Bitcoin Fundamentals Report #177

This week... Russia and US taking serious look at bitcoin, SEC proposed rule, price analysis, mining news and updates, and the Solana hack debrief.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

This week... Russia and US taking serious look at bitcoin, SEC proposed rule, price analysis, mining news and updates, and the Solana hack debrief.

In Case You Missed It...

- (Podcast) Progressive Fed Nominees, Arizona, and Evergrande - FED 79

- (Livestream) We are now livestreaming Fed Watch on Tuesdays

- (Op-Ed) The Real Reason Federal Reserve Chair Powell Retired "Transitory"

- New article coming very soon to Bitcoin Magazine, stay tuned

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups, or becoming a paid member!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Market Commentary

| Weekly trend | Bullish breakout |

| Media sentiment | Neutral |

| Network traffic | Relatively high |

| Mining industry | Healthy, steady |

| Market cycle timing | Beginning new 2-year cycle |

Hello Bitcoiners!

The fundamentals of bitcoin continue to explode! The expansion of the network and industry is truly amazing. The price will follow soon.

Let's hit this week's top stories...

Russian 180 on bitcoin happening fast

Two weeks in a row, I've written about the back and forth with Russian bitcoin regulation. It started with the Central Bank calling for a complete ban on bitcoin and bitcoin mining. Then last week, Putin came out in support of it, saying bitcoin mining was a good fit for the country. This week, multiple government officials and agencies are demanding bitcoin be brought into the fold.

The Russian Chamber of Commerce wants the government to recognize bitcoin mining and the Finance Ministry wants banks to be able to sell bitcoin.

The Ministry of Finance suggested letting banks sell #bitcoin while the Chamber of Commerce thinks mining should become an established business.@namcios covers the news:https://t.co/HgmCDzZuWf

— Bitcoin Magazine (@BitcoinMagazine) February 3, 2022

A new estimate from the Kremlin says Russians own roughly 16.5 trillion rubles worth of bitcoin and "crypto". That comes to more than $200 billion. I think that is an overestimate, I'd put it about $50-100 billion in bitcoin. Perhaps, their estimate was at the price top. Still, not a small sum.

Any regulation that restricts bitcoin usage in the country will be met by severe push back from now rich bitcoiners, or even established oligarchs that own lots of bitcoin (cough, Putin).

This is exactly what people, including myself, have been saying since 2013. Bitcoin incentives work on the individual, not groups (e.g. governments). When bitcoin is approaching a critical mass amongst the individuals in a country, only then will the government react by looking at crack downs. By then it's too late, it's reached a tipping point. Only the most authoritarian countries (e.g. China) will be able to pull this off. Those are also the countries that are shooting themselves in the foot.

US Bipartisan Bill to Exempt transaction under $200 from capital gains tax

If Russians have $100 billion in bitcoin, Americans have more. If there is one country that is the most deeply entwined with bitcoin, it is the United States. There is almost zero chance draconian regulation is coming here. But we cannot let our guard down. In absolute terms, the US is far ahead, but as a percentage of wealth and GDP, US adoption is likely behind Russia.

There has been no news about the upcoming executive order which I reported on last week, but this week did have news about proposed legislation.

BREAKING: Bipartisan US bill would EXEMPT #Bitcoin transactions from tax if capital gains are less than $200

— Bitcoin Magazine (@BitcoinMagazine) February 3, 2022

This is a great first step. It will free 90% of transactions from the unusual tax burden of capital gains. If you hold the bitcoin for 1 year, capital gains are taxed at 15% in the US; less than a year, 30%. That means transactions with up to $1300 in capital gains value would not pay capital gains.

If I buy $1000 in bitcoin and it doubles to $2000 in 2 years, when I go to spend that bitcoin, I am required to pay 15% on the gain, or $150 in tax. Under the proposed bill, I wouldn't have to.

This rule would go a long way in relieving the burden for small transactions, but it does not apply to larger, more systemically important amounts. If I started with $1,000,000 in bitcoin and it doubled to $2,000,000, I'd owe the full $150,000.

Of course, many people say you can split your larger transactions into smaller ones to stay within the limit, but that will have its social limitations.

Lawmakers are just starting to grapple with the implications of bitcoin. Once bitcoin is stable in value for 10 years, whether that is at $1 million or $10 million, these capital gains taxes will be a huge burden on business and the economy.

The SEC continues to drag their feet on bitcoin clarity

Hester Peirce is seen as a bitcoin-friendly regulator at the SEC. In this interview, she says there is a new proposed rule that will make it easier for exchanges to register with the SEC.

The proposed regulation however, falls short of making specific policies on the treatment of bitcoin or altcoins. While Peirce is friendly to bitcoin, she is also a "crypto" supporter in general. That makes her frustration understandable. The reason the SEC can't figure out how to treat this space, and the reason Peirce is getting frustrated, is because they want to lump bitcoin in with illegitimate scams (altcoins).

The logical and obvious road forward is to address bitcoin with a rule, and hold off on altcoins. You won't be able to make a rule that treats altcoins like bitcoin, because, while there are a few honest altcoins, 99% are dishonest scams that should be taken down by the SEC if they enforced their own rules.

I'm not saying I want the SEC to do this, only that this is the contradiction they are having such a rough time with - i.e. 'how do we write a rule that covers bitcoin's unique nature, but which doesn't allow the garbage that loosely resembles bitcoin?' They will drag their feet until they recognize the two distinct things as different, bitcoin and "crypto".

For bitcoin to be monetized, it must make the distinction with altcoins black and white. I'm writing a new op-ed on this for Bitcoin Magazine right now. Stay tuned.

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $40,716 (+$3,638, +9.8%) |

| Market cap | $0.771 trillion |

| Satoshis/$1 USD | 2,455 |

| 1 finney (1/10,000 btc) | $4.07 |

Become a paid member to access our much more in depth technical analysis on the member newsletter.

Last week, I said, "it comes down to the next move." Price was $36,078, so for most of the week, we had no movement.

However, at the time of writing, price is spiking to the upside, breaking several minor resistance points and a major one, being the diagonal resistance trend line.

Right now, it is in the heart of the resistance zone, however, the initial bearish structure is broken. That doesn't mean the larger bearish momentum is broken and price can't turn around and go to new lows again, but it does mean it is less likely to happen now, and probably won't be a massive 30% drop to $20k as some analysts were predicting.

I don't expect it to race straight through this area without stopping. I predict price will struggle with $40-41k, taking at least several days for it to clear the low $40k's.

My outlook remains extremely bullish and I'm calling for fireworks in Q1 and Q2 this year.

Bitcoin Daily Chart

Interesting thread here from @_log_scale_ about valuing bitcoin (website readers will see the tweet embedded). Our main agreement on the view that governments will get on board quicker than most expect and the US might be one of the first.

#Bitcoiners — Reconcile any bearishness you have with the following:

— “Log Scale” | Producer of T₿S — The Bitcoin Spot (@_log_scale_) January 10, 2022

A) Friday's poll: 80% of you think a $1 million BTC price (~$20 trillion market cap) is enough to trigger global FOMO into hyper- #bitcoin -ization.

THREAD ⤵️ https://t.co/O0rgKLRGki

He points out that bitcoin market cap has a multiplier. So, if a $1 billion is put into bitcoin, the bitcoin's market cap will rise by more than $1 billion by some multiple. Bank of America research says 107x (!), but a realistic number is much lower, between 3-10x.

Another interesting thing he links to is Ric Edelman, financial advisor to financial advisors, says professionals are recommending 3-5% allocation to bitcoin, and about 1/3rd of investors will do that THIS YEAR. Log Scale runs the numbers on what that means, and lands on a possible total investment into the bitcoin this year of $11.5 trillion.

Take that times a multiplier of 3-10x and the market cap of bitcoin could increase by $30-100 trillion this year.

My conclusion: I think these numbers are too bullish, even for me. What they don't consider is the diminishing multiplier effect. $1 billion put into bitcoin when the market cap is $1 billion will have a much higher effect than when the market cap is $1 trillion. Also, market timing matters. $1 billion in a bear market, or at the top, will be swallowed and result in a negative multiplier, but in a bull market the multiplier could be 100x.

This is great info for any market valuation model and think something like this is bound to happen eventually. Not in 2022, though. I'm expecting solid performance up to $250-350,000-ish this year.

Get more price analysis, Sign up for the Bitcoin Pulse!

Mining and Development

| Previous difficulty adjustment | +0.1777% |

| Next estimated adjustment | 0% in ~13 days |

| Mempool | 33 MB |

| Fees for next block (sats/byte) | $0.96 (17 s/b) |

| Median fee (finneys) | $0.85 (0.20) |

Mining News

In an extraordinarily rare occurrence, 3 solo miners found bitcoin blocks this week. It is highly improbable for even one solo miner to find a block, the fact that 3 did so this week is almost unbelievable.

People who have bought into the evil bitcoin miner meme are very surprised by this story. Bitcoin miners voluntarily, though temporarily, turning off their rigs to help their neighbors? What?

Yep. The way bitcoin mining is evolving is that it is a marginal consumer of electricity during off-peak times, which is very helpful to power plants and consumers alike. To meet peak demand a few hours a day, power plants have to waste a lot of energy during the off-peak hours. The plant is designed for maximum efficiency at those higher output levels, but if they have to keep turning the dial up and down throughout the day to meet demand, the plants are running less efficiently.

Bitcoin mining demand allows energy companies to balance out load throughout the day. There is zero truth to the socialist meme of a greedy-dirty-miner. Bitcoin miners have a vested interest in keeping their power producer happy and healthy (unlike bureaucrats and politicians hundreds of miles away).

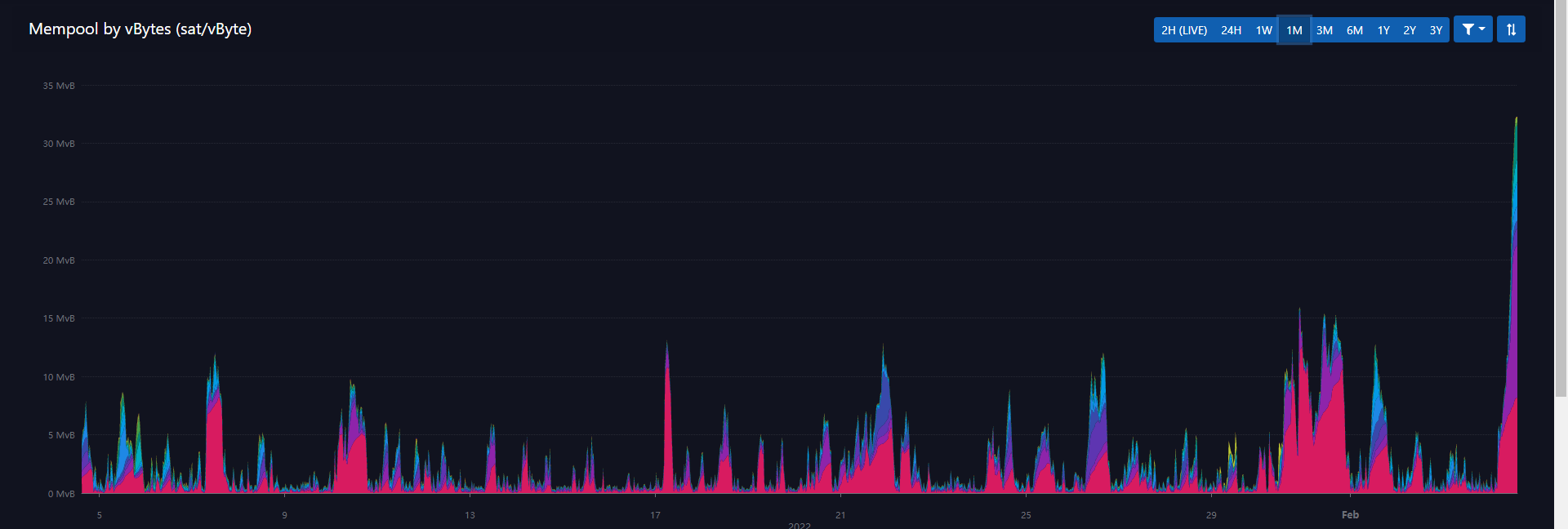

Mempool

The mempool is spiking the most in 6 weeks, meaning a more than usually number of transactions are being sent, and those transactions are backing up at the nodes to be ordered in a block. This usually corresponds to higher levels of price volatility. Hopefully, it turns out bullish.

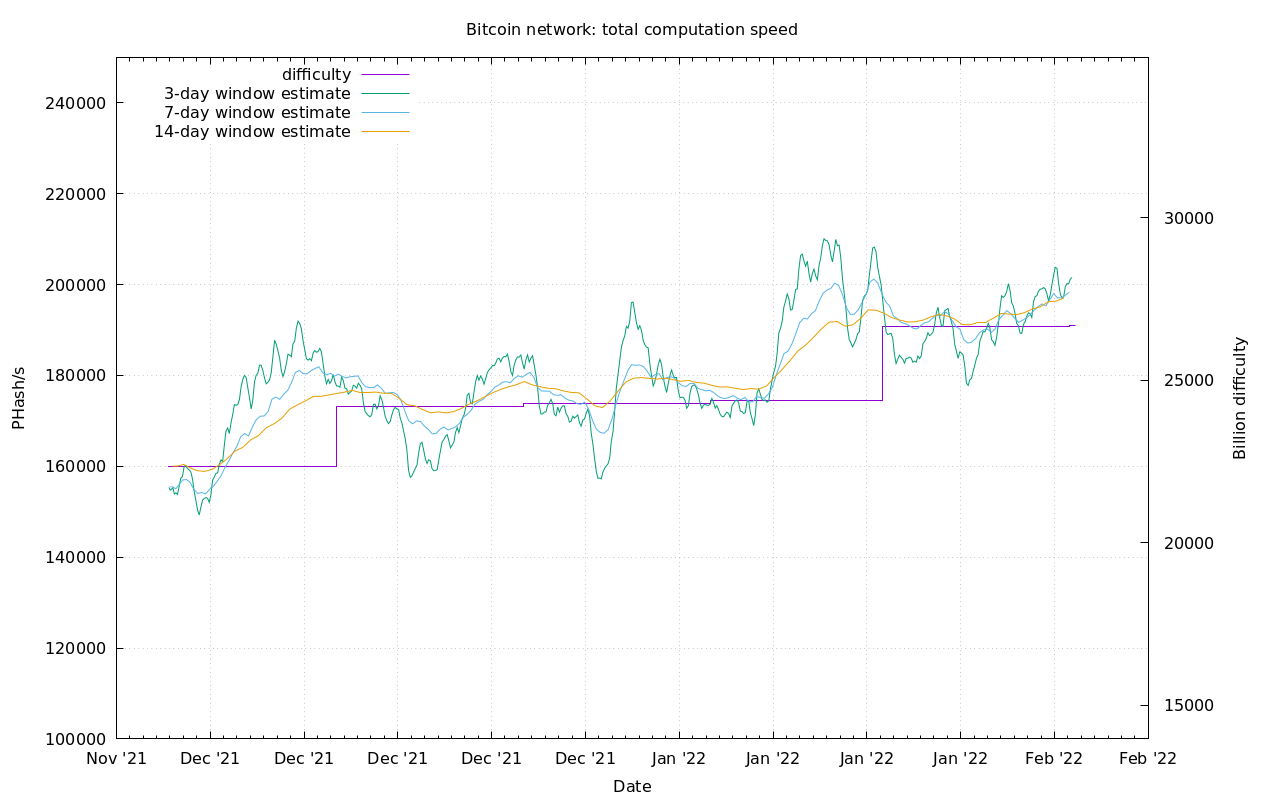

Hash Rate and Difficulty

Hash rate looks strong. We had a very minor increase in difficulty of 0.17% yesterday, but with the price possibly breaking out here, we could see another large increase in hash rate soon. Bottom line is no problems, mining looks healthy.

Altcoins / CBDCs

$200M in a "wormhole bridge". 🤦♂️ Altcoins are jokes. https://t.co/0Qy5U6Z6JJ

— Ansel Lindner (@AnselLindner) February 3, 2022

It has turned out even worse than my above tweet. As of now, it's north of $320 million lost in this hack of yet another garbage DeFi protocol. Since the hack, Solana has been turned off by the centralized team, while it patched and recovered the tokens.

"wETH" stands for wrapped ether. This is ethereum tokens sequestered by a digital signature on another network, in this case Solana. The ETH can then be transacted on the new network. It is a practice closely related to sidechain pegs, pioneered by Adam Back and found in the Liquid Network on top of Bitcoin, done the right way (1:1 BTC backed by federated system, with no false pretenses to decentralization).

Anyway, back to Solana. They have experienced 4 major exploits in the last 4 months, this being the worst. Despite this, many suckers are still buying into the marketing of Solana as an "ethereum killer," which is funny because Ethereum has its own issues.

Solana is a DeFi hub. Many automated contracts are setup to trade with the use of collateral, of which this wETH was a major part. If the funds were not recovered or replaced prior to the network being turned back on, most contracts would default in a fatal cascade to its internal financial pyramid system.

The plot thickens... As it turns out, the lost funds were replaced by Jump Street, a giant global high-speed trading firm, who recently acquired Wormhole, the makers of this exploited bridge. Employees at Jump Street have since commented that there is a 140-member team at Jump Street trading "crypto", no doubt tasked with raking profits from inexperienced shitcoin traders. Of course, they saved their golden goose.

.@JumpCryptoHQ believes in a multichain future and that @WormholeCrypto is essential infrastructure. That’s why we replaced 120k ETH to make community members whole and support Wormhole now as it continues to develop.

— Jump Crypto 🦬 (@JumpCryptoHQ) February 3, 2022

I've said it before, but it bares repeating in light of the Jump Trading snake oil in the above tweet; DeFi (decentralized finance) is not a sustainable or scalable use case for this technology. All its promises are lies. It is not decentralized or secure, and never can be. Bitcoin has solved these problems the only way possible, by decentralizing the bare minimum consensus and proof-of-work mining.

We know these are shady practices by altcoins, because Bitcoin can do what DeFi does - it's trivial. The difference is Bitcoin won't attach a shiny speculative token to it, or add unnecessary and insecure complexity. All these claimed use cases of altcoins that Jump Street thinks are part of a "multichain future" do not need separate tokens! The separate tokens are the dead giveaway it's a scam.

These use cases can be done on top of bitcoin, and will be done on top of bitcoin, as soon as people realize they cannot be accomplished with altcoins. The altcoin promises cannot be kept. Bitcoin will be one that keeps them all.

Never Forget The DAO

Do not forget the day Ethereum died as a legit project. The DAO hack happened on June 17, 2016, where 3.6 million ETH were legally claimed from a silly ethereum contract they were explicitly warned was insecure ($50 million at the time, $10.6 billion today). Despite the promises of "code is law", the centralized Ethereum team coordinated a hard fork of the network, stealing back the coins. They were the hackers, stealing back the legitimately claimed coins.

They did this by using their control of the code and influence in the community to change the blockchain, simply reallocating those coins to other people. They call this moral outrage the benign sounding and purposefully confusing, "irregular block transition."

Altcoiners will spin all their failures that bitcoiners have correctly predicted into learning experiences, just to continue their scam.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

February 4, 2022 | Issue #177 | Block 721,821 | Disclaimer

Meme by: Unknown

* Price change since last week's issue