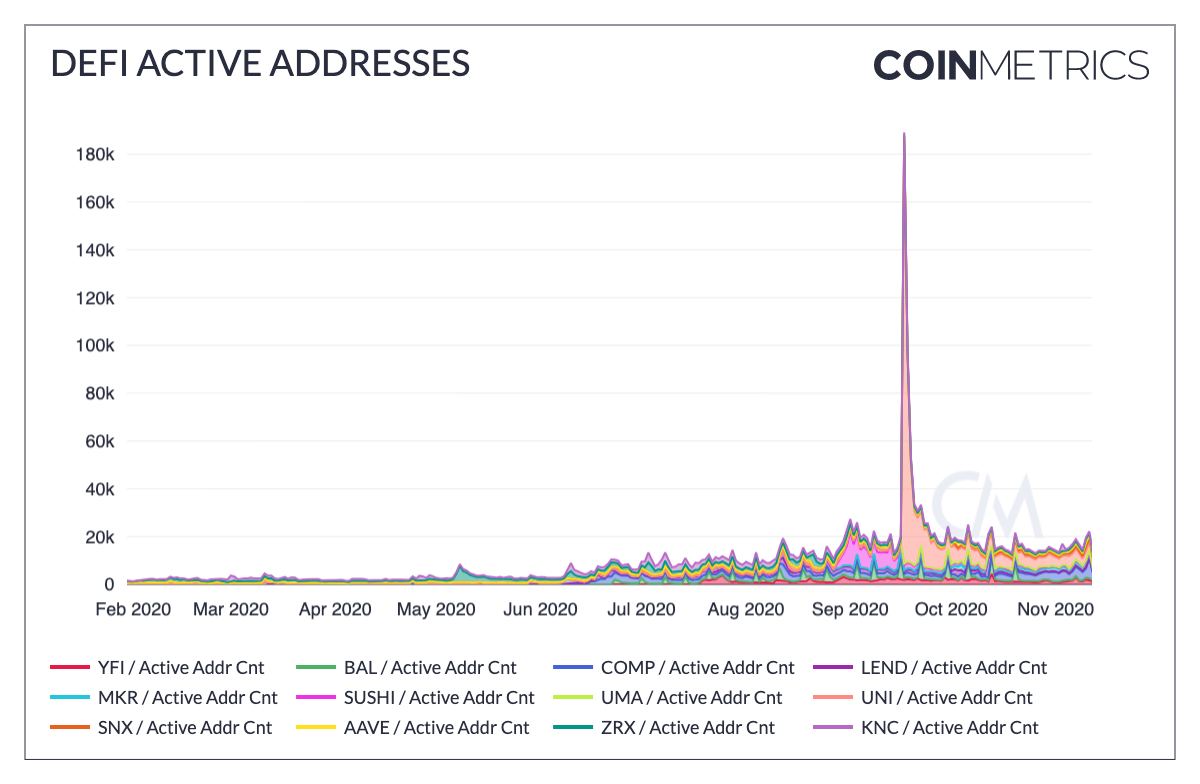

On the below chart, the number of active addresses is still quite disappointing. There is little evidence that any productive use of these tokens is taking place requisite with their market caps. It is highly unlikely to reflate a ponzi back to its previous levels. We believe the Defi ponzis have run their course for the most part. There may be continued hype and some popular launches in the future, but the story of Defi only needs to write an ending.

Miscellaneous

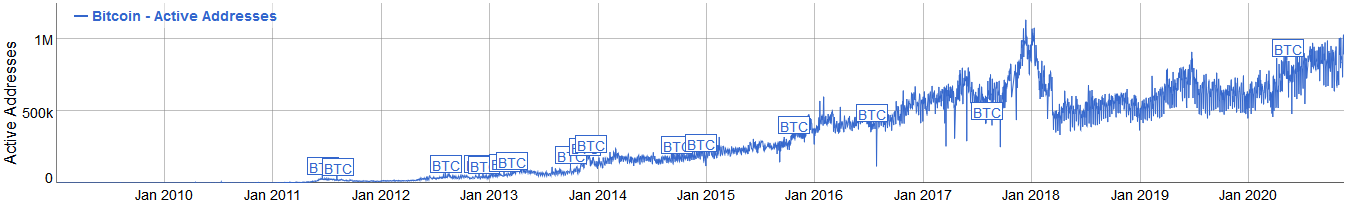

Defi active addresses (accounts numbers) above maxed out around 200k but typically is only 30k. Now, compare that to Bitcoin, which is near all time highs for active addresses with approximately 1 million. The ATH happened at the peak of last bull cycle but was short lived. The current state is a healthy steady climb which we expect to continue to grow.

We want to draw attention to another interesting metric created by glassnode about on chain behavior (detailed here). Glassnode separates UTXO (unspent transaction outputs) into two categories: Long-Term Hodlers which are balances that haven't moved in 155 days, and Short-Term Hodlers (or traders) which are balances that have moved within the last 154 days. Pictured below is the data charted with the price which reveals some correlation.

Demystify Bitcoin Jargon with the Bitcoin Dictionary

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See