Macro Chart Rundown - 6 Dec 2021

In this post: Ukraine situation and Europe, Oil and natural gas, Dollar, Eurodollar futures inversion

If you like this content, SUBSCIBE and SHARE! Thank you.

In this post:

- Ukraine situation and Europe

- Oil and natural gas

- Dollar

- Eurodollar futures inversion

Russia and Ukraine

I've talked about this on recent podcasts. I believe Ukraine is a much more likely place for hostilities to break out than Taiwan. Russia has just announced its "red lines" which include no further eastward expansion of NATO and no NATO interference in Ukraine.

Russia does not necessarily want a war right now, but they are positioned to take advantage if one were to break out. Russia's overriding geopolitical concern is strategic depth, giving them a buffer with Europe.

The Davos crowd are the warmongers here, i.e. the fading globalist elites especially from Europe, but you still see some in the US called Neo Cons. They cannot allow Russia to dictate terms, but they know they cannot win a war in Ukraine. They want to provoke Russia, and I think that is what is going to happen in the next year.

All Davos can do is threatened tighter sanctions on Russia, which the Russians don't care much about honestly. The most recent threat is to cut them out of SWIFT which would effectively cut them out of the global financial system.

That would be a huge bonus for bitcoin, because it allows people to still move money globally and in a censorship resistant way.

Despite other reports, if Russia attacked eastern Ukraine it would be a one-sided affair. Russia would roll through, perhaps all the way to Odessa and control the whole north of the Black Sea coast. Europe is faced with a hard choice, let Russia dictate to them and watch Ukraine crumble internally, or be embarrassed on the battlefield and face the possibility of even worse demands from Moscow.

Watch this part of the world carefully in the coming months.

Energy

Checking in on natural gas in Europe first. Over the last month, we've seen the price jump back through resistance and has been holding above our identified area of interest on the chart. There have been, however, a series now of lower highs, signifying this move has less and less fuel behind it.

Weather so far this winter has been mild in the US and Europe briefly relieving some worry in Europe and prices to drop slightly. The big issue affecting European gas is the situation in Ukraine adding uncertainty in the near term and economic risk in the long term.

US Nat Gas Price

US natural gas got nowhere near the level of European futures. It suffered along with oil over the last week, and gapped down dramatically today.

I wanted to include again the long term chart of US natural gas to put this price rise in context. The recent spike, in no way, changes the direction of natural gas prices in the US. Right now they are very near the average price over the last decade with the trend still lower.

Over the next decade, export demand for US natural gas will surge, and that could put upward pressure on price. But that development comes after the next phase of the global market meltdown in 2022. We'll cross that bridge when we get there.

Oil

Big sell off in oil in the last couple of weeks, including a 12% drop on Nov 26th. It was the largest single day percentage drop, without a gap, since the 90's. Reports are starting to trickle out about the devastation caused to hedge funds and traders on that day.

Long oil was a very popular trade, because everyone and their mother has been pumping up the price and screaming about inflation. They were caught and the price dropped hard.

Technically, there are still higher highs and higher lows, making this bull market remain intact. However, that single day drop rekt a lot of bulls who will think twice putting back on their bullish positions.

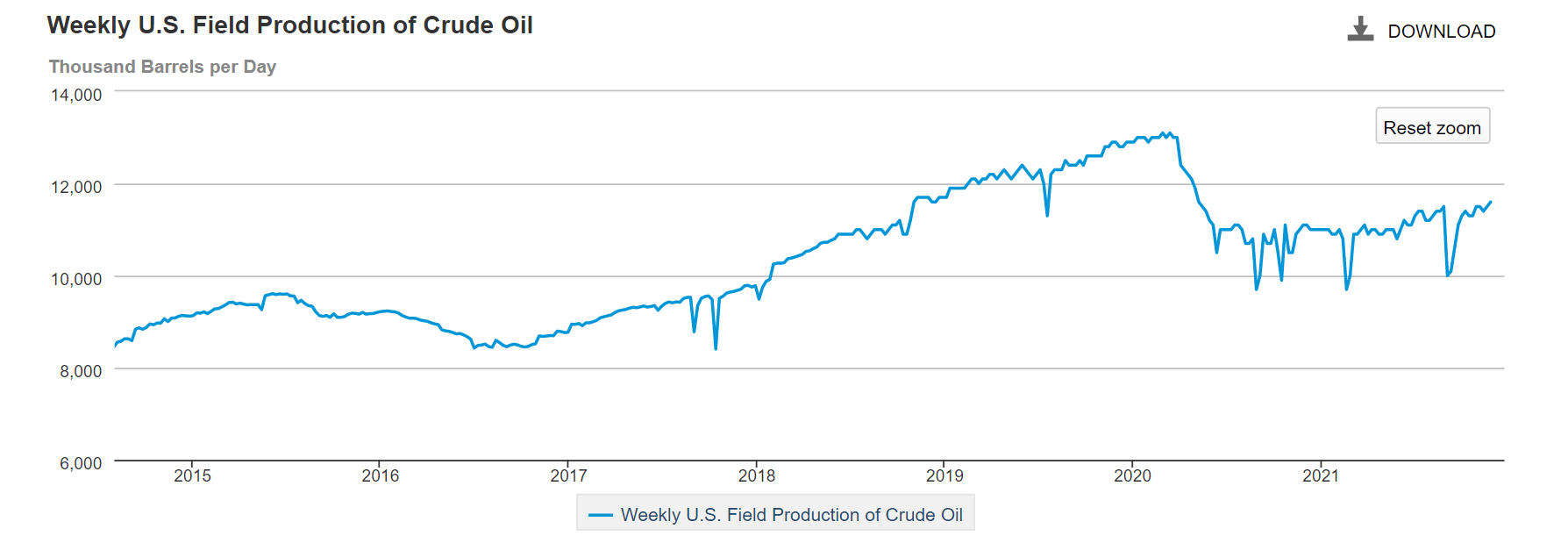

US Oil Production

More production is trickling online in the US. The current week's data shows the highest output yet since the corona crash at 11.6 million bbl/day. I expect this number to slowly climb over the next year. Maybe by Dec 2022, production will be nearing the 13 mbd mark again.

Imagine the oil price if Biden hadn't closed the Keystone pipeline. It would be A LOT lower. Again, the spike in the oil price does not signify inflation, it shows dramatic market disruption in supply. This is not more dollars chasing the same amount of goods, it's the roughly the same amount of dollars chasing fewer goods. When the US is pumping 13 mbd again, the oil price will be far below today's levels.

CPI Prediction

Energy is a massive input to CPI inflation. As it sits, oil dropped 19.6% in November and natural gas dropped 15%. This will dramatically affect the MoM change in these very important energy metrics in CPI.

Energy did not drop all that way at the beginning of the month, so this impact will be lower than those numbers. However, it is plausible that Energy factors drop 5-10% MoM and instead of recent numbers of 30% YoY. This would help push CPI down into the 3-4% range, in a big surprise.

CPI is released on the 10th. I'll be watching it very closely. Expert forecasts are 5.9%, with energy, I completely expect a surprise to the downside on inflation. Perhaps the first of many.

Dollar (DXY)

Dollar has made its break out. Nothing stands between current levels and 100 on the DXY. There is a big story on the other side of the coin, and that's the Euro. We'll get into that a bit below.

I used the below chart in the show notes for Fed Watch, showing that the dollar and bitcoin have been very correlated this year. My reasoning is that they are both safe havens. The dollar feels the impulse first, followed about a month later by bitcoin. Price action in bitcoin over the last few days (sorry didn't have time to update the chart), might have changed this picture quite a bit, but the trend is still generally intact.

Euro troubles

The Flip-side is the Euro. If the dollar is heading into strength, the Euro will be heading into weakness. Europe is facing a perfect storm as I mentioned above briefly in Ukraine.

Allow me to quickly summarize my thoughts on the Europe's dilemma.

Since the end of WWII, Europe has relied on the US to be their muscle, and get everyone to buy into "western" ideas for the global economy. The US also provided an expeditionary counterweight to Russia on Europe's eastern front. The events in Afghanistan changed all of that.

After the messy and incompetent withdraw from central Asia, the world immediately sensed a softening of borders everywhere. The Americans won't be there with a military to keep the peace. Europe is without their muscle, and Russia without its counterweight. The US role as expeditionary border keeper is very quickly dying, and the American society doesn't care. We are more concerned with our house, the critical takeover of our schools at every level, media, and government. We don't care about Ukraine anymore (and that's even with a President that was personally enriched by that country).

Europe is staring the reality of their impotence right in the face, as Russia not only has all the cards in Ukraine but also has a choke hold on Europe's energy needs as well.

Capital is starting to flee the Euro in a big way, and it doesn't have fall to far. They make up only 20% of global reserves and 30% of global transactions (but some of those are with the dollar). If the Euro were to lose just 5% of their respective share of currency market, it could have a death spiral type effect.

This would be a currency crisis in the Euro, which the dollar and bitcoin would massively gain from.

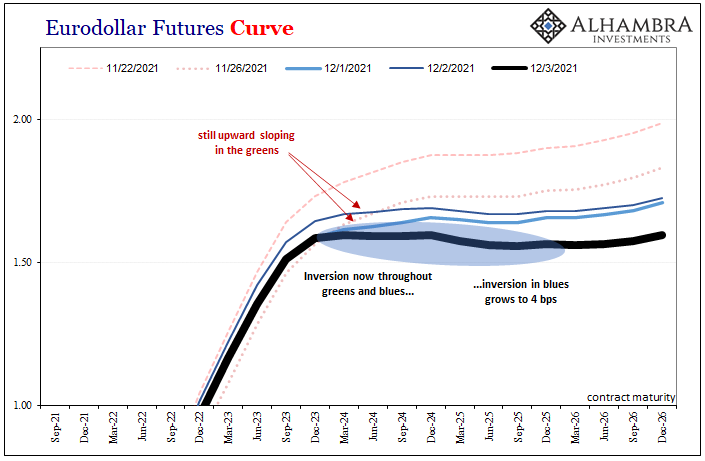

Eurodollar inversion

Something is not right in the global dollar system.

I pulled this chart from one of Jeff's recent posts. It shows the Eurodollar futures curve, perhaps the second largest most liquid market in the world, and it inverted in the middle of the curve.

Since the first day of inversion, it has grown and spread. This is a major deal. For one it shows that the Fed isn't keeping interest rates low, Eurodollar rates are also very low, and many other markets agree.

The above inversion is signaling a major "landmine" as Jeff puts it, in the near future. According to the curve it's out there at the end of 2023, but I think we are already seeing the beginnings of the European debt crisis that could extend that far into the future. And this one the Euro might not survive.

That's where I'm going to leave it for this issue. Questions or comments, reach out on twitter to @AnselLindner.