Gold ATH Is Not Driven By Central Banks

We're told by social-media analysts that central banks are buying gold and that is why the gold price has been spiking. The data says different. Let's dive in.

Rogue Report #117 | December 22, 2025 | Block 929,018

A growing number of analysts with large social followings are confidently asserting that gold’s rally this year is almost entirely the result of central bank buying. It’s a clean story. It reinforces audience bias. And it’s mostly wrong.

The demand data simply does not support that claim.

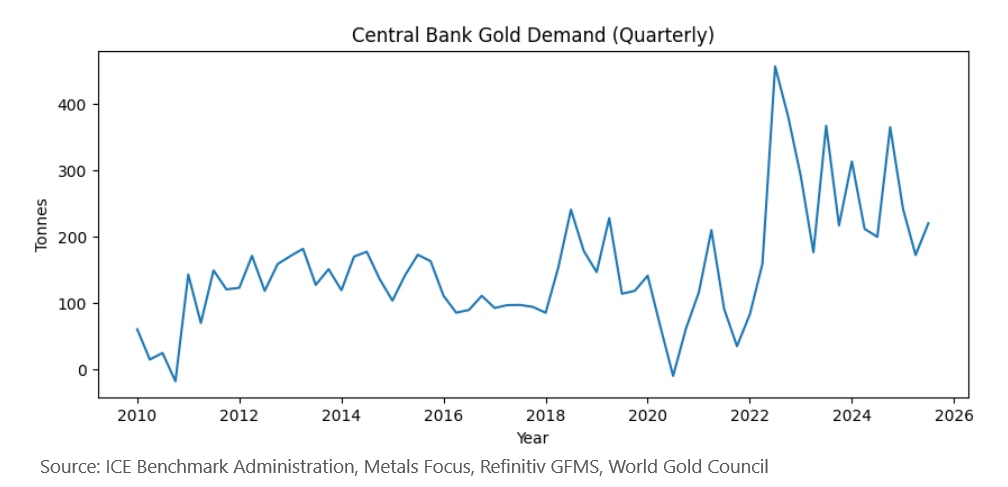

Yes, central bank gold demand stepped higher after COVID. That part is true. But what’s being ignored, conveniently, is that central bank buying in 2025 is materially lower than the 2022–2024 peak, even as gold prices have gone nearly vertical. If central bank demand were the primary driver of this rally, the data would show acceleration. It doesn’t.

What has accelerated is investment demand, particularly through financial channels. ETFs and investment flows are doing the marginal price setting. That distinction matters, because it changes what kind of rally this is.

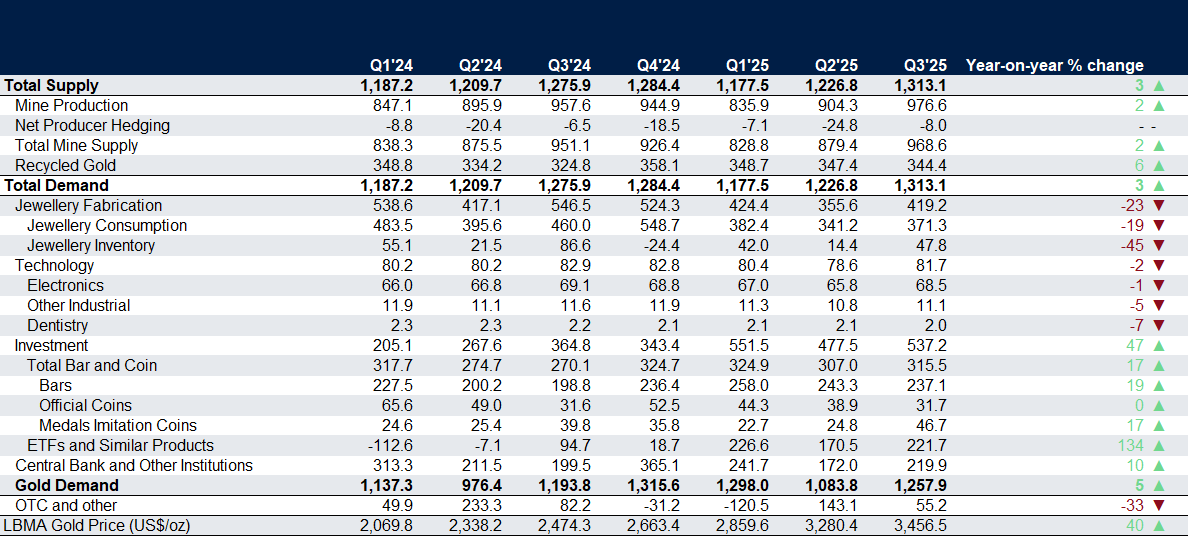

Gold data

As you can see in the data above, jewelry demand is roughly twice the size of central bank demand, and ETF investment demand alone surpassed central banks outright in Q3 of this year. That alone should raise red flags for anyone claiming this is a sovereign-driven move.

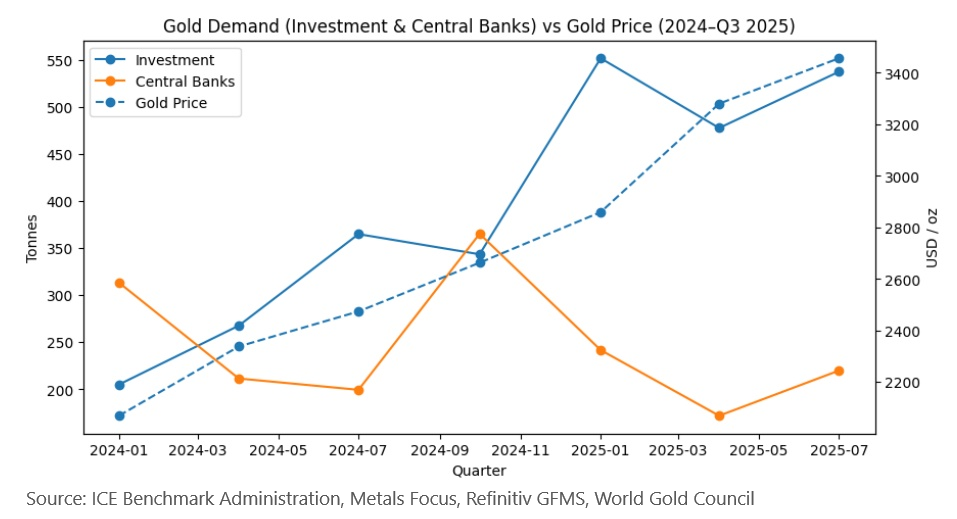

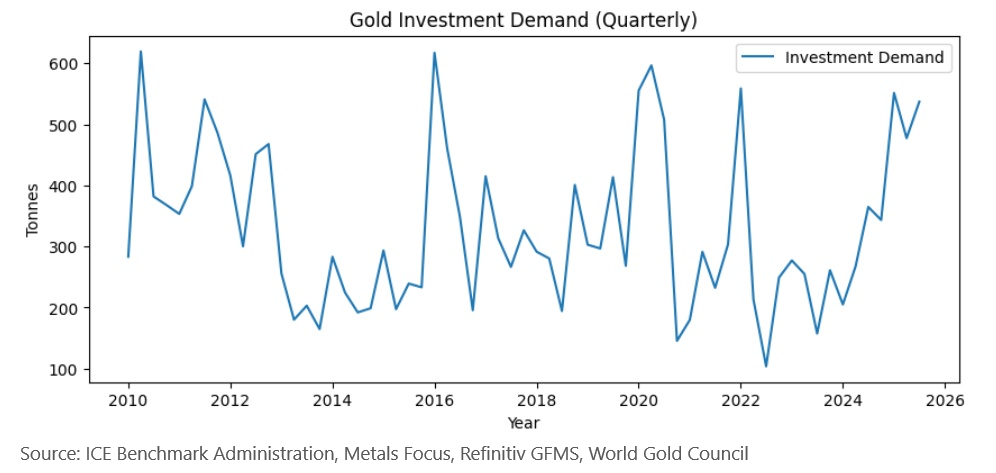

Let’s strip the analysis down to just Investment demand and Central Bank demand, the two categories most often cited as price drivers.

So far this year:

- Investment demand has averaged over ~520 tonnes per quarter

- Central bank demand has averaged closer to ~210 tonnes per quarter

Investment demand is doing more than double the work of central banks in terms of marginal flows this year, while price is rising. That is important because investment demand (including ETFs) has a different character than central bank demand. Central bank accumulation lends itself to narratives about monetary regimes and reserve diversification. Something we've seen from the social media analysts. Investment demand, by contrast, is far more susceptible to speculation, momentum, and price-chasing behavior.

Now zoom out.

If we pull the full dataset back to Q1 2010, central bank buying does show a structural step-up post-2018. But even so, current levels are not dramatically above pre-COVID norms, and more importantly, central bank demand has been in a downtrend since Q3 '22.

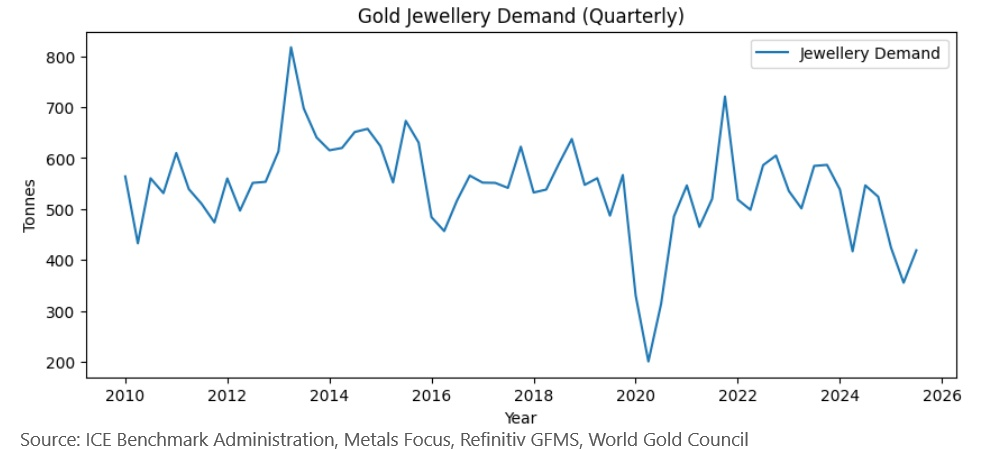

Central banks do not operate in a vacuum. What's happening to other types of demand?

Jewelry demand is the largest single source of physical demand and roughly twice as the size of central bank demand, and it has been falling.

Investment demand, on the other hand, is volatile by nature. But in 2025, it has surged alongside price, while central bank demand has stagnated. That behavior is not consistent with a long-term structural accumulation story. It is consistent with late-cycle financial participation.

That’s a major red flag.

Central bank buying is in a downtrend, while FOMO is gripping investment buyers. And again, ETF demand surpassed central banks outright in Q3.

Total Demand Is Key

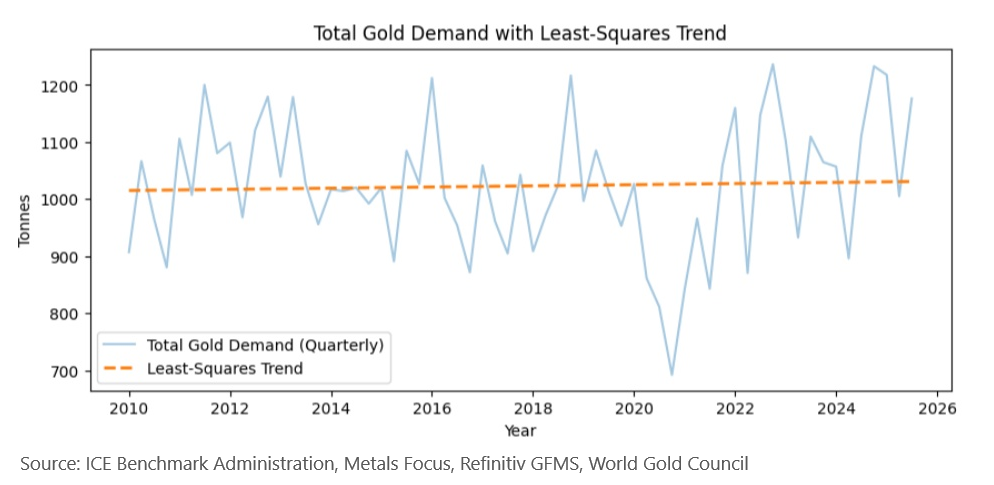

Implied in the “central banks are buying all the gold” narrative is that total gold demand must be rising dramatically. If gold prices are up nearly 70% year-to-date, and we know gold supply is relatively stable, then, in theory, that price move should reflect a surge in total demand.

Social-media analysts would have you believe that surge is coming from central banks. It isn't.

When we look at total gold demand going back to 2010 and apply a least-squares trend, a method designed to identify true structural direction, we find that total demand is rising by only:

- ~0.25 tonnes per quarter

- ~1 tonne per year

That works out to roughly 0.025% annual growth. In other words, total demand is effectively flat.

After fifteen years of QE, negative real rates, war, sanctions, inflation shocks, record ETF launches, and record central bank purchases, total gold demand is essentially unchanged.

So where exactly is this paradigm-shifting demand that’s supposedly driving a generational price breakout? Nowhere, it's just a speculative bubble.

Total demand versus price

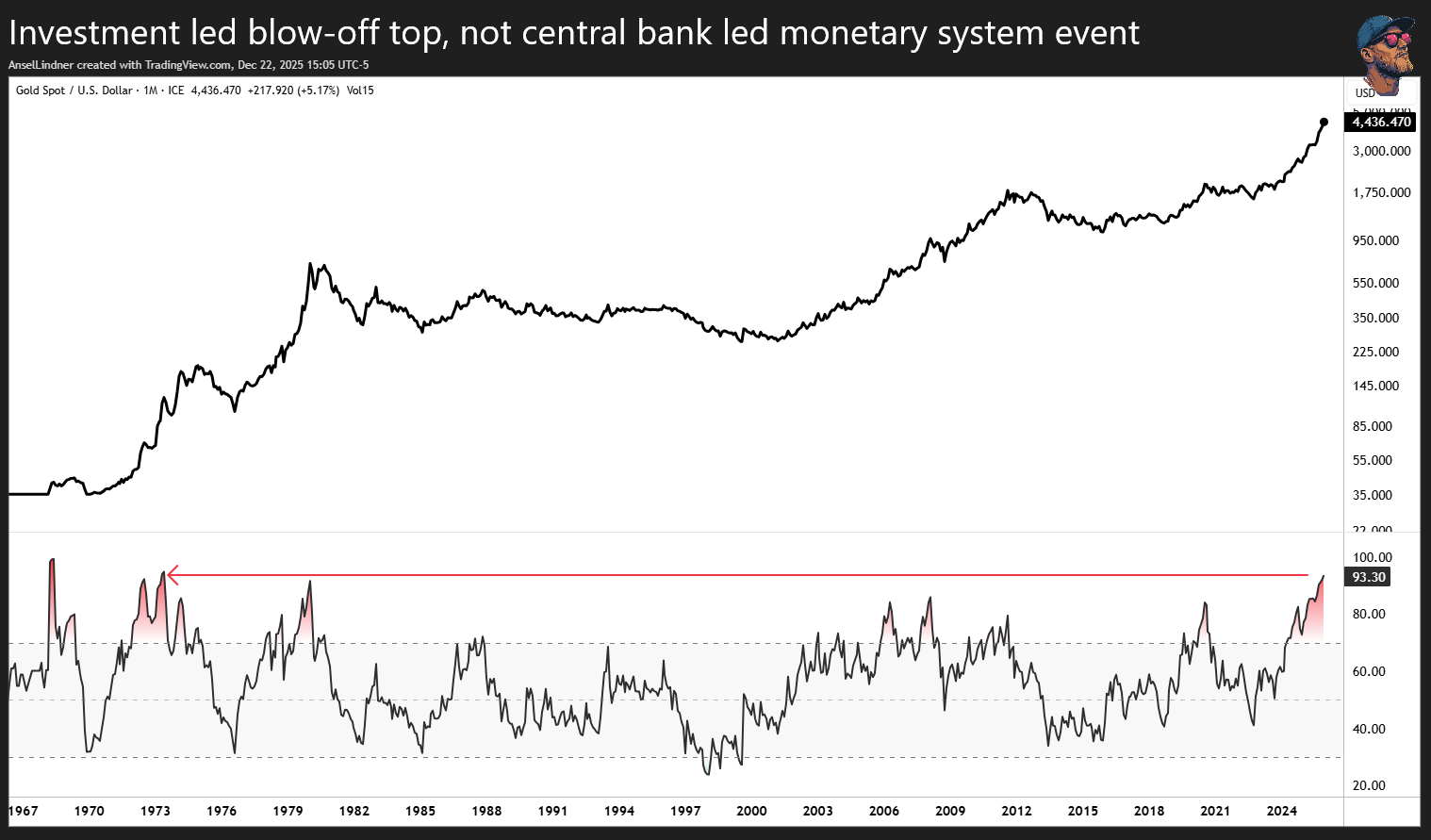

Gold prices, meanwhile, are on a generational rally.

On the monthly chart, momentum indicators are stretched to historic extremes. RSI is hovering near levels not seen since the early 1970s, shortly after the gold window was shut. These are not conditions associated with the early stages of a structural bull market. They are conditions associated with late-cycle excess.

When prices rise this aggressively while underlying demand remains flat, the implication is clear: price is being driven by valuation, positioning, and narrative.

That doesn’t mean gold must collapse tomorrow. But it does mean the risk asymmetry now strongly favors profit-taking. It's not the time to be getting FOMO and betting the farm on gold at these levels.

Conclusion: It's Not The Central Banks

Gold’s rally is not being driven by central bank buying. Central bank demand is structurally higher than a decade ago, but it has been in a downtrend since the 2022 peak. Jewelry demand is falling. And total demand, measured objectively, is flat.

What stands out in 2025 is investment demand, particularly ETF flows. That fits far better with a speculative or momentum-driven phase than with a durable structural repricing. These are classic late-stage bubble mechanics.

This blow-off top and subsequent correction could ultimately be remembered alongside prior historic peaks. I’m not calling the top. I’m calling proximity to a top, the call I’ve stood by since late October.

HODL strong. Thanks for being members!

A

- Podcast links and Socials

- Disclaimer

- Feedback form

- Original charts and analysis are CC-BY