Fundamentals Report #101

August 7, 2020 | Issue #101 | Block 642,668 | Disclaimer

The Bitcoin Dictionary paperback is

LIVE on Amazon!

Vital Bitcoin Stats

Weekly price: $11507 (+$178, 1.57%)

Mayer Multiple: 1.31

Est. Difficulty Adjustment: +0.75% in 3d

Prev Adj: -2.78%

Sats/$1 USD: 8,690

1 finney: $1.15

Market Commentary

This week's bitcoin news cycle has felt a little slower than last week's during the monster breakout. Many bitcoiners were content to watch the dollar tank while bitcoin and gold went up. We talk about why that isn't necessarily going to continue in the Price section below.

This week, also saw a growing optimism around Bitcoin's upcoming soft-fork Taproot. It's a big technological advancement and there seems to be little disagreement or contention. This is a welcome change after the community conflict over Segwit, the last soft-fork.

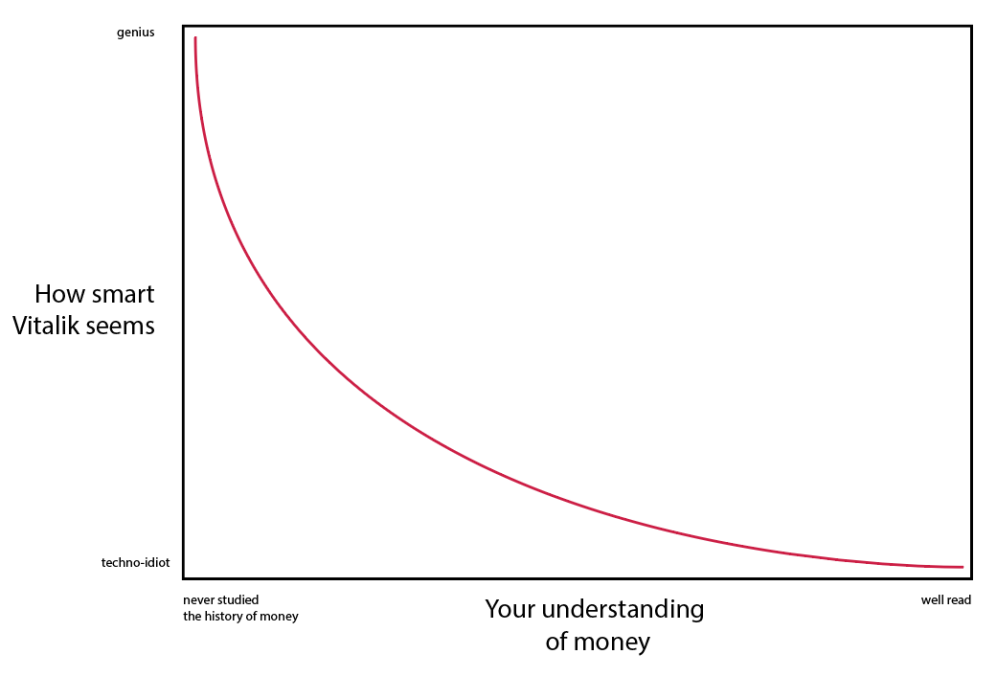

Lastly, the suspended disbelief in the legitimacy of DeFi and altcoins is overwhelming. Below, we comment on a new analysis of DeFi busting the commonly parroted narratives, but here we'd like to point out the total lack of critical thinking in altcoins. In its place is the belief in pluralism, the combination of some bizarre ideas like decentralization is trivial, adversaries/attacks are second thoughts, and money is naturally divergent tending toward barter. There is no logical examination of the costs and benefits or of competitive incentive structures in DeFi.

Despite what casual pumpers claim, Ethereum and altcoins in general did not, all of a sudden, find product market fit. It's the same suspension of disbelief present during the ICO boom, when people threw around things like, 'we're democratizing funding and will revolutionize the world.' And where did that lead to? ... Nowhere! Only bitcoiners asked the simple questions like how to get from A to B, from the claim to implementation, from a centralized project to a decentralized protocol?

Other Top Stories in Bitcoin

Dave Portnoy of Barstool Sports and leader of the Robinhood retail army, has invited the Winklevii twins to teach him about Bitcoin. Lots of bitcoin people were beside themselves with glee that this army of retail traders are going to be exposed to bitcoin like this. It's not that important. They'll be weak-hands and end up losing money. They should be taught about saving and tightening their belts, not day-trading bitcoin.

Bitmain Delays Antminer Shipments Amid Internal Conflicts

Previous heavyweight Bitmain is embroiled in infighting between founders. Several physical takeovers and re-takeovers have occurred in the last year. By physical we mean shenanigans like the founders calling the police on each other and one of them changing all the locks when the other founder was out of town. Now it seems they are having to delay all their shipments of new mining equipment, due to that and other natural disaster limitations in China.

Federal Reserve announces plan to develop a new round-the-clock real-time payment and settlement service to support faster payments

The Fed thinks payments are the issue. Simply get rid of the regulations standing in the way of payments as they are! LOL.

Price

Weekly BMI | -1 : Slightly bearish

In this section we take a look at some technical analysis for bitcoin. We keep this very basic and relate it back to fundamentals as much as possible. More detailed technical analysis can be found on our member letter the Bitcoin Pulse.

A surprising short-term correlation has developed in the market. Gold, bitcoin, and the S&P500 are all moving exactly inverse to the DXY, but contrary to the inflationists' day dreams, that spells impending disaster. The DXY is massively oversold with a bullish divergence. This is a strong and reliable reversal signal. Nothing goes up or down in a straight line.

Along with the reversal in the dollar, we see an impending reversal in gold and ethereum. Gold is the most overbought in 40 years on the daily and monthly charts, and ethereum finds itself in the worst overbought position since its all time high.

These other assets which bitcoin has been highly correlated with over the last few weeks are flashing red. A reversion to the mean is coming, but lucky for bitcoin it is in a relatively much better position to weather a storm.

Mining

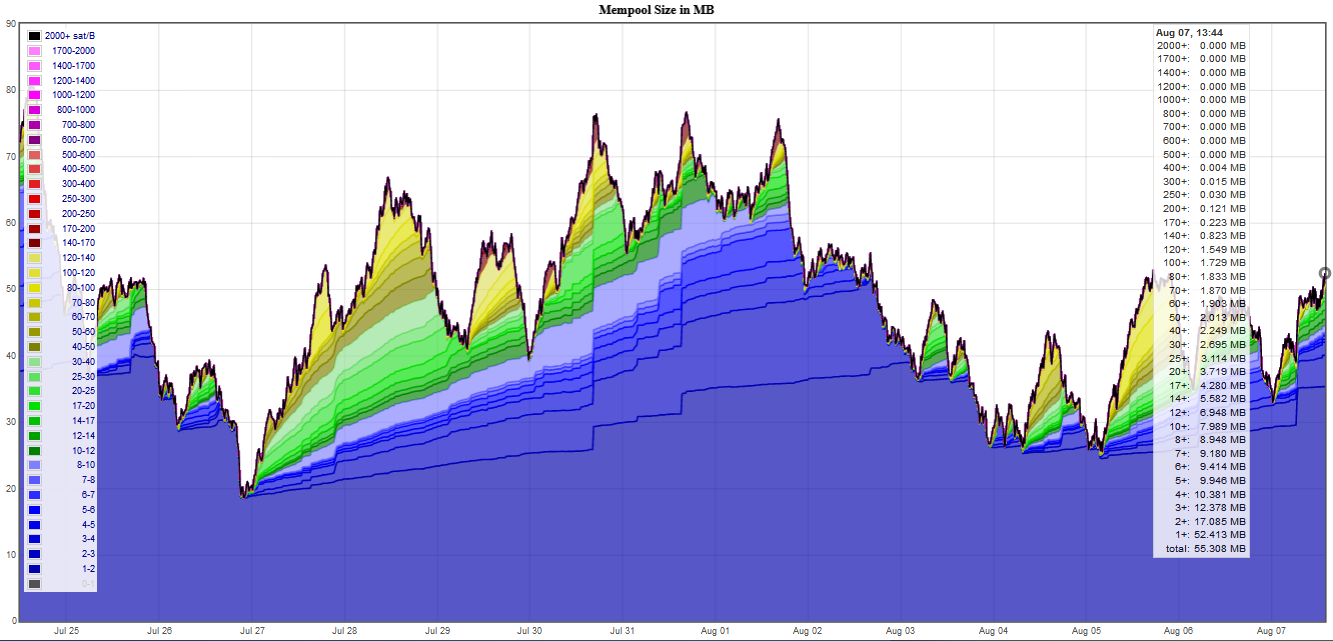

The mempool continues to be busy since last week and currently sits at 50MB (requiring ~50 blocks to clear) with fees remaining over 100 sats/byte to get in the next couple blocks. The hashrate has remained consistent this difficulty adjustment period and is expected to adjust up less than a percent on Monday. Check out Jochen Hoenicke's site to estimate the fees you will need in order for your transaction to be processed in the desired time.

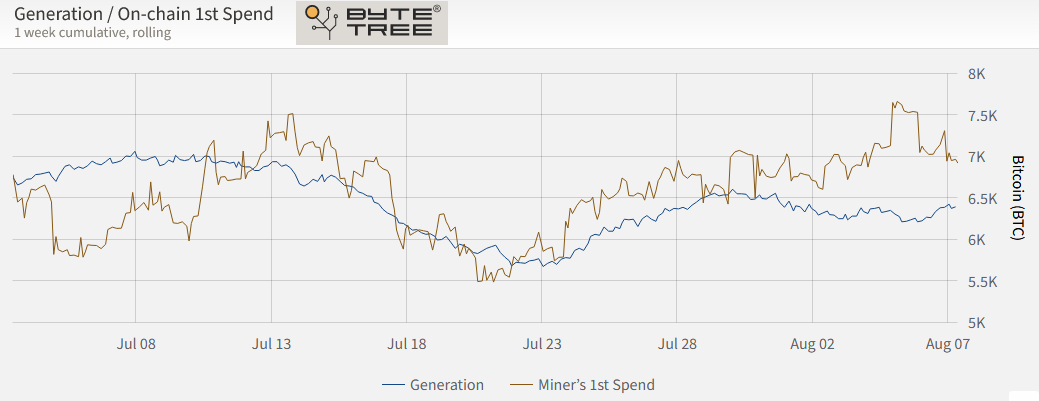

The second chart is from ByteTree and shows miners' First Spends compared to new coins generated as a 7-day average over the last month. We're still not sure the extent to which this data is useful. Pre-halving, big price drops lined up with an increase in miner First Spends, which was trending between 12k and 14k per week. Now, post-halving, as the spread widens between coins generated and coins spent, we do not see the same downward pressure on price. There may not have been enought time for a new pattern to emerge, so we will continue to watch for anything interesting.

Stablecoins / CBDC / Altcoins

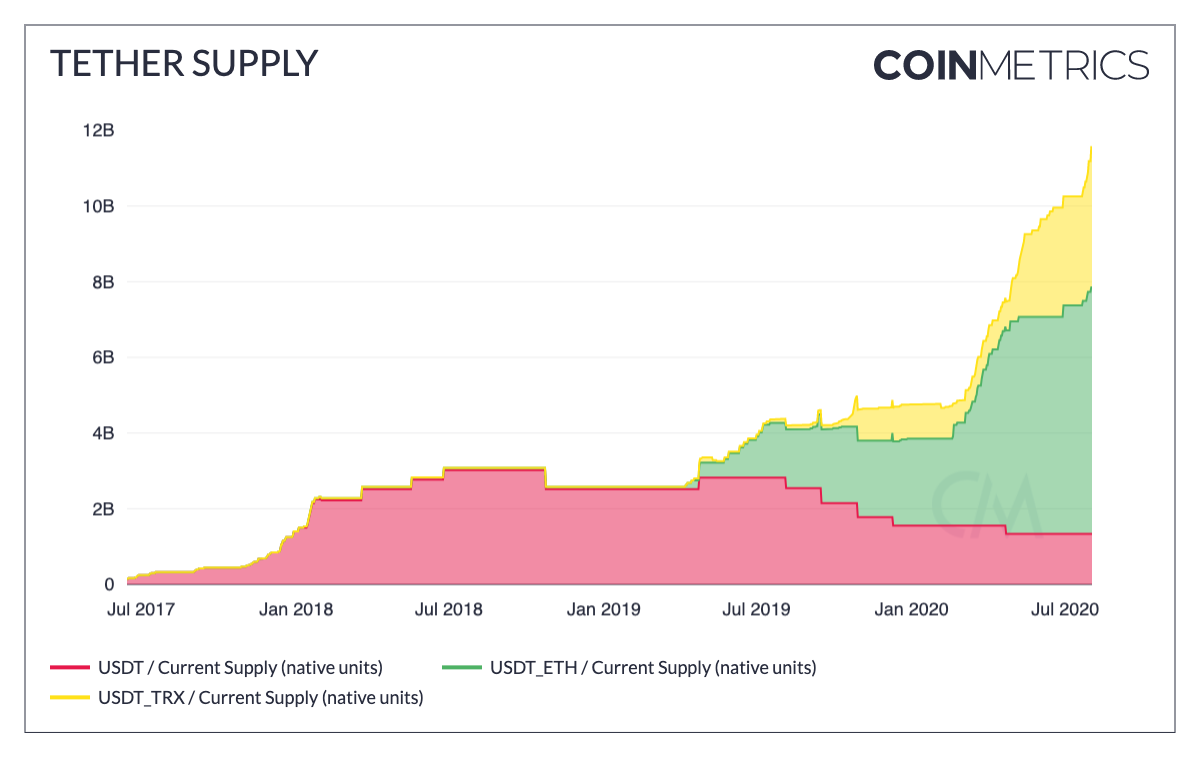

Tether Dominance : 7.7% ( -0.7%)

New analysis of the over-hyped Amateur-finance (AKA DeFi) tokens shows roughly 99% of supply is held by an average of only 500 people. What is striking, and a very disappointing, is the extent to which these 500 whales have captured bitcoin news media with their marketing. An outsider looking in, reading outlets like Coindesk or believing scammers like Coinbase, would think these amateur finance apps were widely used and vetted by the market. The facts tell a different story, one which paints a picture of a corrupt and scam-filled industry.

Ethereum Classic (ETC), the original Ethereum network, has fallen victim to a couple of attacks this week. This isn't the first time, and it won't be the last.

Speculation in the community about the source of these attacks is circulating under the surface. Some believe it is an ETH conspiracy to harm ETC's reputation and weaken miners. ETH has a vested interest in its miners having a less powerful position, so they are less able to push their weight around when it comes to the intended transition to Proof-of-stake. To understand the power miners have over the transition, think about what would happen if en masse they decided not to mine the last few hundred blocks prior to the transition to PoS or if they decided to continue mining a ETH PoW chain?

Miscellaneous

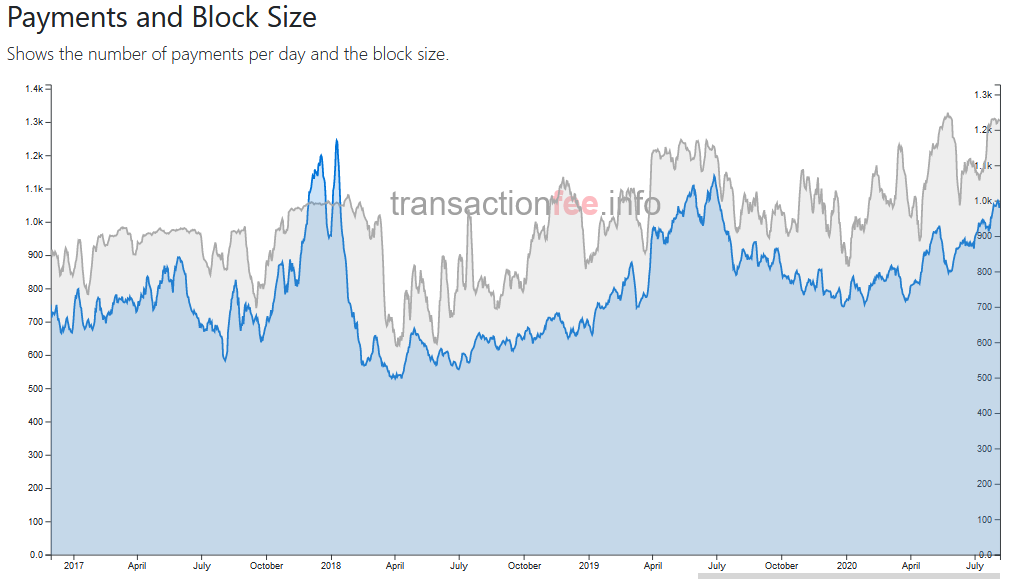

Here is a beautiful snapshot of the number of payments and block size going back to 2017 from transactionfee.info. Back in 2017 you can see the blocks were maxed at 1mb for a good portion of the year. With SegWit, blocks are now maxing out between 1.2 and 1.3mb. We anticipate the network to be super busy when the price breaks ATH as traders will be moving in and out of exchanges. We are curious to see how the network and fee market react when it happens; and the affect the noobs entering this cycle has (we suspect they will pay higher fees than required).

Demystify Bitcoin Jargon. Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages.

Over 180 Bitcoin related terms, concepts, and idioms.

This work exposes the reader to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.

Send feedback and/or take our quick survey!

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See