Climax in markets leads to bullish period ahead - Proton 4

A look at seasonality, and historical trends preceding recessions.

September 28, 2023 - Made public on 10/11/23

| Bitcoin Price | Change* | Mrkt cap | Satoshis/$1 |

| $27,151 | +$551, +2.1% | $0.528 trillion | 3,684 |

Where is the Recession?

Coming into this year, it felt as if most macro analysts agreed a recession was going to happen this year. In 2022, the first half was negative GDP growth but they didn't label it a recession. Even laymen started talking about recession, stagflation, etc. I stuck my neck out with specific odds on a recession, always eyeing EOQ3 as a pivotal time.

Those odds were: 25% hard landing, 50% soft landing, 25% no landing. So, a 75% chance of a mild or better recession.

Well, EOQ3 is here and we have no recession. In fact, markets are telling us we are very far from recession and several charts are climaxing as we speak. The dollar has put in a green candle 11 straight weeks, raging all the way to the 50% fib retracement (tweaked fib to candle bodies at top and bottom).

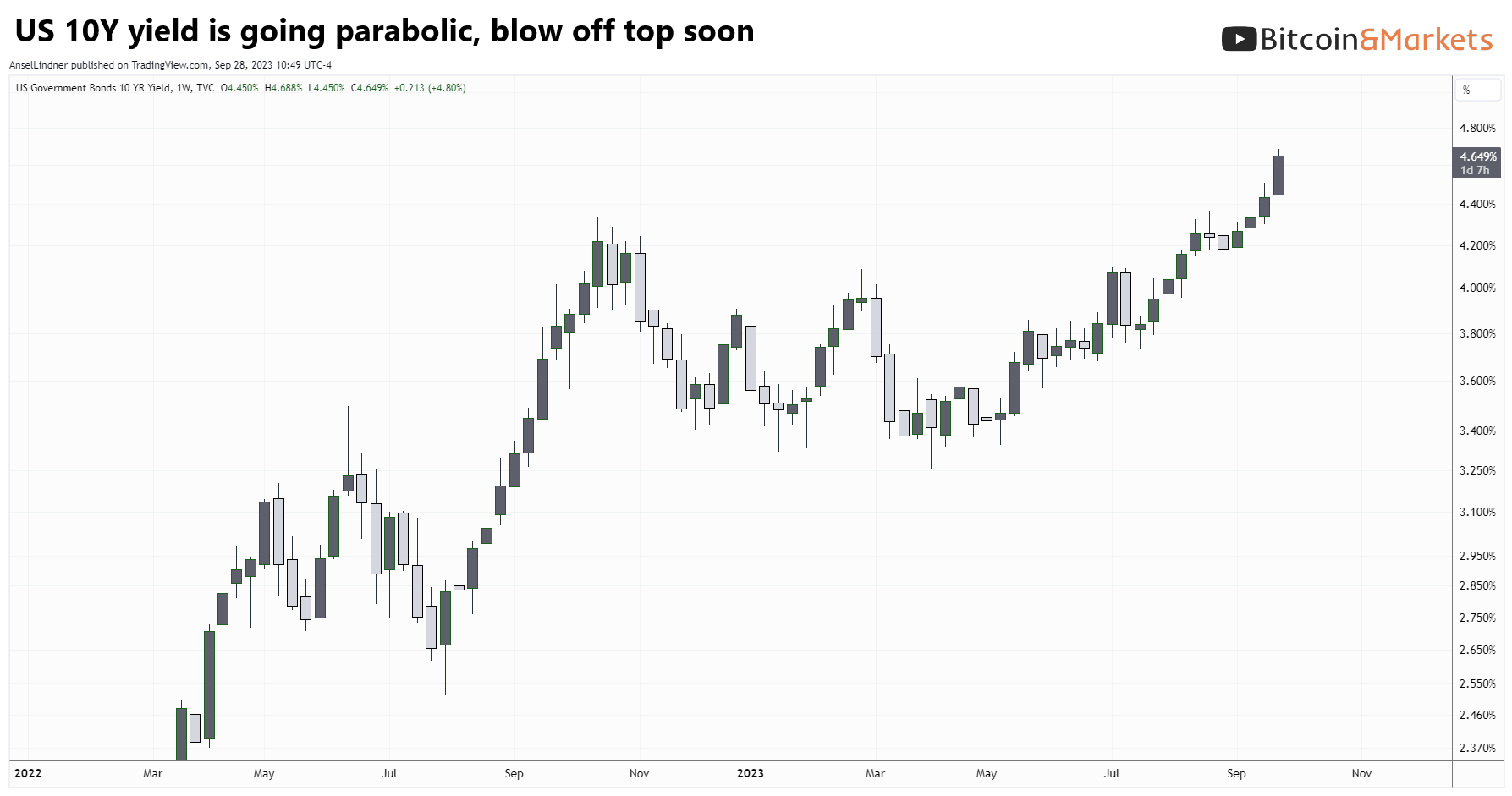

The US 10Y yield is going parabolic.

And oil looks very similar to the dollar, hitting the 50% retracement fib as well.

This is not what the start of recession looks like. In fact, it is exactly the opposite.

If not now, when?

As it stands right now, markets are not signaling a recession anytime soon. My recession odds were updated back in August on Pro #24 for the "next 15 months" out to Q3. That was the odds of a recession starting by Q3 2024 considering it being a election year of some super-corrupt people in office.

- 10% chance of no official recession

- 50% chance of mild recession, this encompasses a return to post GFC normal call and/or big government spending packages

- 40% chance of deep recession, no big government spending packages, banking crisis and Fed to ZIRP again

I'm extending these odds out to the end of 2024. We have to start seeing some signs of recession on the charts, which we just don't yet.

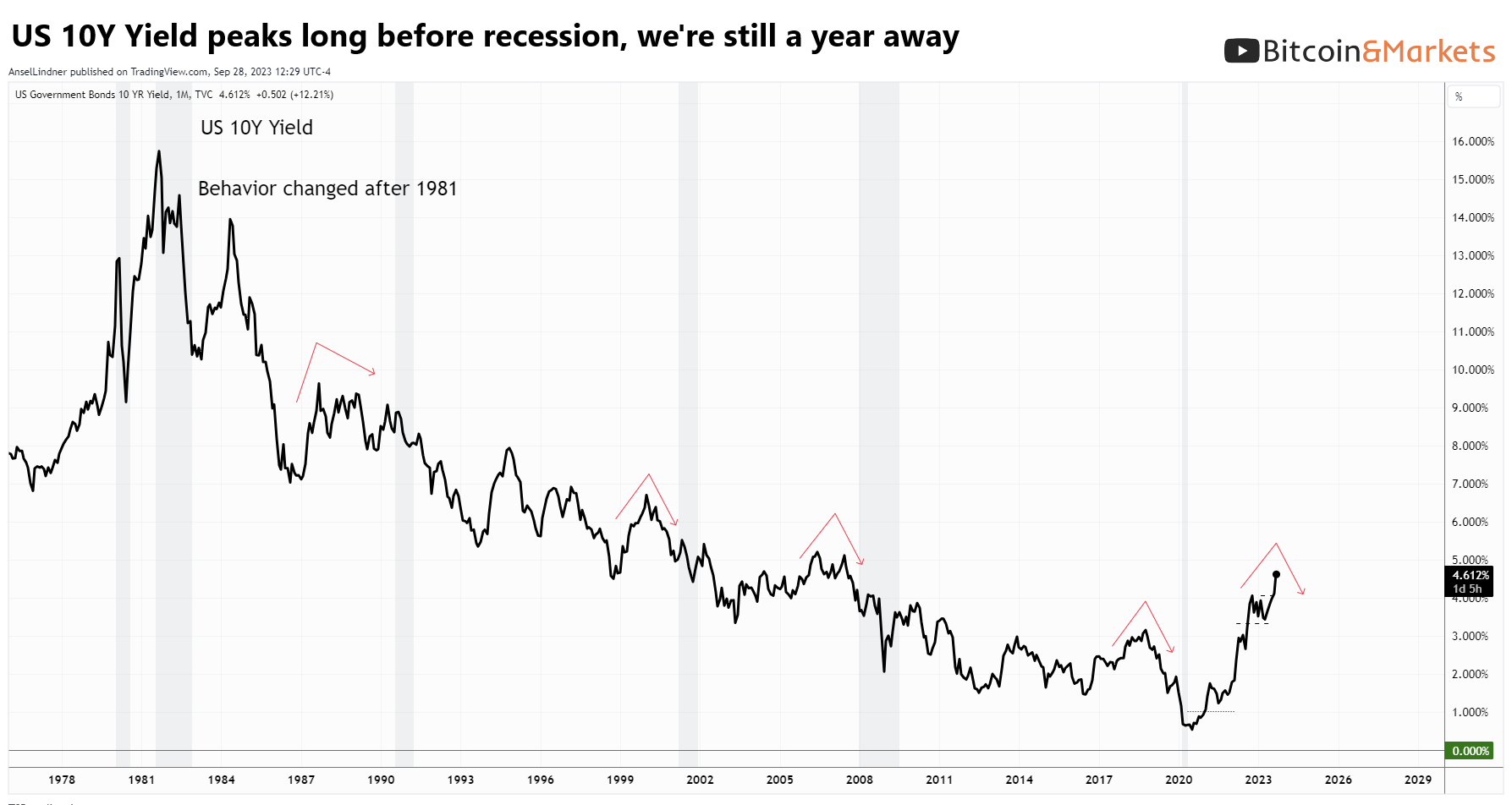

Historically, rates top a year or so before a recession and are well on their way down by the time an official recession starts, as collateral rehypothecation slows and banks become defensive. With rates screaming higher, a recession could be far away. Next, should come a top in yields, followed by a period where they are falling despite whatever the Federal Reserve policy rate is. Yields don't particularly care about the Fed.

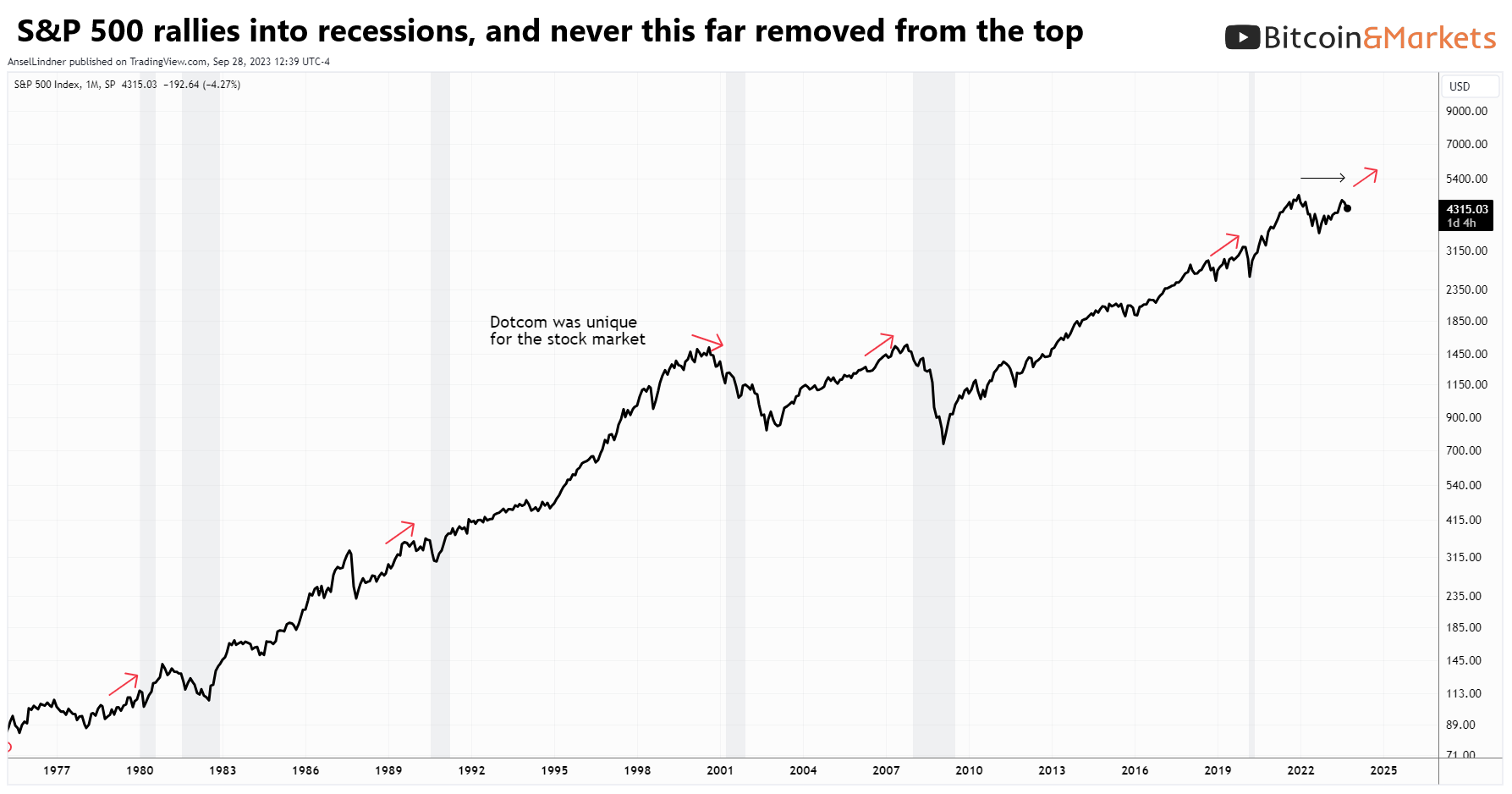

Also, stocks tend to perform very well in the year prior to recessions. I pointed this out on BM Pro as well, and I heard it from Darius Dale of 42 Macro with actual numbers (I used a chart and didn't crunch the numbers). He said the 12 months leading up to recession average a 16% return on stocks, and the last 3 months was 9%. That is huge considering yearly returns only average 7% over the long term. That means years leading up to recession see over 2x normal returns. We haven't see this either, yet.

Only the Dotcom recession showed any significant downward price action prior to recession (it was uniquely a stock-driven recession). Never has the stock market been as long removed from the high, and then went into recession.

Therefore, I am expecting a very good Q4 for stocks and bonds and bitcoin. These good times should continue, with an official recession coming either in second half of 2024 or 2025.

Seasonality

All of these moves in MAJOR markets are corresponding with the end of Q3. This seasonality is very important because most major market crises happen around the end of Q3, with end of Q1 coming in second most important seasonally. I think if we stripped out all the seasonal adjustments in almost every metric, we'd get a better idea what the real seasonality looks like, it is very powerful.

In banking, there is a well known seasonality to interest rates and loans. December-February activity is typically at it's lowest. It ramps up through the spring and summer, and tends to climax each year in August or September. That being the case, quarterly reports due by banks to the SEC or other agencies, would also culminate around the end of Q3.

The effect of the government's fiscal year is also huge. It runs from 1 Oct to 30 Sept. I remember in the military, we submitted our dream spending items in September because units would try to use all their money before 1 Oct. Government spending is a significant portion of the economy and getting bigger all the time. Government contractors would orient their fiscal year around the government's probably.

Lastly, the good ol' agriculture cycle. Obviously, the agricultural sector is going to be oriented around a fiscal year oriented around seasonal harvests. Those come at the end of summer or end of Q3. Trading in futures and options would therefore target those dates for delivery.

Bitcoin Forecast

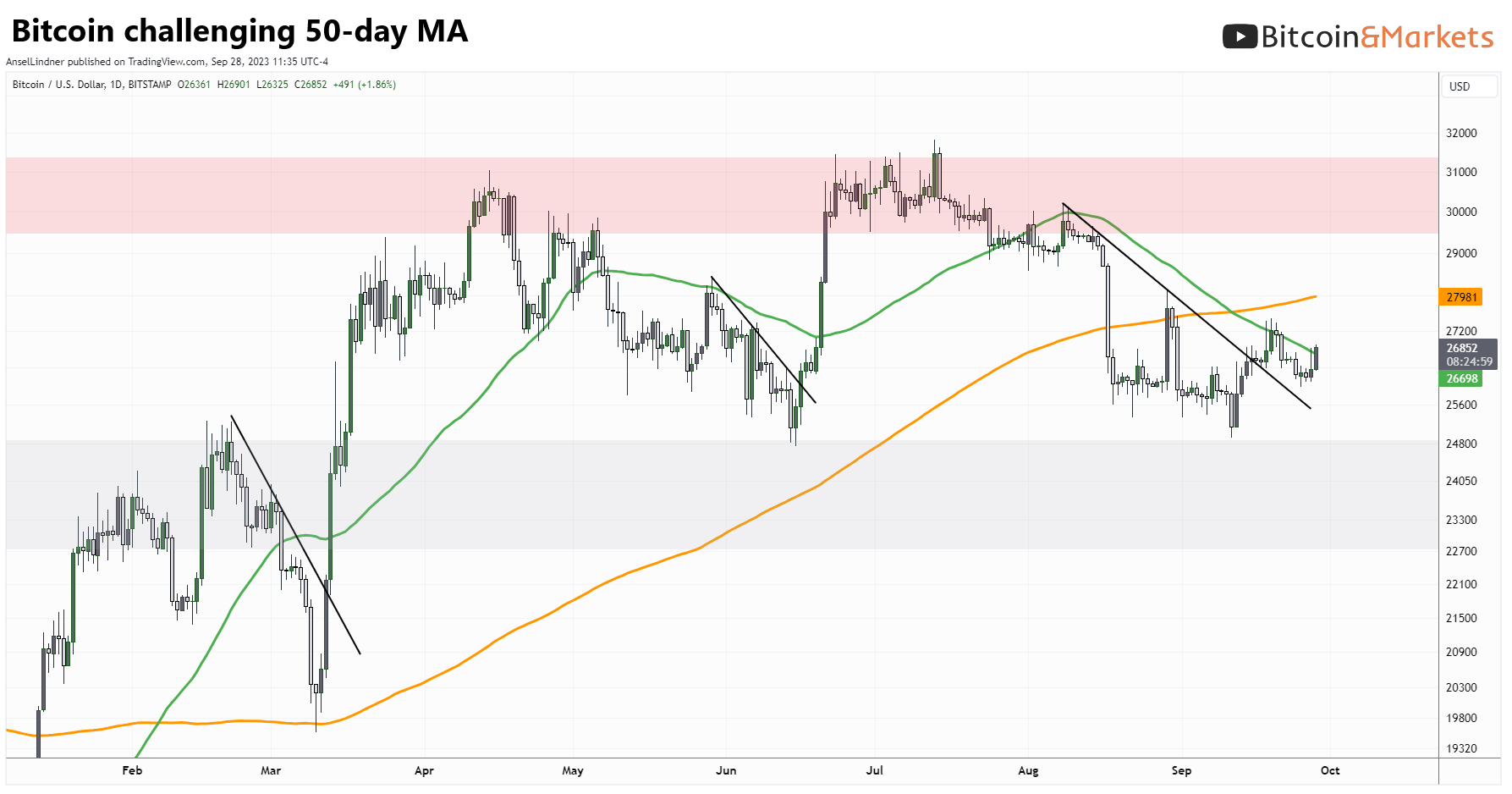

Short-term: I was correct about $26k becoming the new support. Price has not been able to mount any significant rally, but has held up beautifully as stocks have gotten hammered. The first milestone will be breaking the 50-day (green).

Previous rallies this year have been lightning fast. There is a possibility of that again (it's almost a trend now). The only other major resistance is the 200-day AND 200-week at $28k. If price can slice through $28k, it will likely rally hard to $31k. A huge statement when compared to the rest of the markets.

Mid-term: A crisis within the next few weeks looks unlikely. Seasonality will shift bull soon. Bitcoin has the perfect stance to break out of this 6-month range and begin heading toward my target for the next major leg of the rally at $48-50k by EOY.

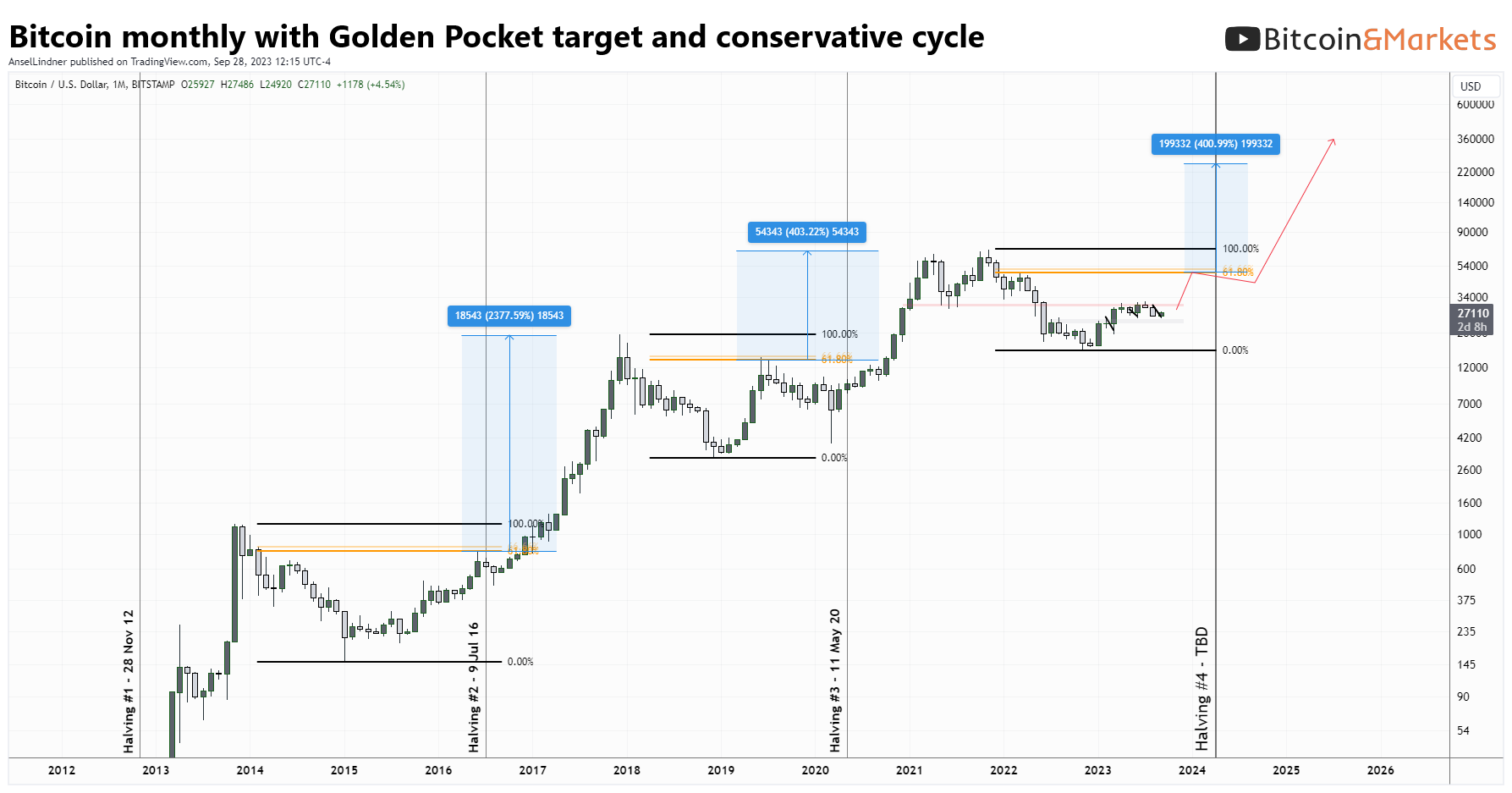

Cycle forecast: My conservative cycle target is $200k-$300k. That is 4-6x the Golden Pocket, bringing market cap to between $4-6 trillion. However, a less conservative cycle target would be $400k based on prior analysis.

That's it for this issue. Thanks for being members!

A

- Podcast links and Socials

- Disclaimer

- Block 809,762

* Since last post